Download Pintu App

2 Altcoins Gaining Attention Ahead of the Fed’s Policy Decision at FOMC Meeting

Jakarta, Pintu News – The countdown to the next policy update from the Federal Reserve (Fed) has begun, and crypto markets appear ready – though still wary of potential volatility. While the price of Bitcoin (BTC) is again testing the $120,000 level, some altcoins such as BNB have managed to set new record highs.

However, conditions are not the same for most other altcoins that are still struggling to maintain price gains. Looking ahead to next week, market participants are hoping that the Federal Open Market Committee (FOMC) meeting scheduled for October 8 will bring positive news for the altcoin market.

Against this backdrop, here are two altcoins worth watching ahead of the FOMC meeting, according to the CCN website.

Aptos (APT)

Aptos (APT) is one of the altcoins that is getting a lot of attention ahead of next week’s FOMC meeting. The main spotlight is on its latest achievement – the launch of World Liberty Financial’s (WLFI) stablecoin product, USD1, live on the Aptos blockchain network.

Read also: 3 Crypto’s to Watch This Week, What’s Up?

This development has sparked increased market momentum. In the past seven days, the price of APT has surged by around 32%, reaching $5.25 at the time of writing. This rise reflects the strong anticipation that the launch of the USD1 stablecoin could attract new liquidity to the Aptos network.

Technically, APT showed further strengthening potential ahead of the FOMC meeting. On the daily chart, APT managed to break the upper trend line of the descending channel pattern, indicating a potential new uptrend.

The Money Flow Index (MFI) indicator also rose to 69.73, signaling strong inflows and increased buying pressure. With the stablecoin’s launch fast approaching, demand for APT is likely to remain high well into the following week.

Adding to the positive sentiment, the Supertrend indicator displayed a green signal, with its indicator line below the APT price – a pattern that usually signals a buy signal and still dominant bullish momentum.

Under these conditions, APT has the opportunity to test the resistance level at $5.78. If the price is able to break this area convincingly, then APT has the potential to continue rising towards $6.34 in the near future.

However, if the bullish momentum weakens and the price drops below the upper trendline again, APT risks a correction to the $4.52 support area. A drop below this level could weaken the current bullish structure and delay the next potential upside.

ApeX Protocol (APEX)

ApeX (APEX) is also one of the tokens being watched ahead of this week’s FOMC meeting.

Read also: Altcoin Season Index Shows Bullish Signals at Level 67, Analysts Say Altcoin Can Outperform Bitcoin

One of the main catalysts in the short term is the end of the Ape Season 1 Early Adopter Bonus program on October 6, which could potentially affect liquidity and trading activity on the ApeX protocol.

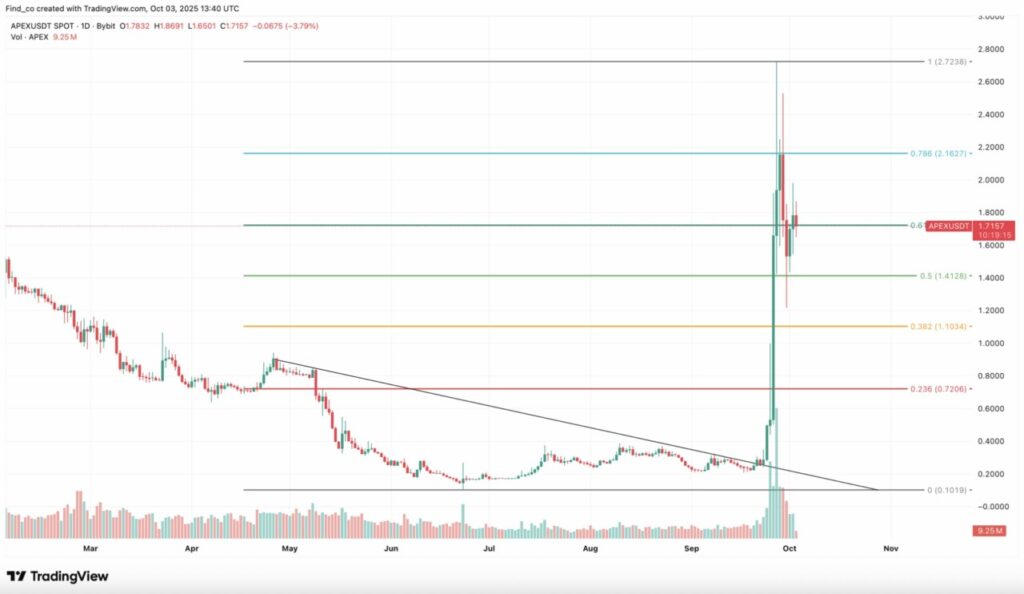

Over the past month, APEX has been one of the most striking performing assets in the crypto market. Driven by the ever-growing bullish narrative in the Decentralized Exchanges (DEX) sector – which is the main focus of the ApeX Protocol – the token’s price has surged by 693% in just 30 days.

As of October 6, 2025, the price of APEX corrected to around $1.71, but technically, the chart structure still shows further upside potential. If buying pressure increases again, APEX has the opportunity to strengthen to touch the previous high area of $2.72.

Even so, potential risks remain. If demand for DEX tokens begins to weaken and traders start rotating to other sectors, the APEX price could drop all the way to $1.10, which would wipe out most of the parabolic gains achieved over the past month.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. 2 Altcoins to Watch Ahead of Next Week’s FOMC Meeting. Accessed on October 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.