Download Pintu App

Dogecoin Climbs 4% Today: Is a 20% Rally Next on the Cards?

Jakarta, Pintu News – Quoting the BeInCrypto page, Dogecoin is slowly but surely continuing to show strength. Earlier this week, the meme was trading at around $0.25, up about 17% in the past month and more than 50% in three months, signaling a solid recovery despite falling 2% in one day.

The Dogecoin (DOGE) price increase hasn’t been frenetic, but it has been steady – and the on-chain data shows that holders’ confidence is growing.

Both old and new wallets continue to add to their holdings, while the chart patterns formed indicate a healthy bullish trend. If this momentum continues, the Dogecoin price has the potential to rise by around 20% again towards the $0.32 level or even higher.

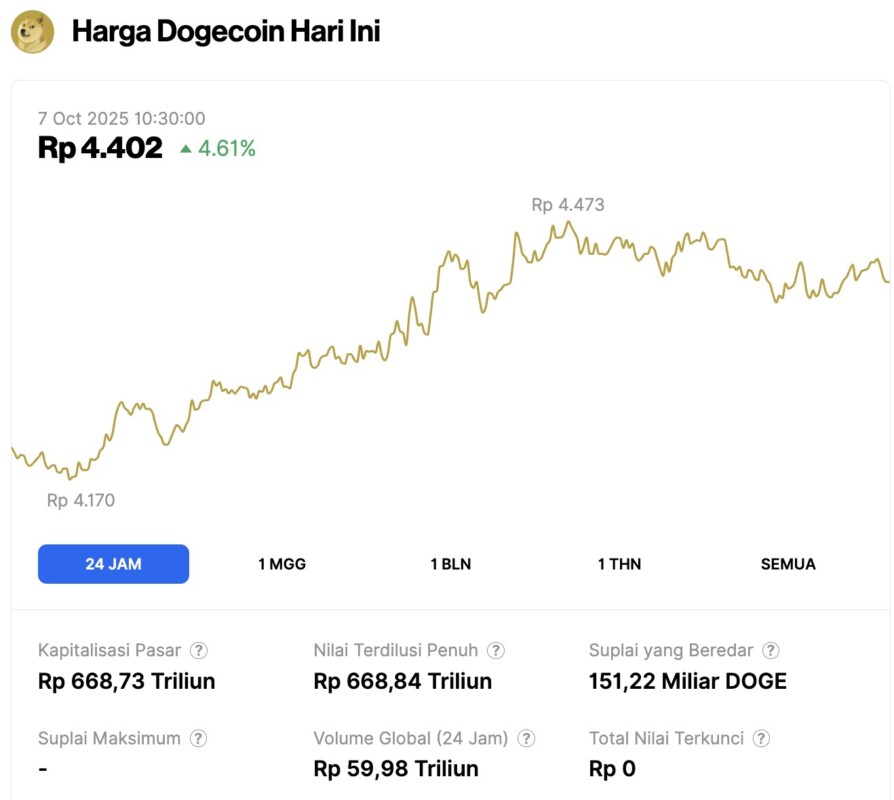

Dogecoin Price Rises 4.61% in 24 Hours

On October 7, 2025, Dogecoin (DOGE) surged 4.61% within 24 hours, trading at $0.2663, or approximately IDR 4,402. Over the past day, DOGE’s price has fluctuated between IDR 4,170 and IDR 4,473.

As of this writing, Dogecoin’s market capitalization stands at around IDR 668.73 trillion, with a 24-hour trading volume of approximately IDR 59.98 trillion.

Read also: Bitcoin Price Hits $124K Today — Entering the Heated Zone: Is a Pullback Coming?

Inactive Coins and Active Holders Strengthen Dogecoin’s Foundation

Two key on-chain metrics show increasing investor confidence in Dogecoin.

The Spent Coins Age Band indicator, which measures the number of coins of different ages changing hands, dropped dramatically by almost 88% – from 486.7 million DOGE on September 16 to just 58.5 million DOGE on October 6. In simple terms, this means that fewer and fewer coins are coming out of wallets, whether they’ve only been held for a week or for years.

When the number of coins sold decreases while the price rises – as it did for Dogecoin – it usually indicates that holders believe the upward trend will continue. They prefer to HODL rather than sell.

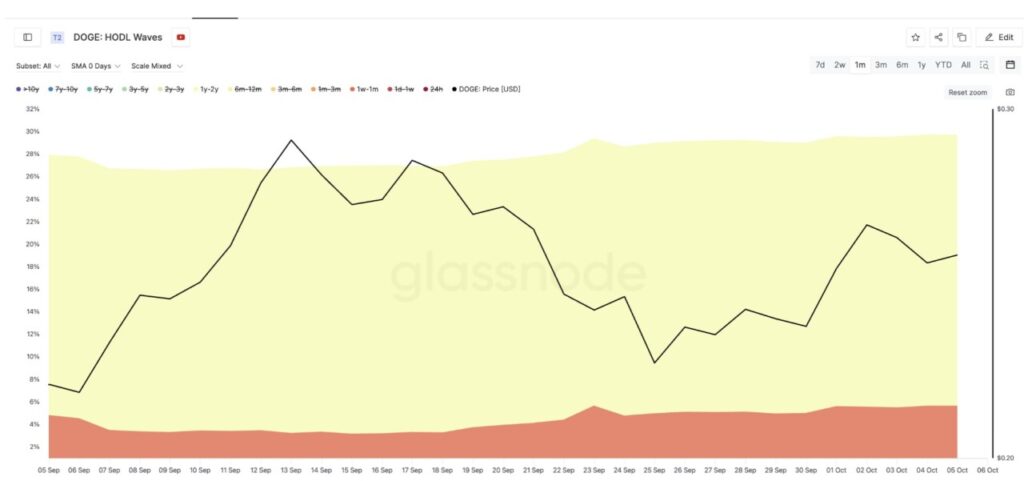

At the same time, the HODL Waves indicator, which tracks how long the coin has been idle, shows that both short-term and long-term holders are now increasing their holdings.

The 1-week to 1-month group increased from 3.16% to 5.65% in a month, while the 1-year to 2-year wallet rose from 23.11% to 24.05%. This means that new investors continue to buy even as prices rise, while old investors stay put – a rare combination that reinforces bullish signals.

Overall, the decrease in the number of coins sold and the increase in holdings shows one thing clearly: Dogecoin’s foundation is quietly getting stronger on the back of steady price movements.

Read also: DOGE Surges 15% from Buy Zone as Whales Snatch Up 30 Million — Can Bulls Breach $0.30?

Dogecoin Price has the Potential to Rise 20% as it Approaches Channel Breakout

Dogecoin is currently moving inside an ascending channel pattern – a bullish formation that forms when the price keeps printing higher lows between two parallel lines. The upper limit of this channel is around $0.28, which serves as a resistance level as well as a potential breakout point.

If the Dogecoin price is able to hold and break above the $0.28 level consistently, then an increase of up to 20% towards the $0.32 to $0.34 target becomes very likely.

However, if the bullish momentum continues to strengthen even though the price is still inside the channel, the breakout could happen sooner, as the upper trendline continues to climb – each new higher high brings Dogecoin closer to the safe breakout zone.

If buyers continue to hold the upper hand, Dogecoin’s price rally could potentially extend to $0.38 based on Fibonacci extension projections. On the other hand, $0.24 is an important support level that needs to be maintained. As long as the price does not drop below this area, the medium-term bias remains bullish. However, a drop below the $0.22 Fibonacci level could invalidate the positive sentiment in the short term.

Overall, Dogecoin’s price movement and on-chain data corroborate each other’s bullish narrative: the coin is not moving much, holders continue to add holdings, and the chart structure is narrowing. All of this sets up a quiet but powerful scenario towards a potential 20% breakout, should resistance be broken.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin Price Eyes 20% Rally as Breakout Setup Builds on Holder Confidence. Accessed on October 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.