Download Pintu App

Crypto Trading Guide: An Expert Guide to Getting Started in Crypto from Zero!

Jakarta, Pintu News – Cryptocurrencies are digital currencies secured by blockchain technology, allowing transactions without intermediaries such as banks. The most famous cryptocurrency is Bitcoin (BTC), but there are now thousands of other digital assets such as Ethereum (ETH), Ripple (XRP), and Solana (SOL).

1. Understanding the Basics: What is Cryptocurrency?

Each crypto asset has a different function – some are used as a means of payment, some are the basis of DeFi (Decentralized Finance) platforms, to those that act as digital collectibles (NFTs). Since the crypto market operates 24/7 and is highly volatile, many investors see it as an opportunity to earn high returns, although the risks are also great.

2. Types of Cryptocurrency Investment

According to Investopedia (2024), there are several ways to invest in the crypto market. Here are some of them:

a. Buying Cryptocurrency Directly

The most common way is to buy and store crypto coins directly through exchanges such as Binance, Coinbase, or Pintu in Indonesia. You can choose between big coins like Bitcoin and Ethereum, or new coins with high growth potential.

b. Investment in Crypto-Based Companies

You can also invest in companies operating in the crypto sector, for example:

- Crypto mining companies or mining hardware manufacturers

- Fintech companies like PayPal (PYPL) or Robinhood (HOOD) that provide crypto services

- Companies like MicroStrategy (MSTR) that have Bitcoin stored on their balance sheets

c. Investment Through Crypto Funds and ETFs

If you don’t want to choose one specific asset, you can invest through crypto-based investment funds (funds) or ETFs (Exchange-Traded Funds). In 2024, the US SEC officially approved the first Bitcoin Spot ETF, which allows investors to invest in Bitcoin without the need to own it directly.

d. Crypto Roth IRA (Retirement Investment Account)

Some investors in the US are using Crypto Roth IRAs to gain tax advantages while investing in digital assets. This type of investment is managed by specialized service providers who also offer safer crypto storage.

e. Become a Miner or Validator

The most direct way to earn crypto is by mining or becoming a validator on a blockchain network. Miners and validators are rewarded in the form of crypto coins, which can be held as an investment or sold for profit.

3. How to Buy Crypto Through an Exchange Safely

Here are the steps to buying cryptocurrency for beginners:

- Choose a trusted exchange, such as Pintu App for Indonesian users.

- Register an account and perform identity verification (KYC).

- Deposit fiat funds (such as Rupiah) into an exchange account.

- Choose the crypto asset you want to buy – do your research first.

- Place a buy order, either through a market order or a limit order.

- Store crypto assets in a digital wallet – either a wallet on an exchange or a more secure hardware wallet.

💡 Important Tips:

Always pay attention to transaction fees (fees) when buying crypto as each platform has a different fee structure.

4. Things to Know Before Starting Crypto Investing

Before you start investing, there are some important things you need to understand:

- Crypto prices are highly volatile. Changes can reach tens of percent in just one day.

- Only invest funds that you can afford to lose.

- Keep up with regulatory developments. Government policies can affect the value of digital assets.

- Understand the tax aspect. Crypto buying and selling transactions in many countries are subject to capital gains tax.

- Diversify your portfolio. Don’t just invest in one coin or project.

It’s a good idea to evaluate your portfolio regularly and adjust your asset allocation according to your goals and risk tolerance.

5. Is Crypto the Right Investment for You?

Not everyone is suited to investing in crypto. Due to high volatility, crypto assets are less than ideal for conservative investors.

However, for investors with a higher risk tolerance, crypto can be a potentially great investment alternative – especially if accompanied by a well-thought-out strategy and research. Many experienced investors suggest that crypto allocation should be no more than 10-20% of the total portfolio to maintain risk balance.

6. Crypto Recommendations for Beginners

For those of you who are just starting out, you should focus on crypto assets that are well-established and have high liquidity, such as:

- Bitcoin (BTC): The first and most recognized cryptocurrency as a store of value.

- Ethereum (ETH): The main platform for smart contracts and DeFi applications.

- Solana (SOL): Known for its transaction speed and low fees.

- BNB (BNB): The main token of the Binance ecosystem.

- Avalanche (AVAX) and Polygon (MATIC): Blockchain solutions that focus on scalability and interoperability.

7. Conclusion: Keys to Successful Crypto Trading and Investing

Investing and trading cryptocurrencies offers great opportunities – but also high risks. You can invest directly in coins, through ETFs, or even become a network validator.

But keep in mind, crypto prices are highly volatile due to speculation and global market sentiment. The value of an investment can double in a day, but it can also plummet dramatically in a matter of hours.

To succeed in the crypto market:

- Keep learning and keeping up with the blockchain industry.

- Use risk management strategies and always set stop-losses.

- Diversify your portfolio.

- Use a trusted platform and secure your assets in a private wallet.

With the right knowledge and discipline, crypto can be a promising long-term investment opportunity in this digital age.

Also Read: Shocking Bitcoin Cash (BCH) Price Predictions for 2025 to 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

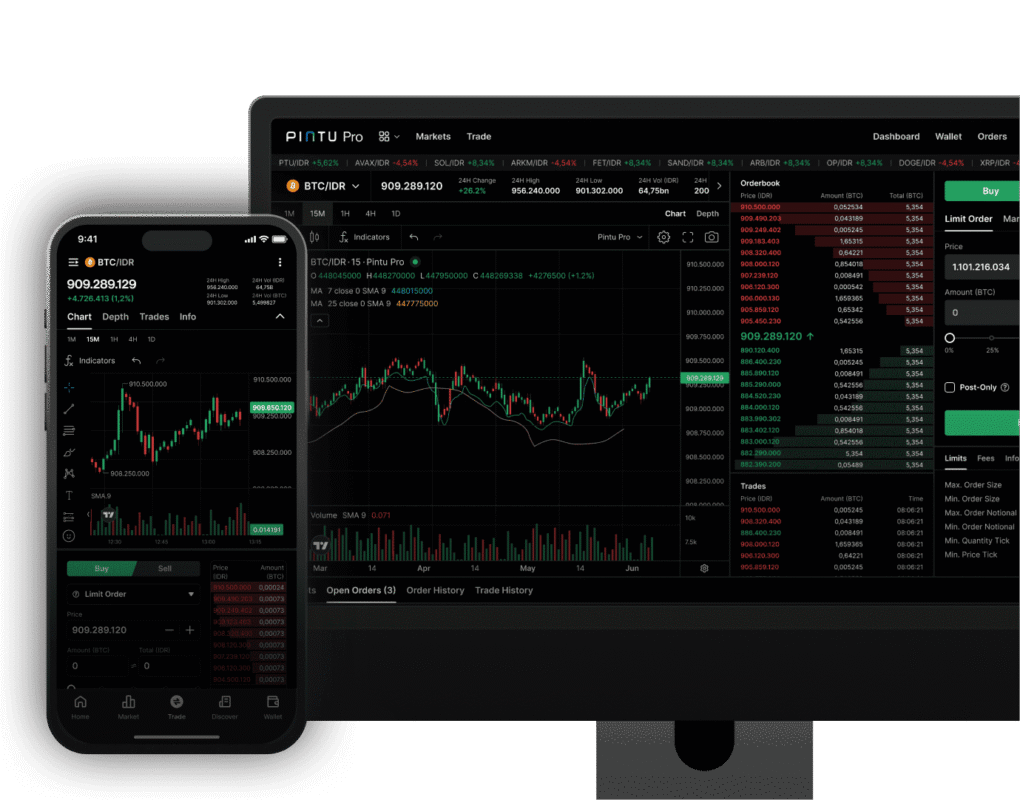

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Allie Grace Garnett. “How to Invest in Cryptocurrency.” Accessed October 6, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.