Download Pintu App

Aster Token Sinks 10% Ahead of Phase 2 Airdrop as Integrity Concerns Mount

Jakarta, Pintu News – BNB-based decentralized exchange (DEX) Aster is back in the public spotlight after facing integrity issues regarding its perpetual trading volume. DeFi and open-source aggregator platform DeFiLlama recently stopped supporting Aster by removing its trading volume data from the list.

The Aster token (ASTER) recorded a 10% plunge on October 6, indicating considerable selling pressure in the market. Interestingly, this development occurred just before the second phase airdrop scheduled to take place on October 10.

DeFiLlama Deletes Aster TOKEN Perpetual Data due to Integrity Issues

Ahead of the Phase 2 airdrop on October 10, Aster’s decentralized exchange faced a major shock after DeFiLlama announced that it would delete Aster’s perpetual contract trading data.

Read also: ASTER Crypto Launches Phase 2 Airdrop on October 10, Open Interest Hits $5 Billion!

This decision was made after the DeFi aggregator platform discovered a “near-perfect correlation” between the trading volumes of Aster and Binance, casting doubt on the authenticity of the trading volume data reported by Aster as DEX.

The founder of the DeFiLlama pseudonym, 0xngmi, was the first to highlight irregularities in Aster’s trading data in the DeFi ecosystem. He showed evidence that Aster’s recent perpetual trading volume mimics trading activity on Binance very closely.

In his analysis, 0xngmi compared the trading of the XRPUSD pair on Aster and its competitor, Hyperliquid (HYPE). As a result, he found that Aster shows a 1:1 correlation with Binance, while Hyperliquid still has separate movements or does not fully follow the Binance pattern.

Interestingly, some time ago Binance founder Changpeng Zhao (CZ) had praised the Aster project for its rapid growth. In fact, a number of ASTER tokens reportedly made their way to Binance spot wallets shortly after CZ’s public statement of support.

Some market observers think that this move could be a test phase ahead of Aster’s possible official listing on Binance.

Recent ASTER Price Development

The issues plaguing Aster have also put pressure on the price of the ASTER token, which is down around 10% after losing an important support level at $2.0. From a weekly high of $2.27 on October 4, the ASTER price has now fallen by almost 20%, erasing most of the gains made earlier.

Read also: Analysts Turn Bullish on Pudgy Penguins as PENGU Becomes the Top-Selling Meme Coin on Solana!

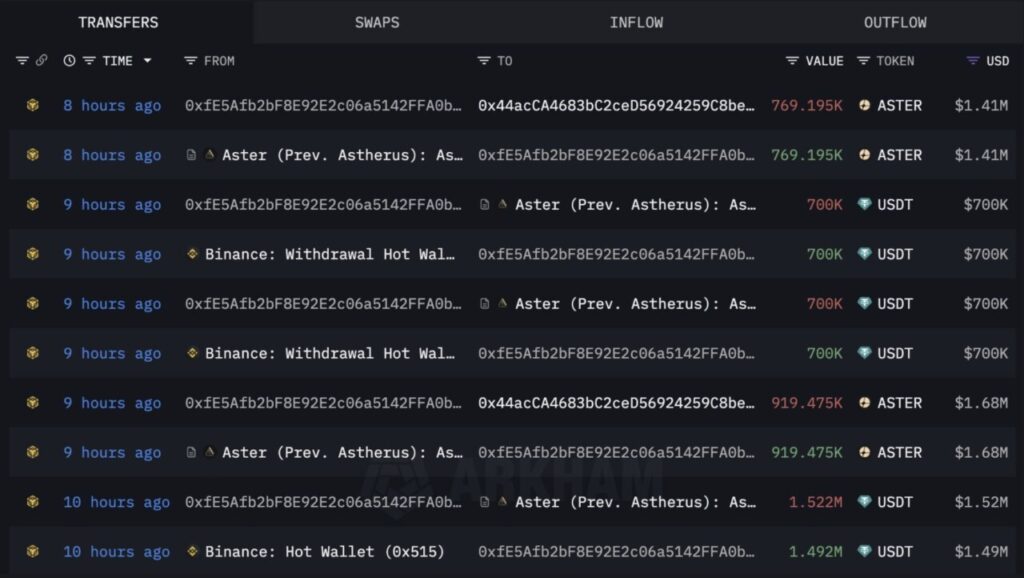

However, amidst the price pressure, whale activity in ASTER tokens remains high. Based on data from blockchain analytics firm Arkham Intelligence, a large investor with wallet address 0xfE5A was recorded buying 1.69 million ASTER tokens worth about $3.16 million today.

The whale previously deposited 2.92 million USDT into the Aster platform, and then withdrew 1.69 million ASTER tokens, indicating significant accumulation amid increased market attention to the project.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Aster Token Crashes 10% On DEX Integrity Issues Ahead of Airdrop, What’s Happening? Accessed October 7, 2025

- Coinpedia. Aster Crypto Price Crashes 10%, Here’s What You Can Expect Ahead of Oct 14. Accessed October 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.