Download Pintu App

3 Altcoins to Watch for Investors After US & UK Task Force Announcement!

Jakarta, Pintu News – The joint announcement between the United States and the United Kingdom on the formation of a Transatlantic Task Force focused on capital markets and digital assets has shaken up the crypto industry.

This initiative is not just a policy update, but also has the potential to shift institutional capital flows into the crypto sector. With digital assets being the main focus, traders are now looking for the best cryptos to watch out for under the new regulatory spotlight.

The Impact of the US-UK Crypto Task Force on the Market

The establishment of the Transatlantic Task Force is an important milestone for digital assets. Within 180 days, the task force will put forward recommendations focusing on digital markets and cross-border usage.

The committee is expected to reduce uncertainty and increase institutional adoption by unifying norms and standards. Analysts note that this alliance might inspire other major economies to follow their lead. With stronger cooperation, crypto markets can gain better trust, transparency, and efficiency of capital flows.

Also Read: 3 Coins with the Biggest Futures Volume This Week According to GPT Chat

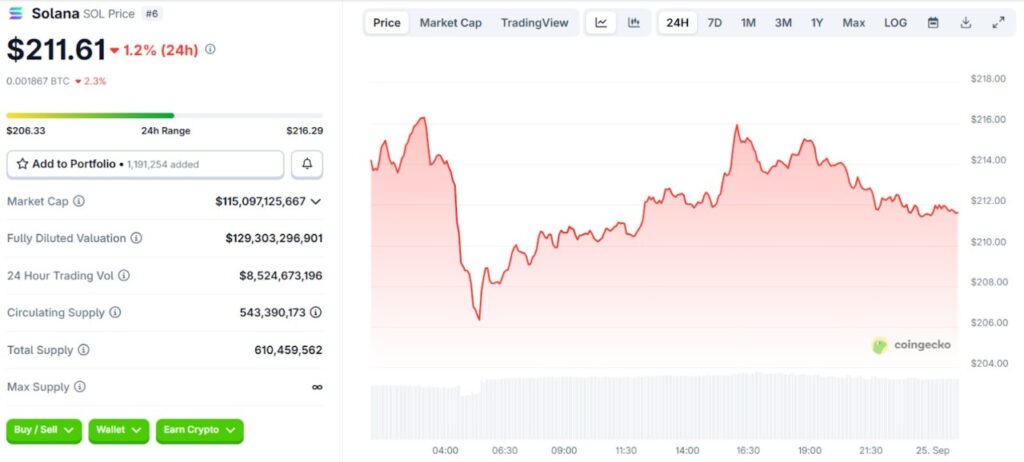

1. Solana (SOL): Institutional Magnet with Treasury Adoption

Solana continues to dominate the news as institutional adoption increases. Nasdaq-listed companies, such as Fitell Corporation, are adding Solana treasuries, signaling a new wave of corporate confidence in blockchain.

Backing from big players like Pantera Capital, which has more than $1 billion in SOL, strengthens its position as a serious alternative to Ethereum (ETH). Solana offers higher speed and scalability, which is particularly attractive to companies and institutions that need fast transactions and low fees.

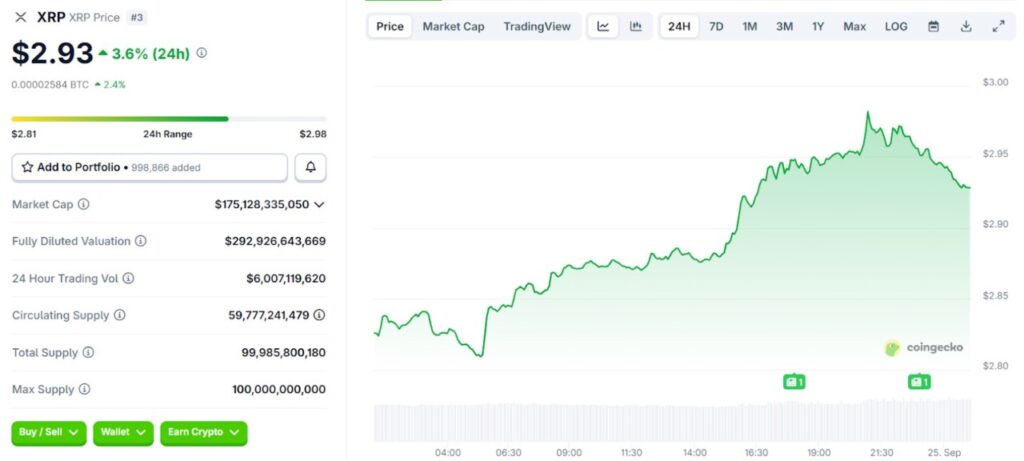

2. Ripple (XRP): Taking Advantage of Whale Activity and ETF Momentum

Ripple has long been embroiled in the regulatory debate, but the direction is starting to favor after the company and the SEC filed a joint dismissal. Ripple Ledger’s institutional settlement layer has gained traction, while whales have resumed accumulation near $2.80 support.

Recent ETF-related developments, including the REX-Osprey XRP product, have renewed institutional inflows. Weekly data showed more than $69 million in inflows, doubling in one week, and raising this year’s total above $1.5 billion.

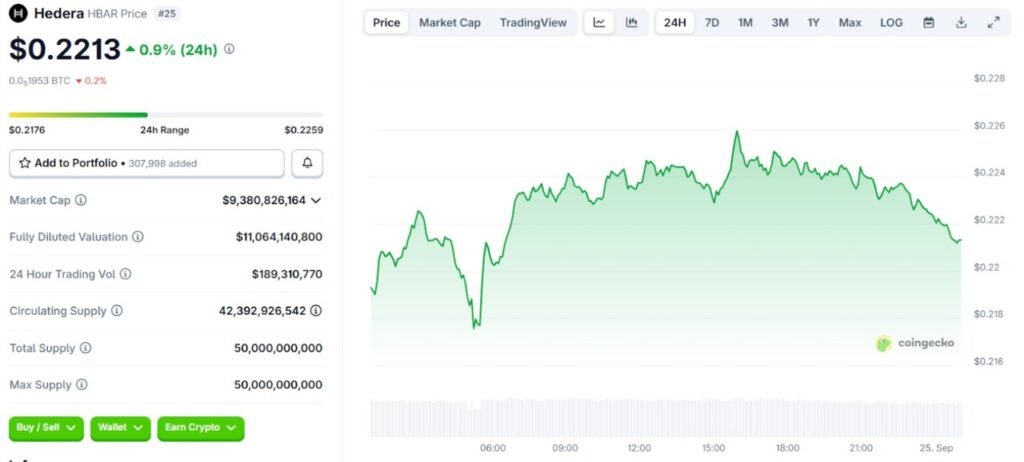

3. Hedera (HBAR)

Link Reader said:

Trading at $0.22 (IDR3,657), HBAR is at a crucial support level. If this level holds, analysts expect a potential rally towards $0.30 (IDR4,987) and even higher.

For long-term investors, the combination of adoption by governments as well as institutional inflows makes Hedera (HBAR) one of the most interesting cryptocurrencies to watch amid the new regulatory landscape.

Conclusion

The formation of the US-UK crypto taskforce has opened a new chapter of adoption and oversight in the digital market. For investors, it is a time to focus on projects with strong fundamentals and institutional relevance.

Solana, Ripple, and Hedera each offer something unique, from the power of meme-driven communities to enterprise-grade layers of trust. Together, they represent the top 3 cryptos to watch out for when the world’s largest financial centers finally harmonize digital assets.

Also Read: 5 Reasons XRP Could Hit IDR66,000 by the End of 2025: ETFs, Fed, & Crypto Market Momentum

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Daily. 4 Coins Investors Are Watching as US and UK Announce Joint Crypto Task Force. Accessed on October 3, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.