Download Pintu App

5 CryptoAmsterdam Analysis: Bitcoin’s Plan Towards ATH & the Beginning of the Altcoin Cycle!

Jakarta, Pintu News – The latest analysis from CryptoAmsterdam shows that the crypto market is currently in a critical phase towards a potential major breakout. Bitcoin is the prime mover with a historical pattern of a two-stage rise towards the ATH, while altcoins could potentially follow in the second phase. With execution discipline and patience waiting for breakout confirmation, this analyst emphasizes the importance of focusing on price structure – not on FOMO.

1. Bitcoin Approaches Breakout Zone Towards New ATH

CryptoAmsterdam crypto market trader and analyst (@damskotrades) has again shared his views on Bitcoin’s (BTC) price structure ahead of a potential new all-time high. In his post on X (October 5, 2025), he explains that Bitcoin’s ATH breakouts are often accompanied by high volatility, which he believes is a natural phase before the next big move.

CryptoAmsterdam said he is still waiting for confirmation of a local breakout structure in the upper range area, or a “workable” price opportunity in the mid-range area. In other words, he has not made any new entries yet and prefers to wait for clarity on BTC’s price direction before initiating additional long positions.

Also Read: 10 Crypto Nearly Hit All-Time High Prices – October 2025 Update

2. Bitcoin Strategy: Focus on Structure, Not Market Emotions

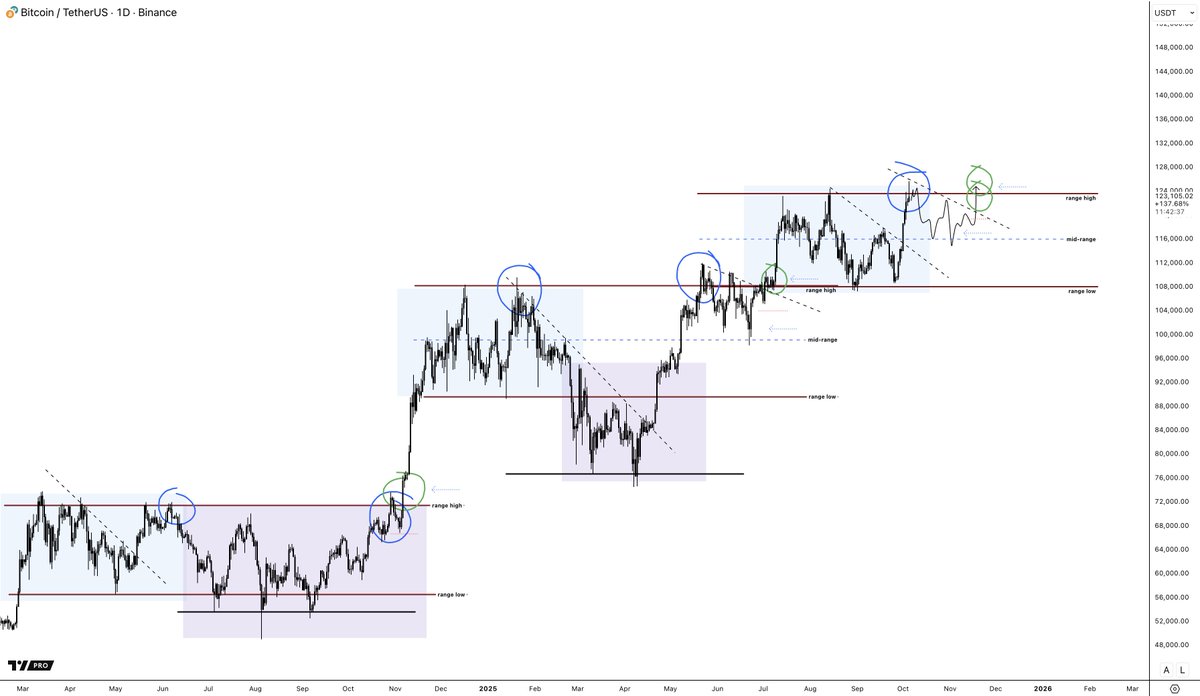

In his analysis, the trader showed a BTC/USDT chart (1D, Binance) that showed three main phases:

- Increase to range high

- Temporary rejection (pullback)

- Breakout to a new price level above resistance

According to CryptoAmsterdam, the current price is still at a point of uncertainty (mid-range), and he will look for a clear breakout pattern before adding to the position. He also emphasized that he will not chase prices at the resistance area, waiting for a clean daily close above the level as confirmation of a new allocation.

This approach emphasizes medium-term execution discipline – not emotional reactions to short-term volatility – which he says remains the key to surviving the extremes of the crypto market.

3. Historical Pattern: Two Legs of Rise Before Altcoin Rise

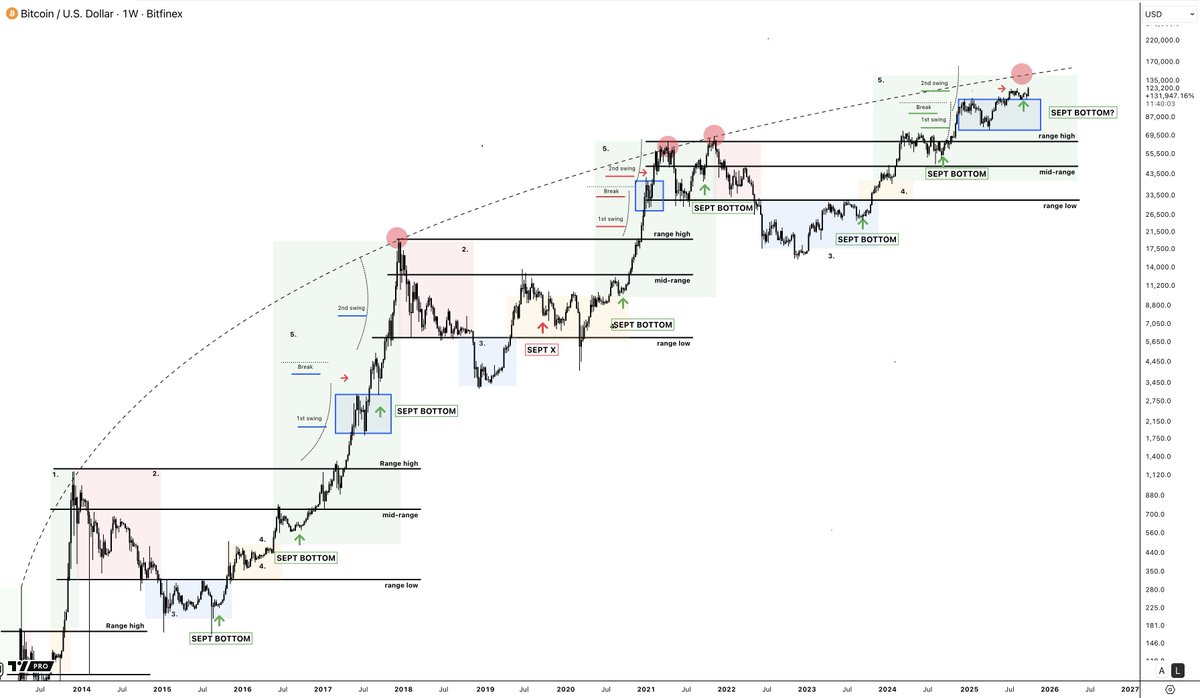

In the second part of its analysis, CryptoAmsterdam explains that Bitcoin has historically always shown two “HTF legs” (High Time Frame legs) when it breaks a new price peak. The pattern is:

- Leg 1: Initial rise (leg up)

- Phase 2: Consolidation or “base/chop” (marked blue area on the chart)

- Leg 2: Advanced hike to new ATH

He adds that the altcoin cycle usually starts after the second leg of Bitcoin has finished forming. This means that Bitcoin’s dominance tends to rise for about 95% of the cycle, before dropping dramatically in the final phase – when big capital starts to shift to altcoins.

“It has historically always been the second Bitcoin leg into new highs when altcoins finally wake up and start their cycle.”

4. Altcoin Cycles: Biggest Momentum Comes After BTC Stabilizes

According to CryptoAmsterdam, at the moment altcoins are still lagging behind Bitcoin, but the potential for a big rise in altcoins will only emerge when Bitcoin actually breaks the range high that it shows in the first chart.

He explained that he has been entering new spot positions since April-May 2025, when the total altcoin market capitalization reclaimed the mid-range area (green zone on the chart). He still maintains that position today, with the expectation of further breakouts following the Bitcoin cycle.

For investors who are newly interested in the current high prices, he emphasized that there is still potential for long-term gains, although ideally the best entry always occurs at support areas.

5. Market Expectations and Forward Execution Plan

CryptoAmsterdam closes its analysis with an important caveat: it will not chase prices at the top of range resistance, for either Bitcoin or altcoins. He is waiting for confirmation in the form of a “clean close above range high” as a trigger for additional allocations.

With Bitcoin’s dominance still high and the market structure showing medium-term breakout potential, he expects the bullish scenario to remain valid as long as Bitcoin is able to stay above its intermediate support. However, extreme volatility ahead of the ATH level is something he thinks is inevitable.

“Looking for a long setup, but letting price develop some more clarity first.”

Also Read: Shocking Bitcoin Cash (BCH) Price Predictions for 2025 to 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CryptoAmsterdam. Bitcoin ATHs Plan. Accessed October 6, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.