Download Pintu App

Ethereum Falls 4% Today (Oct 8) — Is a Move Toward the $6,500 Level Still Possible?

Jakarta, Pintu News – Ethereum (ETH) price has the potential to experience a strong bullish breakout in the next few weeks as Wall Street investors’ interest in ETH-based ETFs increases.

As of October 7, the ETH token was trading around $4,800, and according to the Murrey Math Lines analysis tool, there’s potential for further upside that could push the price toward $6,500.

So, how is Ethereum’s price moving now?

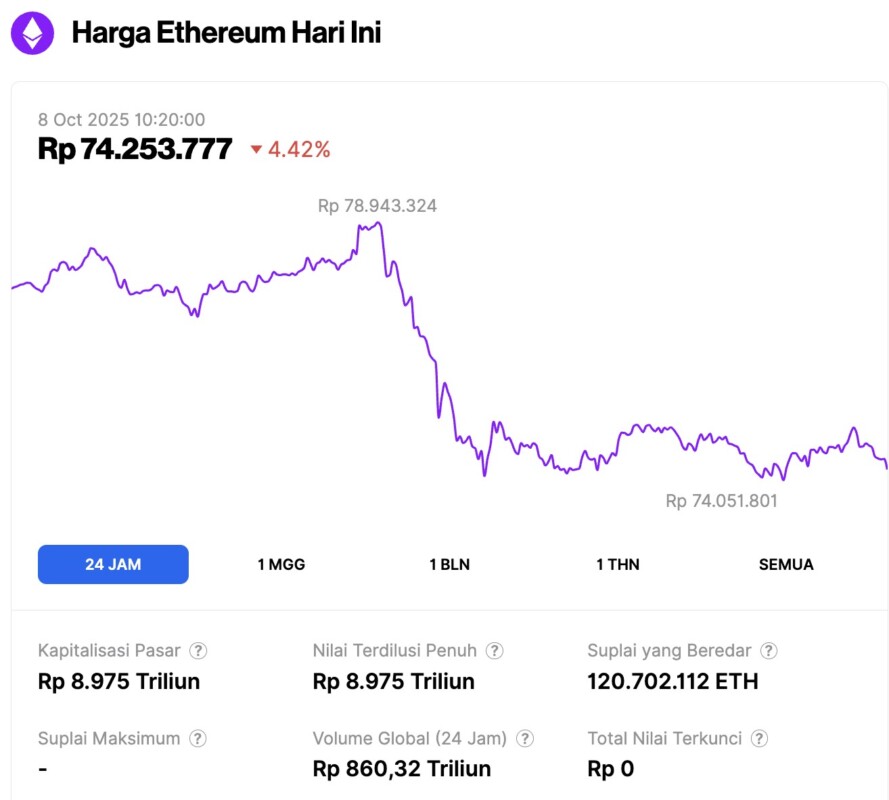

Ethereum Price Drops 4.42% in 24 Hours

On October 8, 2025, Ethereum (ETH) was trading at around $4,453, equivalent to IDR 74,253,777, marking a 4.42% decline over the past 24 hours. Within that time frame, ETH reached a daily low of IDR 74,051,801 and a high of IDR 78,943,324.

At the time of writing, Ethereum’s market capitalization is estimated at approximately IDR 8,975 trillion, while its daily trading volume has climbed 29% to IDR 860.32 trillion in the past 24 hours.

Read also: Bitcoin Falls to $121,000 — Can BTC Rebound to $130,000 Next?

Murrey Math’s Line Hints at Ethereum Price Hike to $6,500

On the weekly timeframe, the price of Ethereum appears to be restrained in recent days as investors are still cautious about pushing the price through the important resistance level of $5,000.

However, a number of chart patterns point to the potential for continued gains in the coming weeks. One of these is the formation of a hammer candlestick pattern, characterized by a small body and a long lower shadow with no upper shadow – a strong signal of a potential reversal to a bullish trend.

Ethereum has also moved above the important resistance level of $4,070, which was the previous price peak in March, May, and December last year. This indicates that a break-and-retest pattern has been completed, which is often considered a sign of continued uptrend.

In addition, Ethereum price is still holding above the 50- and 100-week Exponential Moving Average (EMA) lines, while the Relative Strength Index (RSI) indicator continues to show a strengthening trend.

Another important signal came from the Murrey Math Lines analysis tool, which traders use to identify areas of support and resistance. Currently, the indicator shows that Ethereum’s price is approaching a major resistance at $5,000.

If the price manages to break through this level, the potential for an increase towards the extreme overshoot area of $6,250, and then to the psychological level of $6,500, opens up. This movement would be equivalent to a surge of almost 40% from the current position.

Conversely, a drop below the $4,000 support level would invalidate the bullish projection for ETH prices in 2025.

Read also: Altcoin Season Has Arrived — Here’s Why Now Might Be the Best Time to Explore Crypto Beyond Bitcoin

BlackRock’s Ethereum ETF Nearly Breaks the $20 Billion Milestone

One of the main factors driving Ethereum’s potential price increase is the increased asset accumulation by US institutional investors.

Data shows that since the spot Ethereum ETF was approved in July last year, the total cumulative fund inflow has reached more than $14.6 billion.

Interestingly, BlackRock’s ETHA ETF continues to dominate the market with cumulative inflows of over $13.9 billion. Currently, the ETF’s total assets under management (AUM) has surpassed $18.6 billion, and it is expected to break $20 billion this week if the positive trend continues.

The ETHA ETF accounts for the largest portion of total global Ethereum ETF assets, which now stand at around $32 billion. Besides BlackRock, some of the other top Ethereum ETF issuers include Grayscale, Fidelity, and Bitwise.

BlackRock’s dominance is also evident in the Bitcoin sector, where total assets under management have risen to close to $100 billion, making it the company’s eighth-largest fund and most profitable so far.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Could Soar to $6,500 as BlackRock’s ETF Nears $20B Milestone. Accessed on October 8, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.