Download Pintu App

Crypto Market is Red in Color, Why Market Crash Today (10/11/25)?

Jakarta, Pintu News – The price of Bitcoin (BTC) plummeted sharply to $102,000 or around Rp1.69 billion after US President Donald Trump announced a 100% tariff on all Chinese products on Friday (10/10). This policy immediately shook the crypto market, triggering a massive sell-off and lowering the global market capitalization by almost 12% in just one day. Read the full analysis here!

Trump’s new policy shakes up world crypto market

The price of Bitcoin (BTC) suddenly fell sharply to $102,000 or around Rp1.69 billion after US President Donald Trump announced 100% import tariffs on all Chinese products on Friday (10/10). This decision immediately shook the global cryptocurrency market and triggered a massive sell-off on various exchanges.

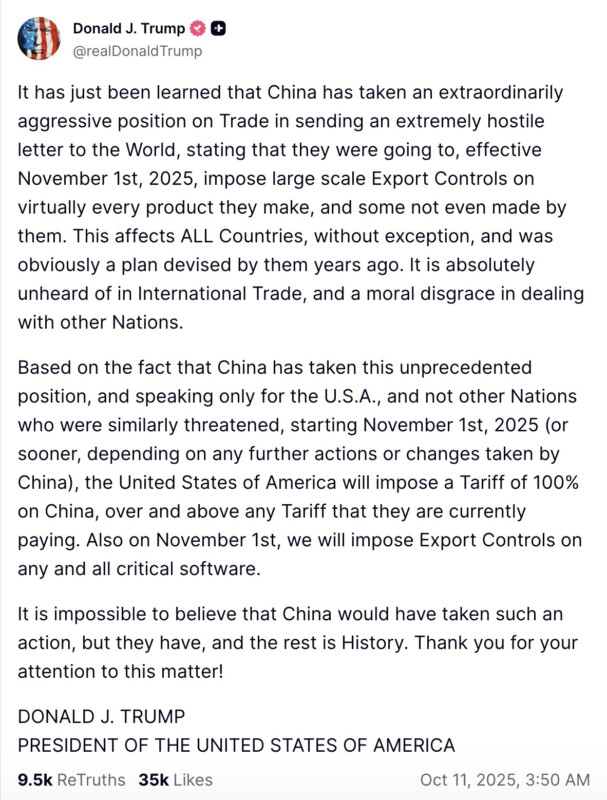

Trump said the policy was taken after China planned to limit exports of rare earth minerals, an important material for making computer chips and semiconductors. Through a post on the Truth Social platform, he considered China’s move as “very aggressive” and potentially threatening the global economy.

Bitcoin Falls to Lowest Level Since June 2025

Following the tariff announcement, the BTC/USDT pair on Binance immediately dropped to $102,000 (Rp1.69 billion) – its lowest level in three months. Meanwhile, on Coinbase, Bitcoin price briefly touched $107,000 (Rp1.78 billion) before recovering slightly.

Also read: Market Dump, These 3 Tokens Are Immediately Bought by Crypto Whale!

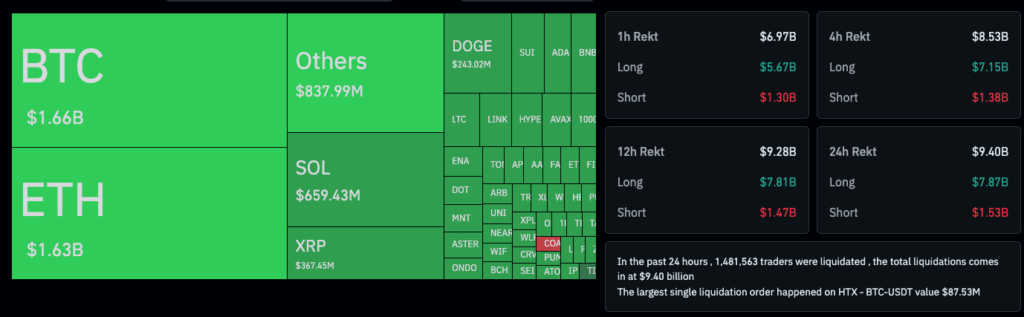

According to data from CoinGlass, the total trading positions in the crypto market that were liquidated in the last 24 hours reached $9.4 billion, with around $7.15 billion coming from long positions. Analysts call this a form of “market capitulation”, which is when investors sell assets out of fear that prices will fall further.

Ethereum and Solana Take a Hit

The price drop was not only experienced by Bitcoin. Other major crypto assets such as Ethereum (ETH) and Solana (SOL) also fell sharply. ETH prices dropped to $3,500 on Coinbase, while SOL fell below $140 in futures trading on Binance.

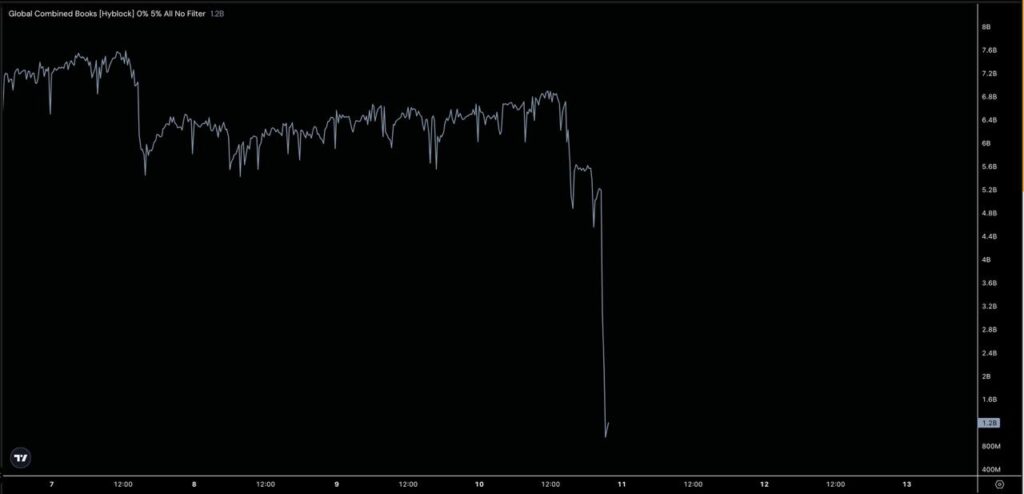

A report from Hyblock Capital mentions that leveraged positions in most altcoins have been “completely wiped out”. In other words, many traders lost their positions due to extreme volatility spikes. The crypto market was met with selling pressure, while trading volumes jumped sharply signaling panic is still ongoing.

The Impact of China’s Tariffs on the Tech and Crypto Mining Industry

Trade tensions between the United States and China are now affecting not only the export sector, but also the tech industry. China’s move to restrict exports of rare earth minerals could disrupt global supply chains that rely heavily on these materials for the production of chips, artificial intelligence (AI) and crypto mining devices.

Meanwhile, the US policy of tightening investment and technology exports to China is considered an effort to reduce dependence on foreign manufacturing. However, the side effect could put pressure on the crypto industry as most mining devices are still manufactured in China. If the supply of chips is hampered, the operational costs of crypto miners could increase.

Crypto Market Capitalization Drops Nearly 12%

In the last 24 hours, the total value of the global cryptocurrency market plummeted by 11.8%, down to around $3.64 trillion (IDR 60.5 quadrillion). This decline shows how sensitive the crypto market is to global economic and geopolitical policies, especially those involving the United States and China.

Read also: Top 3 Altcoins in October 2025

Analysts warn that volatility is likely to continue in the next few days.Whales and institutional investors are expected to remain cautious until the full impact of the tariffs is clear. However, some market participants think that a sharp decline like this could actually be a moment to buy crypto assets at a discount.

Conclusion

The 100% tariff policy against China has once again shown how strong the relationship between global geopolitics and crypto market movements is. Bitcoin’s (BTC) price drop to below Rp1.7 billion is a reminder that this market is still very vulnerable to major economic policies.

Even so, many analysts believe that crypto fundamentals remain strong in the long term. Investors are advised to remain vigilant, implement risk management strategies, and monitor developments in the US-China trade relationship – as the next move in the cryptocurrency market could be determined by political decisions in Washington and Beijing.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin plummets to $102K on Binance as Trump announces 100% tariffs on China. Accessed October 11, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.