Download Pintu App

After the Massive Crash, What is the Condition of the Crypto Market Today (10/13)?

Jakarta, Pintu News – Bitcoin (BTC) price is attracting attention again after successfully testing important technical levels amid positive news about trade relations between the United States and China.

While analysts see the potential for a new rally, the behavior of crypto traders has also come under scrutiny as they are busy blaming President Trump’s tariffs for last weekend’s market decline. The combination of geopolitical factors and technical signals is now creating new tensions in the cryptocurrency world.

US-China Trade Relationship Improves, Market Sentiment Recovers

After heating up due to rare mineral export policies and plans for 100% additional import tariffs from the US, trade relations between the United States and China are now showing signs of improvement.

China’s Ministry of Commerce expressed its willingness to return to the negotiating table to discuss export policies and other trade issues that had caused tension.

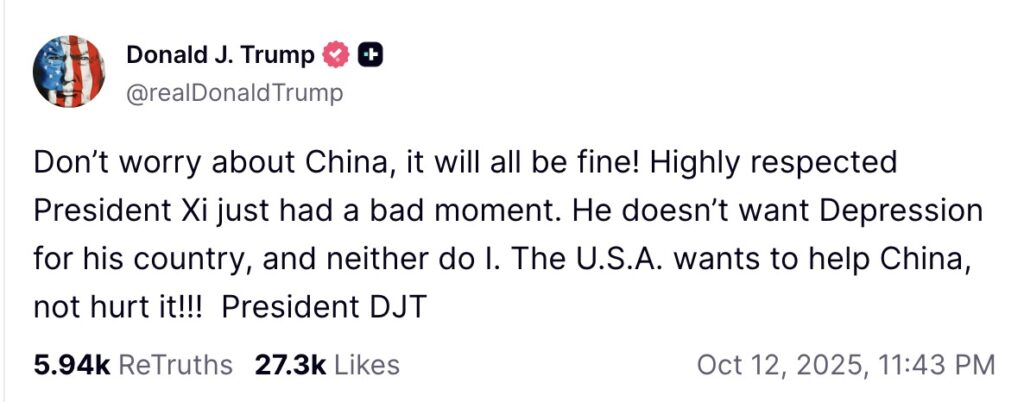

US President Donald Trump also made a calming statement via Truth Social, writing that the two countries “don’t want to hurt each other” and that he believes relations with President Xi will improve. This softer stance from both sides is a positive signal for global investors who had been worried about the economic impact of a prolonged trade war.

Read also: 1 Pi Network (PI) Price in Indonesia Today (10/13/25)

According to a number of market analysts, the move has the potential to drive a price recovery in various risky assets, including crypto. If this positive momentum continues, the selling pressure that pressured the market late last week could turn into the start of a new rally.

Bitcoin (BTC) Tests “Golden Cross”: A Signal of Parabolic Rise?

Amid easing geopolitical tensions, Bitcoin (BTC) is testing the “golden cross” technical pattern, a bullish formation that has historically been the precursor to large price spikes. Based on market analysis from Mister Crypto, a similar pattern once triggered a rally of up to 2,200% in 2017 and around 1,190% in 2020.

Currently, the price of Bitcoin is trading at around Rp1.82 billion (approximately $110,000), approaching a key area that could potentially be the starting point for further gains. Analysts think that if BTC is able to stay above this level, there is a greater chance of a parabolic rally in the next few weeks. Mister Crypto writes that the current technical formation “looks very strong” and that confirmation of the breakout could send prices “soaring.”

Technically, a golden cross occurs when the short-term moving average (usually 50 days) crosses above the long-term average (200 days). This pattern is often considered a signal that the price trend is beginning to shift from bearish to bullish, reflecting a major change in market direction.

Also read: Gold Jewelry Price Today, Monday October 13, 2025

Market participants are now waiting for confirmation of the movement in the next few days. If Bitcoin is able to maintain momentum above Rp1.8 billion, it is not impossible that the cryptocurrency market will return to the euphoric phase as it did in the previous cycle.

Crypto traders blame Trump for market crash

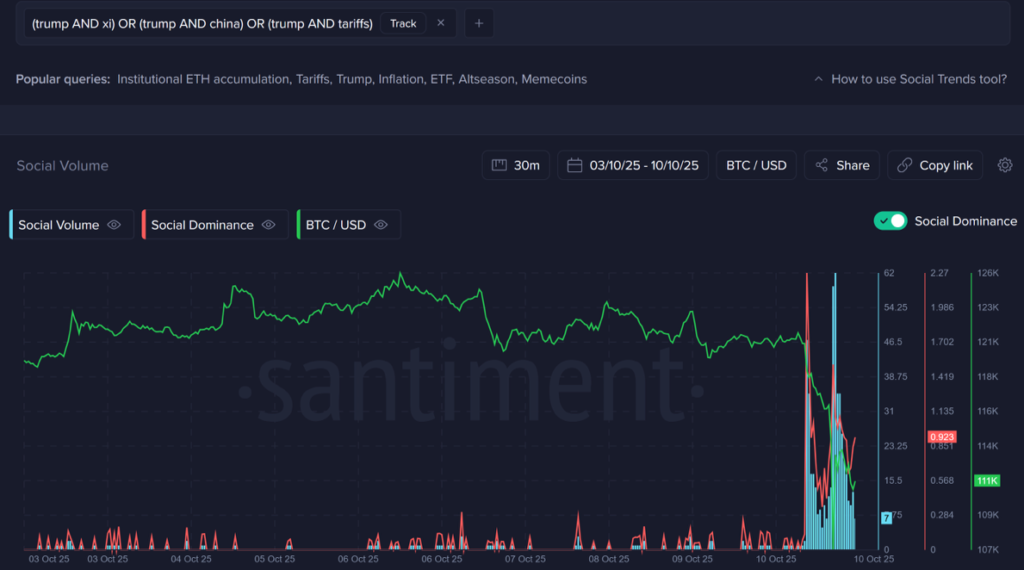

Meanwhile, the behavior of the crypto trader community is back on the table. Many retail investors immediately pointed the finger at President Trump’s new tariffs on China as the main cause of Friday’s crypto price drop. However, a report from Santiment mentioned that this habit of looking for a “scapegoat” is a common reaction among traders who try to find one single cause behind market turmoil.

Santiment believes that the cause of the market decline is not solely due to tariff policies. “This is a typical form of rationalization from retail investors who need a concrete reason to explain the decline in crypto prices,” the report states.

Following the price drop, the topic of US-China policy and crypto spiked on social media. This spike in conversations shows how traders often associate geopolitical factors with cryptocurrency price movements, despite the fact that market movements are more influenced by technical factors and global risk sentiment.

This phenomenon illustrates the unique character of the crypto market-quick to react to news, emotional, and highly dependent on public narrative. This is why volatility in the cryptocurrency market is often higher than in conventional assets like stocks or gold.

Conclusion

The easing of trade tensions between the US and China has breathed new life into global financial markets, including the cryptocurrency world. With Bitcoin (BTC) now testing a golden cross pattern, market participants see a chance of a major rally if the positive momentum continues.

However, the emotional behavior of traders who are quick to react to political news suggests that volatility will remain high, so caution is warranted amidst the huge potential opening up in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Here’s what happened in crypto today. Accessed October 13, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.