Download Pintu App

BNB Surges to $1K, Which Altcoin is Ready to Explode Next?

Jakarta, Pintu News – The month of September reminded markets that leadership among altcoins can change quickly. Ethereum (ETH), long considered the dominant force in the crypto space, had to relinquish its position to BNB (BNB), which surged past the $1,000 price for the first time.

At the same time, new players like Aster (ASTER) began to challenge Hyperliquid’s (HYPE) dominance in the booming perpetual DEX sector. Endorsements from luminaries such as Changpeng Zhao (CZ) also strengthened the competition.

Even so, Ethereum hasn’t been completely out of the spotlight. Its ecosystem continues to show resilience, especially through the Layer 2 (L2) network and the liquid (re)staking sector, which is starting to look like the clear winner in this market cycle.

This report from Cryptonews discusses what these developments could mean for the market in the coming months, as well as which altcoins are likely to lead the next wave.

BNB’s moment of awakening

For many market participants, September brought an unexpected change in direction. Instead of the usual Ethereum being the main driver of the market narrative, the spotlight now shifted to BNB and its expanding ecosystem. For the first time, BNB broke through the $1,000 mark, even setting a new record high of $1,079.

Read also: Telegram Founder Pavel Durov Predicts Bitcoin Price to Break $1 Million!

Matas Čepulis, founder and CEO of LuvKaizen, emphasizes that this surge is not just driven by the enthusiasm of retail traders, but also has the support of institutions:

“It’s interesting to see retail traders continue to push the BNB price up, but more significant is the support from large institutions such as Franklin Templeton who partnered with Binance, as well as companies that have quietly accumulated BNB on their balance sheets. Plus, Binance’s quarterly token burning program is reducing supply, further strengthening this upward push.”

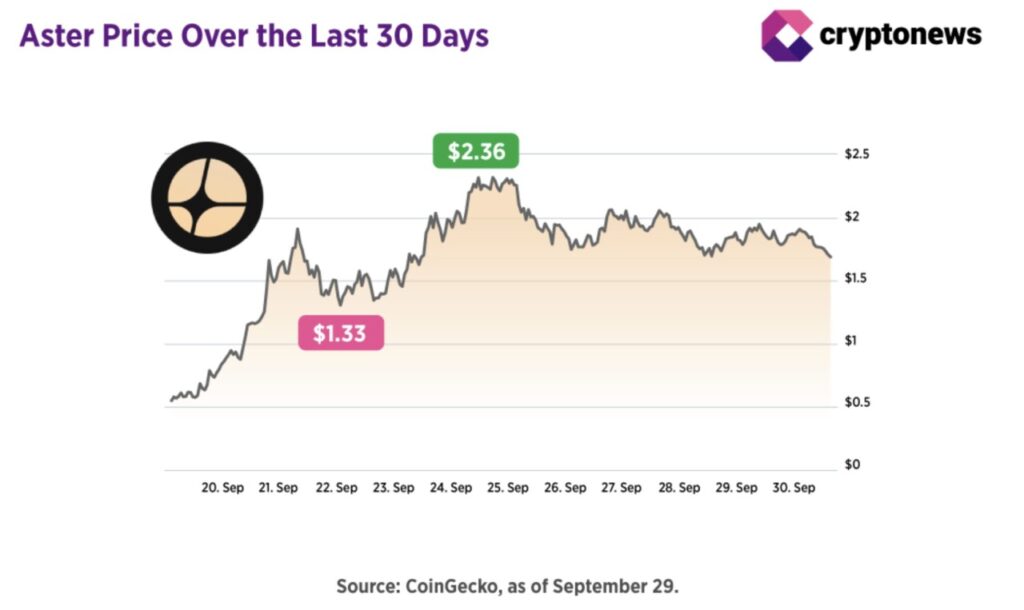

At the same time, the market is also starting to look at the perpetual decentralized exchanges (perp DEXs) sector. After the success of Hyperliquid, a new project called Aster is heating up the competition. The project has attracted great attention, especially after receiving direct support from Changpeng Zhao (CZ), which led some to dub it the “Hyperliquid killer”.

Čepulis highlighted that Aster tokenomics could be a key deciding factor:

“The plan is to implement fixed supply, declining emissions, and burning transaction fees-turning ASTER from an inflationary to a deflationary token. What makes it even more attractive is the strong support from CZ and its ties to the BNB ecosystem. If this plan works, ASTER could be one of the assets with the biggest supply shock effect this season, perhaps even rivaling Hyperliquid.”

The BNB and Aster stories reflect a broader change in crypto market dynamics. Čepulis sees this as part of a major trend shift:

“All of this is happening amidst a decline in Bitcoin’s dominance. This shift opens up space for altcoins to shine, and right now BNB is in pole position-although Aster seems to be quietly preparing to join the race.”

Time to take another look at Layer 2 coins?

Although Ethereum lost the spotlight to BNB during September, the ecosystem still showed solid resilience. Last summer could even be considered a “mini season” for Ethereum. Not only did ETH set new highs, but a number of projects in its ecosystem also saw a surge.

One of the most prominent sectors is Layer 2 (L2) networks, which are often referred to as the “silent workers” of the blockchain world as they handle much of the activity behind the scenes. One of the best examples is Arbitrum (ARB), which rose from $0.26 to $0.61 between late June and August – a jump of more than 130%.

Currently, both Ethereum and the projects in its ecosystem are experiencing a correction phase after the previous rally. Even so, interest in Layer 2 coins remains high.

Joaquin Mendes, COO of Taiko, sees this sector as one of the most promising in the market today:

“The real opportunity is in select altcoins with strong fundamentals, particularly Ethereum’s Layer 2 solution, which continues to see increased adoption and has the potential to attract new interest as the scalability narrative develops.”

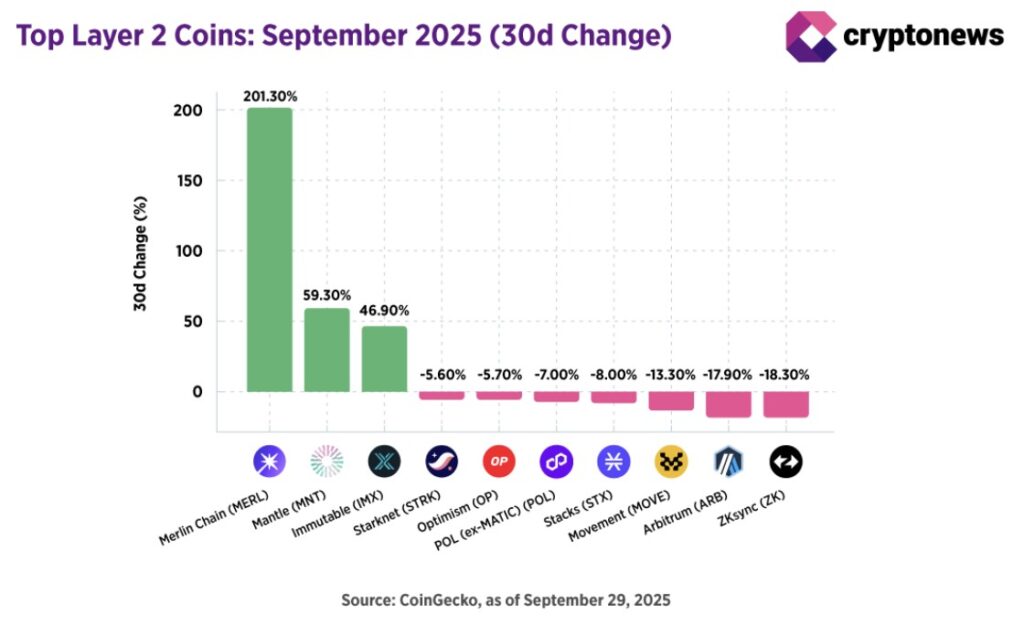

According to data from CoinGecko, some of the best performing Layer 2 tokens during September actually came from various ecosystems:

- Merlin Chain (MERL) which is linked to the Bitcoin (BTC) ecosystem,

- Mantle (MNT) which is strongly supported by the Babit exchange, and

- Immutable (IMX) which focuses on the gaming and NFT sectors.

Their success shows that the momentum of L2 coins is not limited to Ethereum alone. However, investors should still be cautious – not all projects in this sector have solid fundamentals, as Mendes also emphasized.

Read also: DEXScreener: 5 Most Active Tokens on DEXScreener Right Now

Furthermore, Mendes added that the recent market correction could be a starting point for healthier growth:

“The latest correction has cleared the overleverage position and created a more stable foundation for the next potential upside. Layer 2 coins remain worth monitoring, as the ecosystem matures and transaction volumes on these networks increase.”

Liquid (Re)Staking: The Sleeping Giant of the Altcoin World?

The growth of the Ethereum ecosystem has been uneven across all sectors. The rally in Layer 2 projects is one bright spot, but other sectors show more selective dynamics.

One example is the liquid staking and restaking sector, which is starting to come into the spotlight although not all projects have experienced a surge.

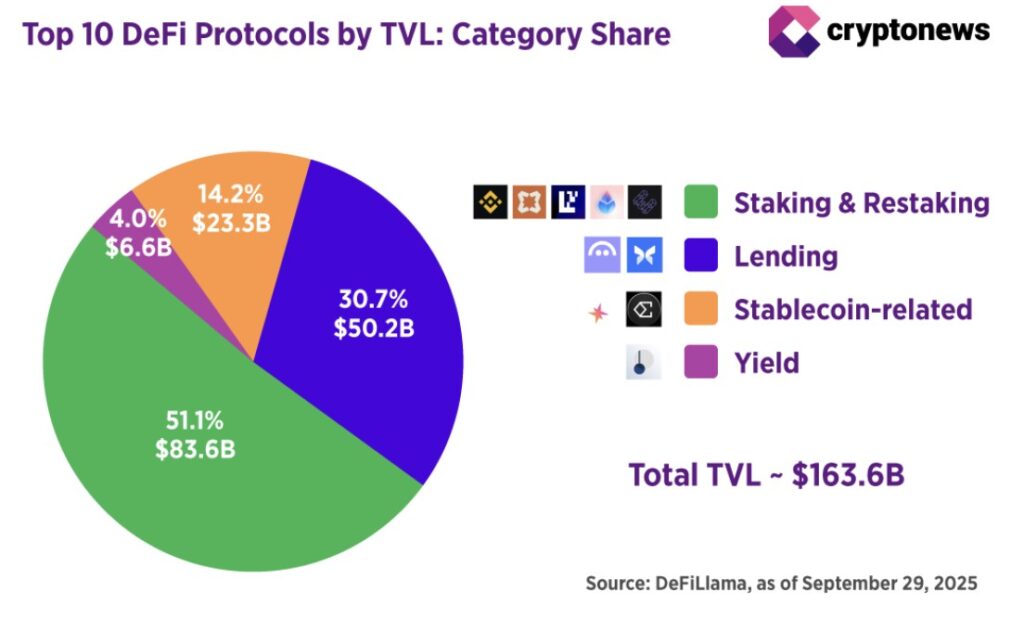

In fact, this is one of the largest sectors in the world of Decentralized Finance (DeFi). Of the top 10 DeFi protocols, liquid staking and restaking hold the dominant position, with a total value locked (TVL) of $83.6 billion, or about 51.1% of the total value locked across major projects.

Read also: Retail Investors Panic Sell, Smart Money and Wahle Crypto Buy These Altcoins Amid Correction

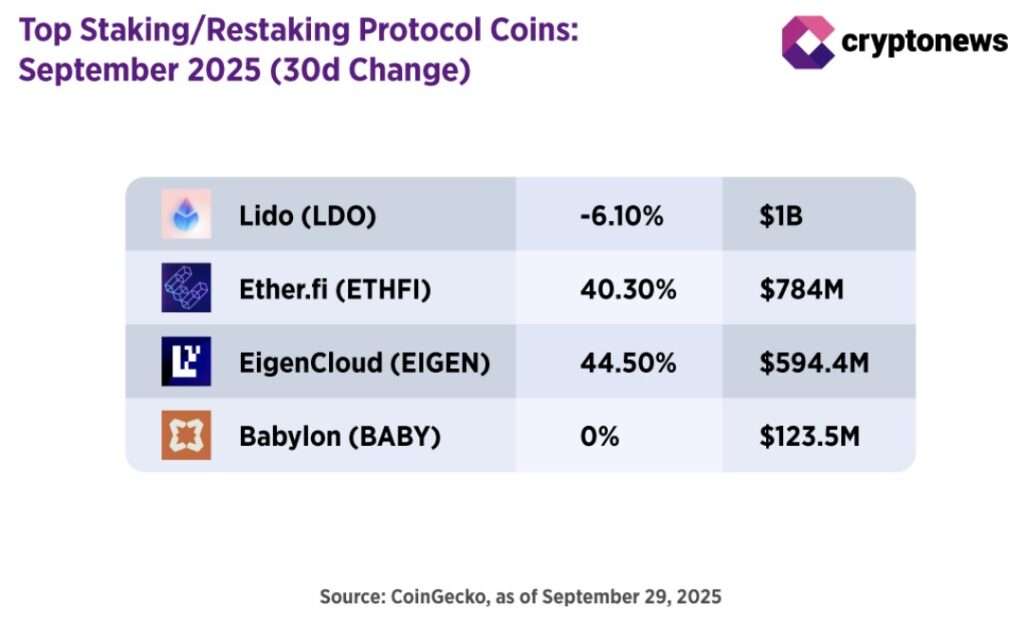

Data from CoinGecko shows mixed price movements:

- Ether.fi (ETHFI) gained more than 40% during the month of September,

- EigenCloud (EIGEN) recorded a 44.5% gain.

Meanwhile: - Lido (LDO), the market leader, fell more than 6%,

- Babylon (BABY) is stagnant with no significant movement.

This discrepancy suggests that capital flows within the Ethereum ecosystem are starting to shift towards new narratives, instead of pushing for an even increase for all projects.

According to David Dobrovitsky, CEO of Wowduck, this sector will be one of the main foundations in the next phase of Ethereum’s development:

“The liquid staking and restaking sectors (such as EigenLayer and Lido) are now starting to emerge as a new layer of trust and yield on top of the Ethereum network. Both have the potential to benefit greatly from the growth of institutional DeFi and tokenized assets.”

This trend highlights a hallmark of the current market cycle: selective growth. Not all projects will rally, but those that align with new narratives and institutional adoption will likely continue to lead the altcoin market in the future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. BNB Rallies: Which Altcoins Could Surge Next? October Report. Accessed on October 3, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.