Download Pintu App

Dogecoin Jumps 8% Today: Microsoft Now Accepts DOGE — What’s the Next Move?

Jakarta, Pintu News – Dogecoin (DOGE) is experiencing rapid market changes following significant technical and corporate developments.

The price of DOGE fell sharply after completing a nine-month bear flag formation, while Microsoft’s decision to accept payments using Dogecoin brought a new dynamic to the market.

At the time of writing, DOGE is trading at around $0.20, up 8% in 24 hours. The question now is, will this integration help stabilize sentiment towards DOGE after the sharp drop?

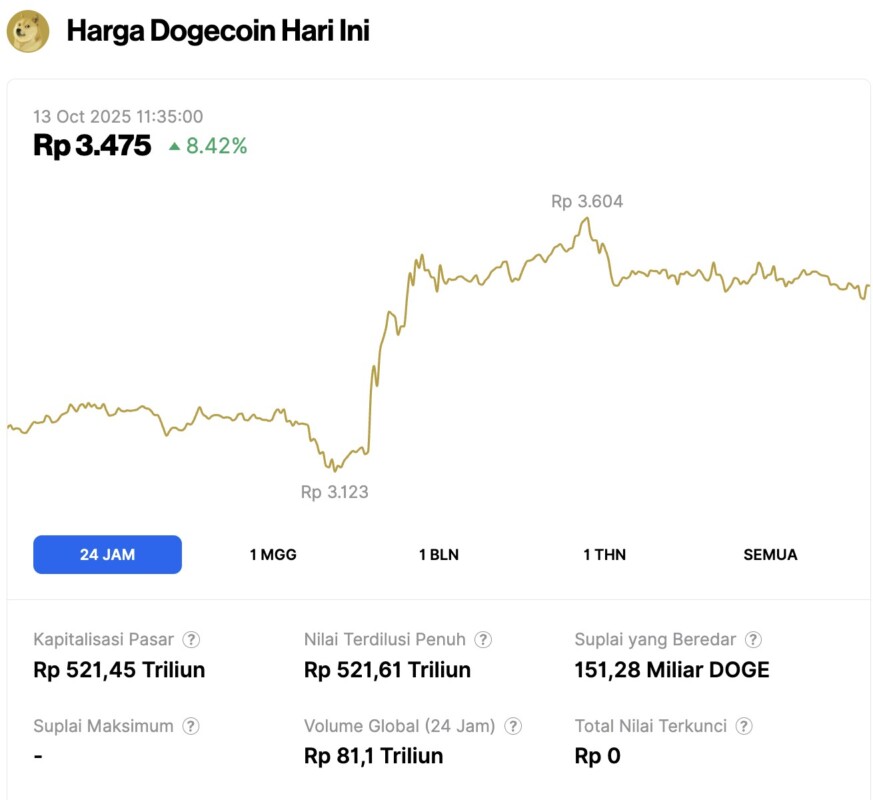

Dogecoin Price Rises 8.42% in 24 Hours

On October 13, 2025, Dogecoin (DOGE) surged 8.42% within 24 hours, trading at $0.2086, equivalent to IDR 3,475. During the same period, DOGE fluctuated between IDR 3,123 and IDR 3,604.

As of this writing, Dogecoin’s market capitalization stands at approximately IDR 521.45 trillion, with a 24-hour trading volume of around IDR 81.1 trillion.

Read also: Ethereum Surges 8% as Crypto Whales Scoop Up ETH at a Discount

Bear Flag Pattern Triggers Sharp Drop in DOGE Price

According to Coin Republic (12/10), Dogecoin’s chart structure shows a prolonged bear flag pattern – a technical formation that usually appears after a sharp decline and is followed by a consolidation phase before resuming the downtrend.

According to data from Kev Capital, the lower boundary of the pattern was finally broken, triggering a measurable downward movement that occurred in just a matter of hours. During the decline, the price of DOGE fell rapidly from the upper boundary of the channel all the way to the projection target before finally stabilizing at around $0.19.

Analysts felt that this move confirmed the weak price momentum over the past few months, as the bear flag pattern has been forming since early 2025. Trading volumes also jumped sharply on the breakout, indicating short-term capitulation among highly leveraged positions.

The increased selling pressure is in line with reduced market liquidity, a factor that often magnifies price fluctuations. Market observers note that this sell-off marks the completion of the overall bear flag structure – a signal that the previous downtrend may have reached an exhaustion phase.

However, traders are still cautious, waiting for confirmation on whether DOGE is able to find stable support in the current price range or will return to test lower areas.

The breakout of this pattern also reflects the broader negative sentiment in the meme token sector, where a number of assets are showing similar technical patterns after months of speculative trading activity.

Microsoft Integration Supports DOGE’s Long-term Prospects

Although Dogecoin’s chart was technically bearish, the announcement from Microsoft shifted the market’s focus towards real-world applications. The company confirmed that it has added Dogecoin as one of the payment options for certain digital products and services.

Read also: 4 Coin BNB Memes Most Accumulated by Crypto Whale in Uptober 2025

This feature was launched through Microsoft’s digital commerce division with the aim of expanding the flexibility of payment methods for users. Analysts see this move as a gradual progress of a major company in integrating blockchain technology into its business ecosystem.

While the payment feature is currently limited to certain services, it shows the continued interest of large corporations to test digital assets as a means of consumer payment.

Some observers consider this decision relevant to Dogecoin’s younger user base, which is generally accustomed to transacting using tokens and other digital assets.

One analyst noted that Microsoft’s approach is conservative yet strategic – not a speculative promotion, but a realistic attempt to expand payment options.

Following the announcement, market reactions were mixed. While some traders see the integration as a supportive factor for the DOGE’s medium-term stability, others think the impact is still too small to affect prices in the short-term.

Nevertheless, Microsoft’s move helped keep trading sentiment stable after the previous massive selloff, and served as a reminder that Dogecoin’s cultural appeal still has practical value in the real world, even when its technical signals are weakening.

DOGE Price Pattern Hints at Potential Recovery

Technical analysts highlight that Dogecoin (DOGE) has completed its second significant decline on the monthly chart – a structure that previously appeared before the major rally phase took place.

Historically, DOGE often shows a pattern of two consecutive dips before entering a period of strong price increases. This repeated formation, sometimes referred to as a “two-dip setup”, once served as a bullish reversal signal in the previous price cycle.

If the same pattern repeats, DOGE prices could potentially recover gradually once trading volumes stabilize and buying interest picks up again. Recent price charts also show that the current decline is in line with previous cyclical behavior, signaling a possiblebottoming phase if the support zone holds.

However, the analyst warns that confirmation of recovery will only be seen if DOGE is able to consistently break through major resistance levels and momentum in the altcoin market strengthens again.

Some market participants refer to historical data showing that after the second drop, the DOGE usually jumps to the next price zone in a matter of weeks or months.

However, this optimistic outlook remains dependent on liquidity recovery and short-term sentiment, especially after Microsoft’s announcement of Dogecoin integration.

Read also: Bitcoin Bounces Back to $115,000 — Is This the Start of a New Rally or Just a Temporary Rebound?

The Next Direction Traders Need to Watch

The direction in which Dogecoin (DOGE) moves next will largely depend on whether the price is able to stabilize after completing its technical pattern. If the support area around $0.19 holds, analysts expect DOGE to enter a consolidation phase before attempting a rebound.

The sustained high trading volume and improving sentiment in the meme token sector could strengthen the price foundation. Conversely, if the price breaks the support decisively, it could trigger another short-term decline towards the previous consolidation zone.

Traders also continue to monitor broader macroeconomic risk conditions, including interest rate policy and stock market volatility that could potentially affect crypto market liquidity.

For now, the Dogecoin market is between two opposing forces: technical pressure from a completed bearish pattern and optimism from new real-world adoption.

How these two factors balance each other out in the next few trading sessions will determine whether DOGE’s latest drop is a sign of trend exhaustion or the start of a new decline.

At the time of writing, analysts consider the market to be technically oversold, but are still waiting for a confirmation signal before concluding that the price has bottomed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Republic. Dogecoin Price Sees Shift As Microsoft DOGE For Payments. Accessed on October 13, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.