Download Pintu App

Awaiting FOMC and Jerome Powell’s Speech: Bitcoin’s New Direction?

Jakarta, Pintu News – Ahead of the release of the FOMC meeting minutes and a speech from Jerome Powell, chairman of the Federal Reserve (Fed), the Bitcoin (BTC) market is showing volatility. The minutes of the meeting are scheduled for release today, followed by the speeches of several Fed officials on October 8 and Powell’s speech on Thursday.

Powell is expected to discuss monetary policy, rising inflation amid a weak labor market, and economic concerns triggered by the US government shutdown. Read the full info here!

The Impact of FOMC Minutes and Powell’s Speech on Bitcoin

Bitcoin (BTC) recently fell to lows of $120,681 after hitting a new record high of $126,200. Currently, Bitcoin (BTC) is trading at $122,495, down more than 2% in the last 24 hours. Nonetheless, analysts remain optimistic about the price’s upside potential following the release of the FOMC minutes and a speech from Jerome Powell.

Uncertainty arising from tighter monetary policy and the volatile global economic situation is keeping crypto investors on their toes. Powell’s upcoming speech may provide further clues on the Fed’s policy direction, which could have a significant impact on crypto markets, including Bitcoin (BTC).

Crypto Analysts Optimistic Despite Bitcoin Correction

The price of Bitcoin (BTC) has plummeted to $120,681 (around Rp2.02 billion) after setting a new record high of $126,200 (around Rp2.11 billion). At the time of writing, BTC is trading at around $122,495, down about 2% in the last 24 hours.

Popular analyst Michael van de Poppe believes thatprofit-taking is natural after Bitcoin reached an all-time high (ATH). According to him, this small decline actually opens up new opportunities for investors tobuy back at the bottom price(buy the dip).

He also added that this kind of pattern is common in bull markets – every time Bitcoin sets a new record, there is a short correction before resuming the next rise.

Read also: Can Pi Network (PI) Price Reach $10 In The Next 2 Months?

Trend Still Bullish, Headed for Parabolic Phase?

Another analyst, CrediBULL Crypto, emphasized that Bitcoin’s trend is still bullish overall. He said, “every uptick now brings us closer to a parabolic move and a potential big top.”

According to him, Bitcoin is still the current market leader, while many altcoins tend to be held back due to a lack of momentum boost. This shows that BTC’s price movement is still themarket leader in the current up cycle.

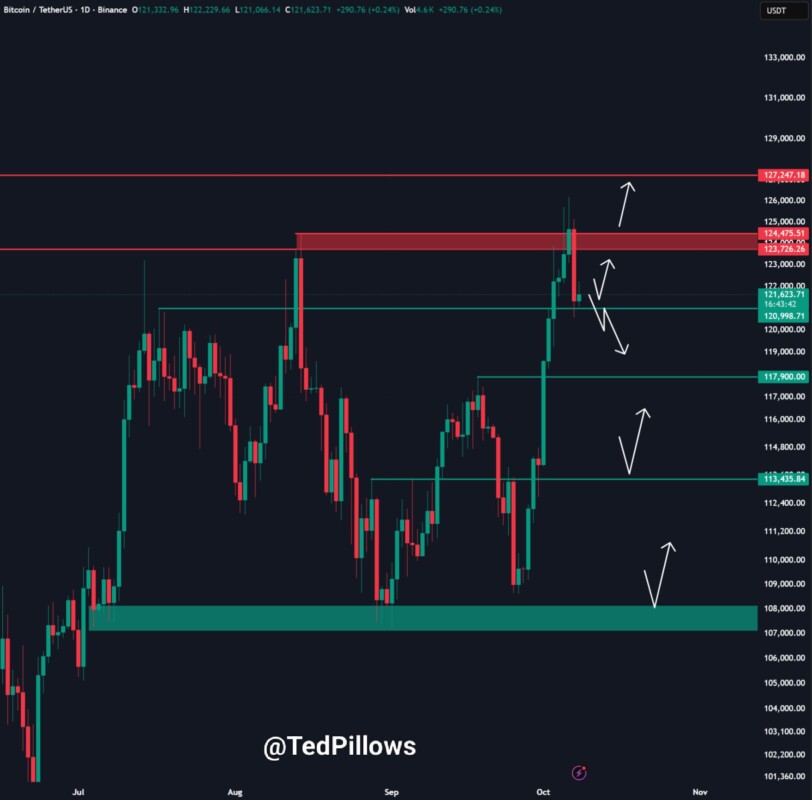

Meanwhile, analyst Ted Pillows noted strong resistance in the $125,000 area, which is an important resistance point for Bitcoin. He predicts that BTC could experience a reversal in this area due to the large support around $120,000.

However, if Bitcoin’s price falls through this level, selling pressure could increase and trigger a further drop towards $117,000-$118,000 (approximately Rp1.96-Rp1.98 billion).

Conclusion

With the release of the FOMC minutes and Jerome Powell’s upcoming speech, the Bitcoin (BTC) market may experience significant changes. Investors and traders are advised to follow these developments closely, as they could provide important indications about the future direction of the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. FOMC Minutes: Jerome Powell Speech, Will Bitcoin Recover or Retrace Further?. Accessed on October 9, 2025

- Featured Image: Fortune

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.