Download Pintu App

XRP Update: Investors Dump $950 Million Worth of XRP as Bullish Setup Collapses

Jakarta, Pintu News – The latest price movement of XRP (XRP) shows a failed breakout attempt, undermining the expectations of optimistic investors.

Despite testing the upper resistance level, the altcoin experienced considerable selling pressure from investors, causing the price to correct again. A sudden wave ofprofit-taking seems to be the main factor behind the price decline that occurred over the past week.

XRP Holders Start Selling Their Assets

XRP balances on exchanges have seen a sharp increase, signaling strong selling activity. In the past seven days, approximately 320 million XRP worth nearly $950 million has been moved to various trading platforms.

Read also: 3 Crypto’s to Watch This Week, What’s Up?

This move reflects a change in investor behavior, where XRP holders tend to take small profits quickly instead of maintaining long-term conviction. This kind of pattern often destabilizes the market and hinders a sustained price recovery, making XRP vulnerable to a deeper correction in the next few days.

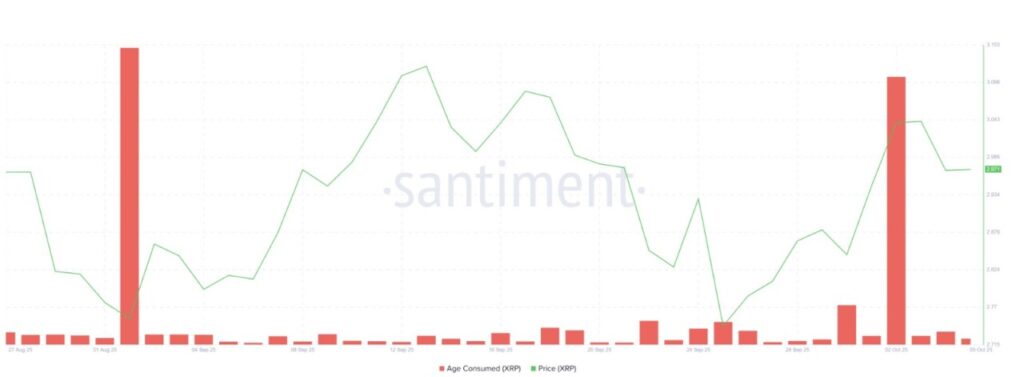

The Age Consumed metric, which tracks the movement of long-hold coins, has also shown a significant spike recently. This indicates that Long-Term Holders (LTH) are starting to sell their assets.

Historically, selloffs from LTH groups reflect declining confidence in the prospects of such assets – a negative signal considering they are usually the linchpin of market sentiment and liquidity.

This wave of selling pressure reinforced the bearish sentiment for XRP. As experienced investors begin to liquidate their positions, interest from new investors decreases, limiting the potential for price gains.

As a result, this massive exit from long-term holders adds weight to the ongoing downtrend and could potentially short-circuit price recovery efforts.

XRP Price Needs to Rebound

On October 6, XRP was trading around $2.96, holding slightly above the $2.94 support level. The altcoin had previously shown the potential to break out of a descending wedge pattern, but the attempt failed for the time being – signaling that there is still downward pressure in the market.

Read also: ASTER Crypto Launches Phase 2 Airdrop on October 10, Open Interest Hits $5 Billion!

If the selling trend continues, XRP is at risk of continuing its decline. The token could drop to around $2.85 or even touch $2.75, which is the lower limit of the wedge pattern. A drop to this level would reinforce the dominance of bearish sentiment in the market.

However, if investors regain confidence and manage to stop the ongoing sell-off, XRP has a chance to rebound. A successful recovery through the $3.02 level could pave the way towards $3.12 or higher, while potentially canceling out the current negative outlook.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. $950 Million XRP Sold In A Week; Price Fails Bullish Pattern Breakout. Accessed on October 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.