Download Pintu App

Bitcoin (BTC) Prints Record Highs, Is a Bear Market Awaiting in October 2025?

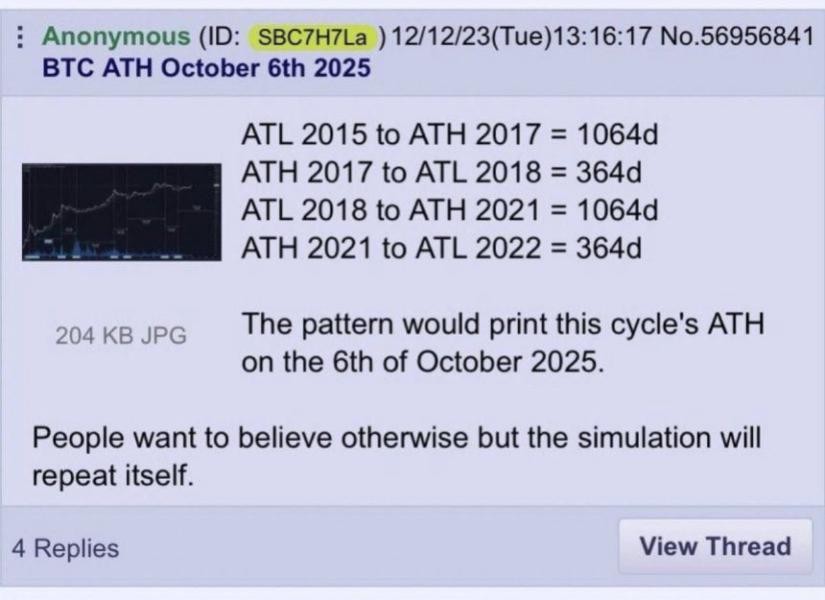

Jakarta, Pintu News – Bitcoin (BTC), the leading cryptocurrency, has set a new record high by breaking the $126,000 mark for the first time. However, this achievement not only caught the attention of investors but also revived discussions about a prediction made two years ago by an anonymous user. The prediction said that Bitcoin (BTC) would peak on October 6, 2025, which proved to be true yesterday.

New Bear Market Predictions

Despite reaching a milestone, Bitcoin (BTC) experienced a drop to around $121,000 just hours after hitting a record high, which led to a lot of liquidation of long positions on various exchanges. These rapid price fluctuations led many to speculate that this latest peak might mark an all-time cycle peak, indicating that Bitcoin (BTC) might soon enter a new bear market phase.

The prediction made in December 2023 states that if historical patterns hold true, the bear market bottom is expected to occur exactly 364 days later. This theory is gaining attention amid today’s volatility, with experts warning that a change in market sentiment may be imminent.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Market Analysis by Doctor of Profit

Doktor Profit, a market analyst, recently warned that despite the current bullish trend, the market is entering a dangerous phase. He noted that despite the prevailing sense of euphoria, the underlying financial indicators point to a potential liquidity crisis.

Doktor Profit highlights the Reverse Repo (RRP) market, which has fallen from a peak of $2.2 trillion in mid-2022 to just $8-10 billion today. This decline raises concerns about the stability of interbank liquidity, suggesting that the financial system may soon face significant dislocation if RRP continues to dry up.

Warning for the Bitcoin (BTC) Market

In the crypto space, recent trends point to substantial inflows into exchange-traded funds (ETFs), with firms like BlackRock contributing over $1 billion in Bitcoin (BTC) and $200 million in Ethereum (ETH) just last week. However, Doktor Profit argues that the broader market liquidity picture remains worrying.

While retail traders express optimism about a “flood of liquidity,” experts warn that cash flows into money market funds may actually drain liquidity from the broader market rather than increase it. The current market environment is also characterized by increased insider selling, where executives are reportedly selling stocks at unprecedented rates, even as retail investor inflows increase.

Conclusion: Bearish Macro Picture

Overall, the sentiment painted a bearish picture on a macro level. Both crypto and stock markets are seen as high risk of entering a bear market after the fourth quarter. This signals that investors should be vigilant and may need to consider strategies to deal with a potential upcoming bear market.

Also Read: Shocking Prediction of Uniswap (UNI) Price Until 2030 According to CoinCodex!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Reaches Forecasted All-Time High, Prophecy Predicts Bear Market Low in 364 Days. Accessed on October 13, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.