Download Pintu App

Bitcoin ETFs Attract Fresh Funds, BTC Finally Reaches $125,000 ATH!

Jakarta, Pintu News – The cryptocurrency market is heating up again with funds pouring into Bitcoin (BTC) ETFs, recording the biggest weekly haul of the year. With this significant increase, Bitcoin (BTC) is now on the verge of reaching new highs, promising greater profit potential for investors.

Bitcoin ETFs: Fund Flows Surge

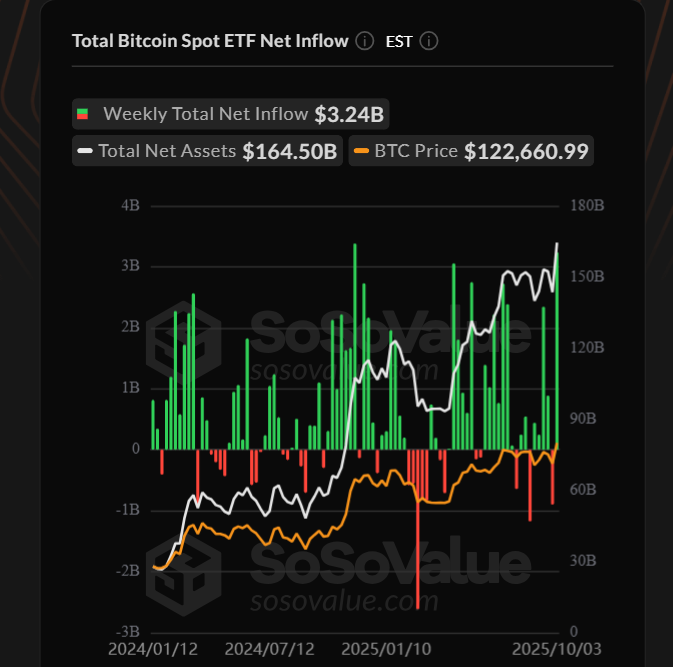

This week, the Bitcoin (BTC) ETF recorded net inflows of $3.24 billion, according to data from SosoValue. This is the largest weekly inflow this year and the second largest since the product’s launch last year. In the same period, only the week ending November 22 saw higher inflows of $3.38 billion.

On Friday alone, the Bitcoin (BTC) ETF attracted $985 million, making it the second largest daily outflow after the record $987 million recorded on January 6. This increase comes after the previous week saw a net outflow of $902 million.

Also read: Bitcoin (BTC) Finally Reaches ATH at $125,000, Is a Correction Awaiting?

Key Drivers: Bitcoin Price Rise

The rise in fund flows into Bitcoin (BTC) ETFs has coincided with a significant surge in the price of Bitcoin (BTC) earlier this month. The cryptocurrency has risen more than 7% in October alone, which is historically the second-best month for Bitcoin (BTC).

Now, the price of Bitcoin (BTC) has almost touched the previous record high of $124,400, with yesterday’s high reaching $124,000. In addition, the market is also responding to the possibility of an interest rate cut by the Federal Reserve in this month’s FOMC meeting. The odds of a rate cut have increased to over 90% after the lower-than-expected ADP jobs report was released this week.

Also read: Shibarium Team Ready to Revive Ethereum Bridge with Compensation Plan!

Market Predictions and Expectations

JPMorgan, one of the leading financial institutions, predicts that Bitcoin (BTC) could reach $165,000 by the end of the year. This analysis is based on what they call the ‘debasement trade’, where investors turn to Bitcoin (BTC) and gold as a hedge against inflation and macro uncertainty, including the ongoing US government shutdown.

On the other hand, Standard Chartered is more optimistic, predicting that Bitcoin (BTC) will reach $135,000 in the near future, driven by the Bitcoin (BTC) ETF boom. The bank also predicts that Bitcoin (BTC) could reach $200,000 by the end of the year. Meanwhile, Citigroup gave a more conservative prediction with a price target of $132,000 by the end of the year.

Conclusion

With massive fund flows into Bitcoin (BTC) ETFs and optimistic price predictions from various analysts, the future of Bitcoin (BTC) looks very bright. Investors and analysts alike are looking forward to further developments that will determine the direction of the cryptocurrency market in the months to come.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin ETFs See 2025 Record Weekly Inflows of $3.2B as BTC Eyes New ATH. Accessed on October 6, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.