Download Pintu App

Apple xStock (AAPLX) Price Today (10/10): Down 0.87% Amid Apple’s Global PC Shipment Surge

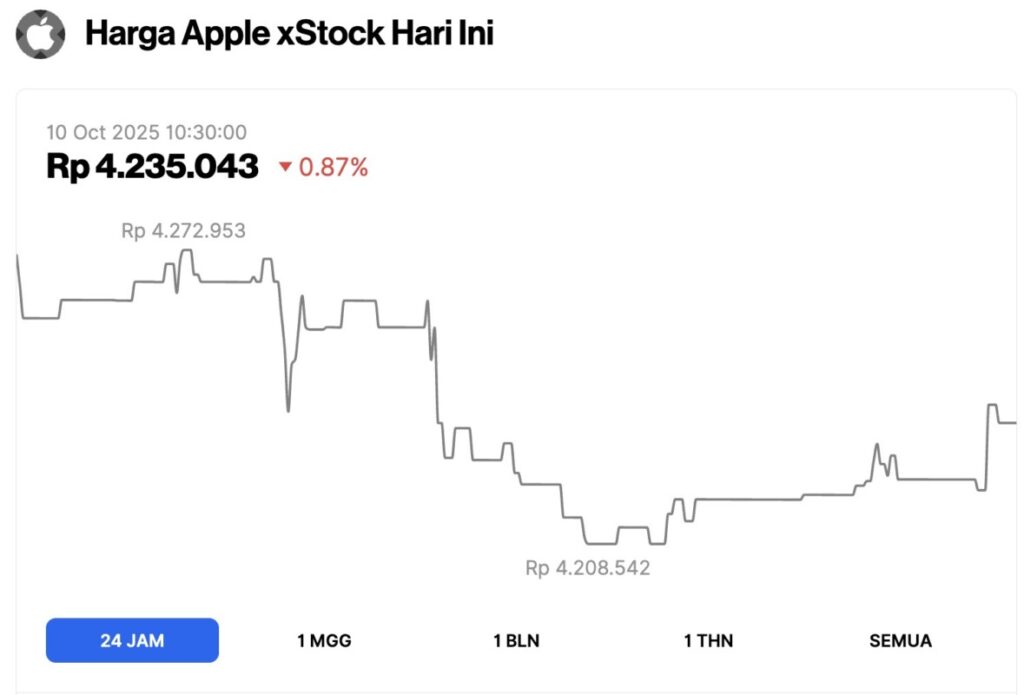

Jakarta, Pintu News – The price of Apple xStock (AAPLX) today, October 10, 2025, was recorded to have fallen 0.87% to Rp4,235,043. Despite the daily correction, Apple stock still shows solid fundamental strength. This slight decline comes amid positive news about Apple’s 13.7% surge in global PC shipments in the third quarter of 2025, driven by increased demand in the education and consumer sectors.

Apple xStock price falls slightly, market sentiment still positive

The chart above shows the price movement of Apple xStock in the last 24 hours as of October 10, 2025 at 10:30 am GMT. Apple’s share price was recorded at Rp4,235,043, down 0.87% compared to the previous day. Throughout the trading period, the price touched a high of IDR 4,272,953 before moving down to reach a low of IDR 4,208,542.

This decline indicates mild selling pressure after the rally at the beginning of the week. However, price movements are still relatively stable with moderate volatility.

This slight decline likely reflects short-term profit-taking, while long-term sentiment towards Apple stock remains positive, especially after reports of the company’s global PC shipment growth rising 13.7% in the third quarter of 2025.

Apple’s Global PC Shipments Surge

Based on a recent report, global PC shipments in Q3 2025 reached 75.9 million units, up 9.4% on an annualized basis. Of these, Apple shipped 6.8 million units, a 13.7% increase over the previous year.

This increase was driven by increased demand from the education sector as well as a shift in users updating their devices due to the end of Windows 10 support.

Globally, Lenovo still leads with 19.4 million units shipped, followed by HP with 15 million units. However, Apple recorded the fastest growth among other major manufacturers, especially in the Asia-Pacific region which saw a rapid surge thanks to education digitization projects such as the GIGA Project in Japan and South Korea.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (10/10/25)

Financial Performance Remains Solid

On the financial front, Apple is performing very strongly. The company’s revenue for the latest 12-month period was recorded at $408.63 billion, with a three-year growth rate of 5.4%. Operating margin increased to 31.87%, signaling cost management efficiency and product pricing strength in the premium market.

Meanwhile, net profit margin stood at 24.3%, reflecting Apple’s ability to convert sales into stable profits. On the balance sheet, the Debt-to-Equity ratio stood at 1.55, while the Altman Z-Score of 10.98 indicates excellent financial health. However, internal activity shows a trend of share sales by executives, with more than 340,000 shares released in the last three months.

Investing in American stocks is now possible at your doorstep through Market xStocks!

Want to invest in big American companies like Nvidia, Coinbase, or MicroStrategy without having to open an offshore account? Now you can easily do so with the xStocks feature in the Pintu app. Through xStocks, you can buy shares of your favorite global companies in the form of crypto assets whose value represents the original share price on the US exchange.

xStocks gives Indonesian investors the opportunity to have exposure to the American stock market right from the Pintu app – with small amounts, transparency, and 24-hour accessibility. So, you can add to your global portfolio hassle-free, right from one app!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Guru Focus. Apple (AAPL) Sees 13.7% Growth in Global PC Shipments. Accessed October 10, 2025

- Featured Image: Unsplash

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.