Download Pintu App

Is the Next Altcoin Season Coming? Inside CryptoAmsterdam’s Market Cycle Analysis

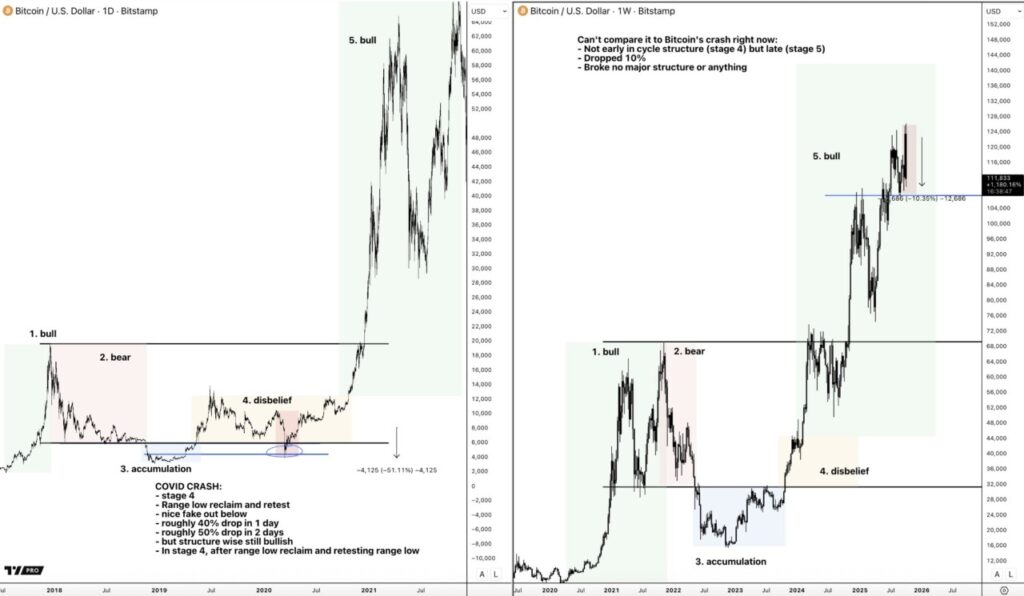

Jakarta, Pintu News – According to a tweet shared by analyst CryptoAmsterdam, the crypto market is currently at the tipping point of a major cycle. Bitcoin (BTC) has led a huge rally since the beginning of the year, but signs are starting to appear that Bitcoin’s dominance is starting to weaken and make room for altcoins to rise.

CryptoAmsterdam thinks the current market conditions have a similar pattern to the time before the big “altseason” in 2020 – when altcoins surged after the COVID-19 crash. Will history repeat itself?

Understanding the Crypto Cycle: From Bitcoin Domination to Altseason

According to a CryptoAmsterdam post, in every crypto cycle, Bitcoin usually leads about 90% of the bull market ride, while altcoins lag behind. Bitcoin’s (BTC.D) dominance increases as Bitcoin price rallies, while most altcoins are depressed.

Read also: Bitcoin Bounces Back to $115,000 — Is This the Start of a New Rally or Just a Temporary Rebound?

However, at the end of the cycle, this pattern usually reverses – Bitcoin’s dominance declines and altcoins start to outperform.

Today, the first signs of such a shift are beginning to emerge:

- Bitcoin’s dominance is starting to decline in the important zone.

- Ethereum (ETH) showed significant gains against Bitcoin.

- Many altcoins are starting to reclaim positions at the bottom of their price ranges – an early sign of entering into the “disbelief” stage before a potential new uptrend.

Typical stages of the crypto cycle include:

- Bull – the price forms a higher high and a higher low.

- Bear – the price drops with a lower high and lower low.

- Accumulation – the price stabilizes below the lower range, forming a new bottom.

- Disbelief – the price starts to rise back to the old range, but the market is still skeptical.

- Bull (continued) – parabolic rally towards a new peak.

COVID-2020 Crash: Lessons from the Past

In March 2020, the crypto market experienced an extreme crash due to the COVID-19 pandemic. Empty order books and massive liquidation sent the price of Bitcoin plummeting.

However, just a few months later, the market reversed course and started one of the biggest bull runs in crypto history.

Technical analysis suggests that the 2020 crash was actually a retest of a major bottom – a “fakeout” followed by a major rally. The same pattern is now being seen in some major altcoins such as Dogecoin (DOGE), which is retesting the macro bottom area with a technical structure similar to the 2020 pre-rally phase.

Current Altcoins: In the Final Stage of Accumulation

Although global economic conditions are different from the pandemic era (without massive stimulus and money printing like 2020), technically, many altcoins are now in an attractive position:

- DOGE and ETHBTC show a stage 4 structure, which is a retest phase before the next bull phase.

- BTC is still keeping its bullish structure on a macro basis, with no major breakdown signs.

- Relevant altcoins such as SUI and KaitoAI displayed similar price patterns to ETH before the big rally in 2020.

Read also: Pi Coin Jumps 5% Today — Could This Be the Start of a 13% Recovery Rally?

However, analysts emphasize that not all altcoins will survive. With thousands of new projects, most new tokens could potentially remain stuck in the “stage 3” phase (directionless accumulation). The focus should be on altcoins with strong technical structures and high liquidity.

Investor Strategy: Be Patient and Selective

Although many technical signals point to a potential alt-season, analysts warn against rushing into the market.

The main strategy is:

- Wait for a clear setup: such as a reclaim at the lower range, confirmation of a higher high, or a breakout at a major resistance level.

- Use spot trading: avoid high leverage as volatility is still extreme.

- Execution is sparse but precise: wait for the moment when the market panics – that’s when the biggest opportunities arise.

As exemplified in last year’s Sui (SUI) pattern, patience and validation of the technical structure are key. Strong altseasons often start from fear and market uncertainty.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Amsterdam. Accessed on October 13, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.