Download Pintu App

Bitcoin Price Plunges to $112,000 Today as Investor Confidence Remains Shaky

Jakarta, Pintu News – Bitcoin (BTC) price remains under pressure despite bouncing back from its post-crisis low. As of October 14, BTC has declined by 1.4%, extending the weekly loss to nearly 9%.

Although the market seems to be stabilizing since the “Great Reset,” the structure of Bitcoin’s price movement still shows bearish tendencies. One key level (discussed in this article) will likely determine whether the price can finally reverse to a bullish trend.

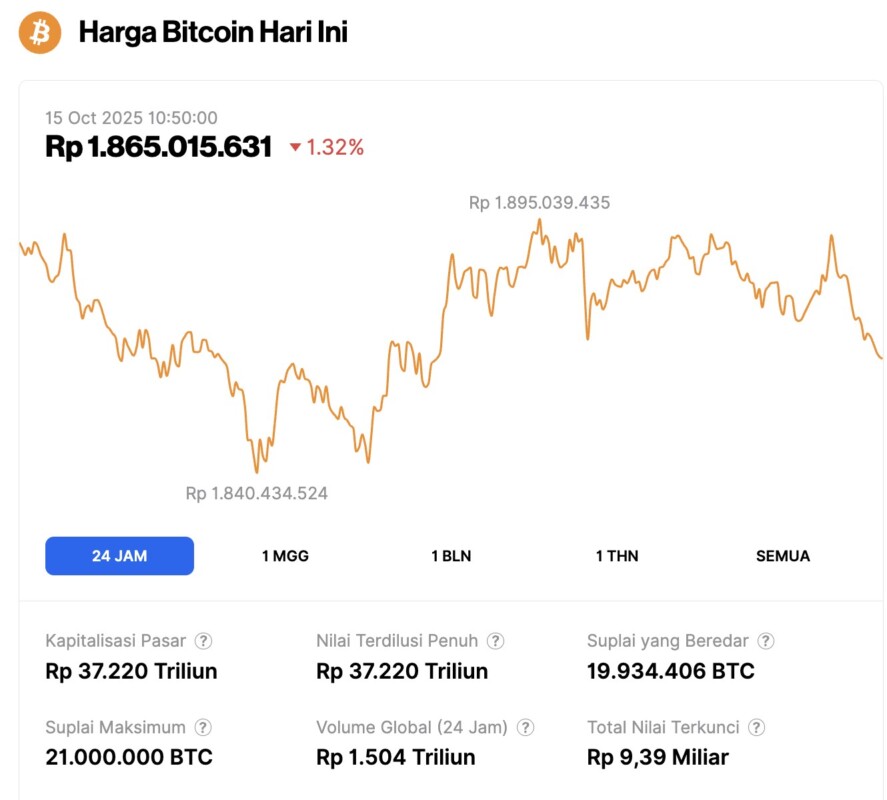

Bitcoin Price Drops 1.32% in 24 Hours

On October 15, 2025, Bitcoin was priced at $112,111, equivalent to IDR 1,865,015,631 — marking a 1.32% decline over the past 24 hours. During this period, BTC hit a low of IDR 1,840,434,524 and reached a high of IDR 1,895,039,435.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 37,220 trillion, while its 24-hour trading volume has soared by 32% to IDR 1,504 trillion.

Read also: Which Coins Are Crypto Whales Buying During the Market Crash?

On-Chain Metrics Show Signs of Stabilization, But Investor Confidence Is Weak

Although price movements are still cautious, on-chain data indicates that the foundations for recovery are taking shape.

One important metric, Net Unrealized Profit/Loss (NUPL) – which measures whether investors are recording gains or losses on paper – fell to 0.50 on October 11, the lowest since April. This suggests that most traders have “absorbed” their losses, which is often a sign that the selling phase is beginning to subside.

The last time the NUPL was at a similar level was on September 25, when Bitcoin formed a local low around $109,000, and then recovered to $124,000 within two weeks, an increase of about 14%.

The Holder Net Position Change metric, which monitors how much Bitcoin is bought or sold by long-term investors, also showed improvement. After the crash, this metric started to become less negative, rising from -24,506 BTC on October 10 to -21,172 BTC on October 13 (a 14% increase). This signals that long-term investors are starting to gradually return to accumulation.

This means that the massive selling pressure that occurred during the liquidation phase is starting to ease. However, market confidence will not be fully restored until this figure turns positive or shows significant buying.

Shawn Young, Chief Analyst at MEXC Research, told the BeInCrypto page that this crash or “reset” is a moment of purification that the market really needs:

“In many ways, the ‘Great Reset’ actually strengthens Bitcoin’s fundamental narrative,” he said.

Taken together, these data suggest that while short-term sentiment remains cautious, the structural forces behind the market are slowly recovering beneath the surface.

Read also: 5 Altcoins that Analysts Are Talking About While Crypto Markets Crash

Bitcoin Price Still Bearish – Breakout at $125,800 could Change the Direction of the Trend

On the daily chart (10/14), Bitcoin is still moving in a rising wedge pattern – a formation that often signals market indecision or exhaustion after a strong rally. After the crash, BTC found support around $111,100 (0.236 Fibonacci level), where buyers continue to defend this zone.

Since then, the price has been moving in a range of $113,900 to $115,100, with the momentum unable to break above $119,200. To recover strength, Bitcoin needs to print a daily close above $115,100.

However, the key level that really determines the change in trend structure is $125,800 – a breakout above this level will confirm the breakout from the upper boundary of the rising wedge and open the way towards $126,200, which is the previous all-time high.

If the momentum continues to strengthen after that, the Fibonacci extension target indicates the potential for further upside towards $136,400.

Comments from Shawn Young, principal analyst at MEXC Research, support this technical view:

“As long as BTC stays above the $110,000 support zone, we could see momentum build again to retest and break $126,000 – a move that could pave the way towards $130,000 as markets adjust growth expectations.”

However, as long as a breakout has not occurred, Bitcoin’s trend is still considered fragile. Failure to break $119,200 could trigger renewed selling pressure, and if $111,100 is broken downwards, the price risks a deeper correction to $104,500 or even $102,000.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Still Bearish Post The “Great Reset” – Yet One Level Could Change That. Accessed on October 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.