Download Pintu App

WLFI 10% Price Drop Doesn’t Shake $0.193 Target!

Jakarta, Pintu News – World Liberty Finance (WLFI), a crypto entity backed by Donald Trump, recently experienced a 10% price drop despite launching a USD1 stablecoin.

This decline came amid expectations that continued development would increase the value of WLFI. However, data shows that massive liquidity withdrawal and bearish market sentiment have affected WLFI prices, which are now under pressure.

Causes of WLFI Price Decline

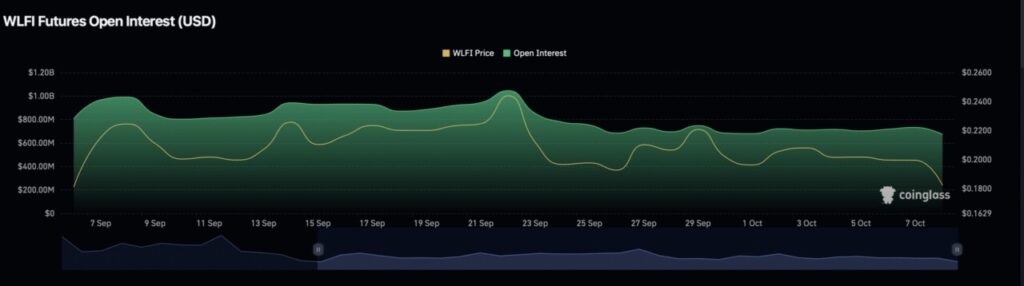

Despite WLFI having launched a USD1 stablecoin on the Aptos (APT) network, the price of WLFI experienced a sharp drop of more than 10%. This decline was driven by a large liquidity withdrawal, reaching $82 million, which reduced the total value locked to $630 million. WLFI’s trading volume also increased sharply, reaching $550 million, more than doubling compared to the previous day.

This drop comes amid a change in sentiment from bullish to bearish among investors, as noted on CoinMarketCap. The sentiment of the community following WLFI dropped from 79% to around 75%, indicating a decrease in interest in trading this asset. Nonetheless, large investors still seem to be positioning themselves for potential future gains.

Also Read: Trump’s Secret Plan May Push Bitcoin (BTC) to $250,000!

Interest from Whale and Institutions

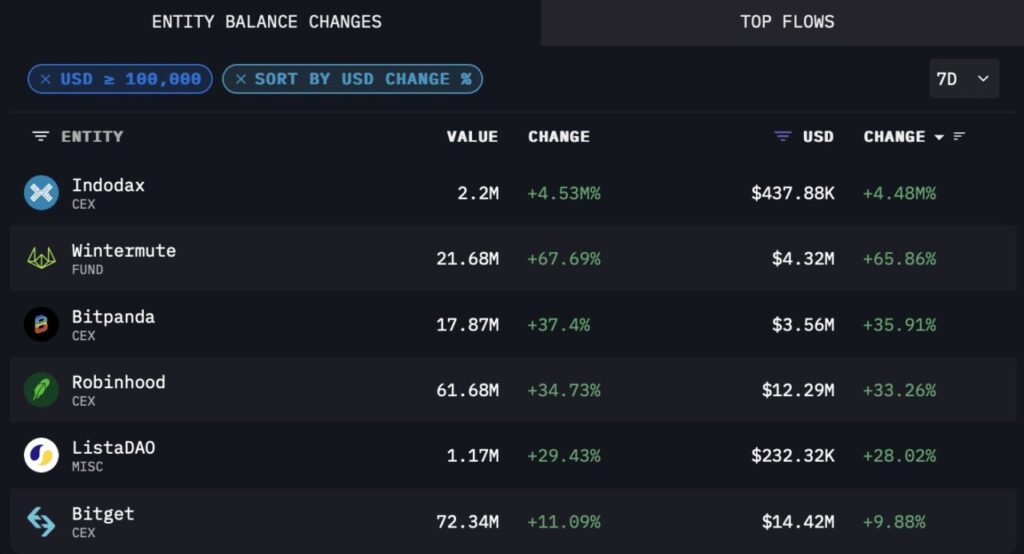

Despite massive selling by individual traders, a report from Arkham Intelligence shows that large crypto entities are still actively accumulating WLFI. In the past seven days, centralized investors such as Robinhood, Bitget, Bitpanda, and Indodax have invested over $30 million into WLFI. This shows that there is still strong interest from big players in the market.

On the other hand, some exchanges such as Binance, MEXC, and Coinbase made small sales of their WLFI holdings, each less than 1% of their total reserves. This suggests that the sales were more of a profit-taking activity rather than an indication of dominant selling pressure in the market. WLFI’s funding rate remaining positive at 0.0033% also confirms this bullish view.

WLFI’s Long-term Outlook

The liquidation map shows that there are still long liquidity clusters forming above the current WLFI price level. These liquidity zones usually act as magnets that attract price movement towards them over time. If this pattern continues, WLFI has the potential to increase, with a price target of $0.193, based on data from the one-day liquidation map framework.

This upside will largely depend on WLFI’s ability to retain the interest of large investors as well as the ability to overcome the bearish sentiment currently affecting the market. With strong support from large entities and continuous innovation, WLFI has the potential to achieve its target price.

Conclusion

Although WLFI has experienced a significant price drop, analysis shows that there are still opportunities for recovery and achievement of higher price targets. Support from major investors and constant innovation are key to reversing the current trend and achieving WLFI’s full potential in the crypto market.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. WLFI drops 10% as $82M exits, yet 0.193 target still in sight. Accessed on October 10, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.