Download Pintu App

Ethereum Hits $4,100 Today — Is a Cup Pattern Signaling a Further Rally?

Jakarta, Pintu News – The price of Ethereum (ETH) has recovered strongly from its low around $3,430, and is currently hovering around $4,100 – registering a gain of around 20%. While this appears to be a solid recovery, price charts and on-chain data suggest that this move is unlikely to be a smooth one.

ETH has the potential to continue to rise, but there is a possibility of a temporary correction before continuing to rise to higher levels. Then, how will Ethereum price move today?

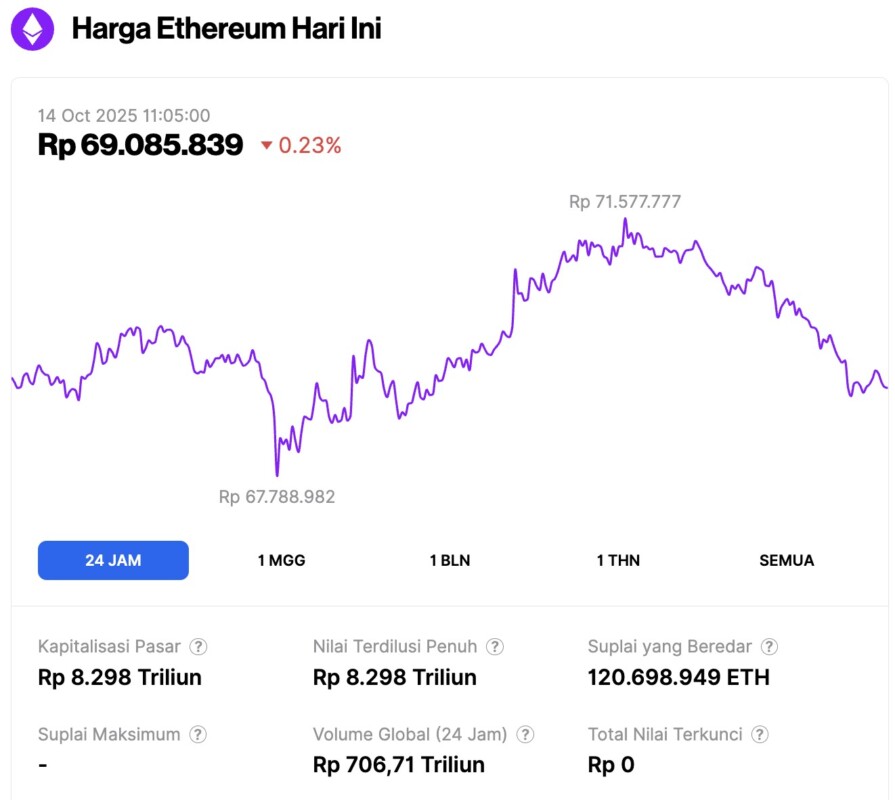

Ethereum Price Drops 0.23% in 24 Hours

On October 14, 2025, Ethereum was trading at approximately $4,148, or around IDR 69,085,839, marking a slight decline of 0.23% over the past 24 hours. During this period, ETH dipped to a low of IDR 67,788,982 and reached a high of IDR 71,577,777.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 8,298 trillion, while its daily trading volume has dropped 17% over the last 24 hours to IDR 706.71 trillion.

Read also: Bitcoin Slips Back to $113,000 Today — Are BTC Holders Turning Cautious?

Whales are Buying ETH, but Other Investors are Still Wary – Ethereum Market Split

Ethereum’s current price recovery seems to be driven by whale wallets, not by small investors. Data from Santiment shows that since October 11, whale wallets have increased their holdings from 100.28 million to 100.36 million ETH.

That means there is an accumulation of about 80,000 ETH, worth approximately $330 million at the current ETH price. This slow but consistent rise indicates a tacit accumulation post-drop, reflecting the confidence of long-term players.

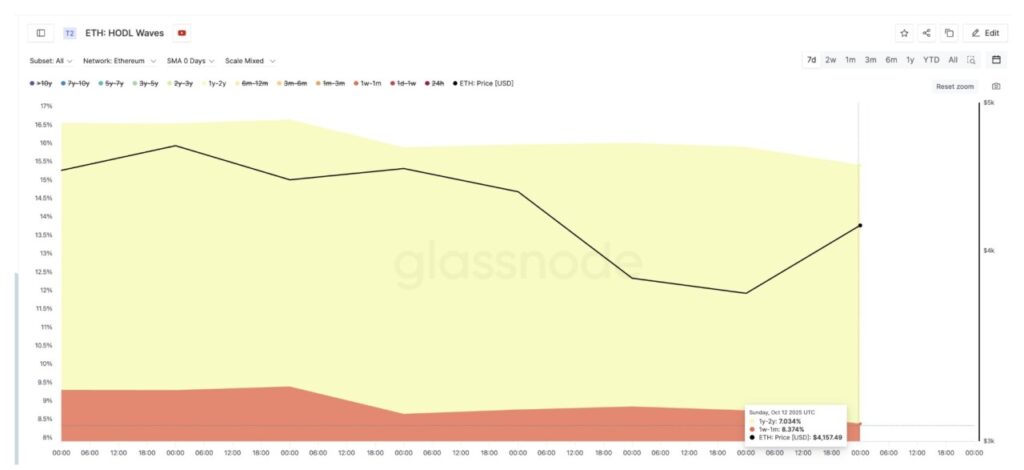

However, some key holder groups have not shown the same conviction. According to Glassnode’s HODL Waves data, which categorizes coins by length of time held, two important groups are reducing their exposure.

The 1-week to 1-month group – typically made up of short-term traders who are quick to react to volatility – decreased its share from 8.84% to 8.37%.

Meanwhile, the 1-year to 2-year group – which are generally medium to long-term holders that help stabilize prices in uncertain times – also saw a decline from 7.16% to 7.03% after the crash.

In fact, these two groups are usually instrumental in shaping short-term momentum and sustaining long-term recovery. Their current caution explains why Ethereum’s price bounce, while promising, still looks lame.

As long as these traders and holders are not yet back in the market, ETH’s recovery is likely to remain dominated by whale action – meaning price movements are still prone to volatility, especially around the resistance zone.

Read also: Could Altcoins Be Gearing Up for a Comeback? These 3 Picks from CryptoAmsterdam Suggest So

Cup Pattern Hints at Ethereum Price Rise, but Correction could be Next

On the 4-hour chart (Oct 13), Ethereum is forming a cup pattern, which is often considered a bullish reversal signal. This structure shows a price movement curving up from around $3,640 towards the $4,130-$4,390 range, with the shape appearing balanced on both sides.

The long tail of the sharp drop on October 11 is excluded from this pattern as it is considered a temporary anomaly that does not affect the main structure.

The volume trend is in favor of this pattern. On theleft side(left cup), a large red candle is seen during the decline. The volume then flattens out at the base of the pattern as the market begins to stabilize. After that, green bars start to appear on the right side as a sign of the return of buying.

Based on this pattern, the price of Ethereum has the potential to rise to around $4,390 – completing the cup pattern with both sides at balanced levels. However, after reaching that point, there might be a temporary correction as the handle part forms.

This handle phase could take ETH down to the $4,070 range, or even $3,950, without invalidating the pattern. But if the price closes below $3,950, the pattern will be broken and become a signal of weakness.

If the handle forms cleanly and momentum is maintained, a breakout above $4,390 could trigger further upside. The next short-term targets are $4,550 and $4,750.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Could Rise and Fall to These Levels Before Its Next Rally – Here’s Why. Accessed on October 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.