Download Pintu App

Crypto Whales Bet Against Bitcoin Again Amid Trump Tariff Shock (10/15/25)

Jakarta, Pintu News – At a time when the crypto market is experiencing high uncertainty, a crypto whale who previously managed to amass $192 million in profits from the market crash, has again opened a large short position against Bitcoin (BTC). This time, the bet comes amid President Donald Trump’s announcement of new tariffs on imports from China, which has added to market volatility.

New Short Position by Crypto Whale

The mysterious crypto whale has opened a short position worth more than $1.1 billion against Bitcoin (BTC) and Ethereum (ETH) just before President Trump’s announcement of 100% tariffs on imported goods from China. According to Yahoo Finance, this move was made by the same wallet that had previously capitalized on Bitcoin’s (BTC) sharp decline to secure huge profits.

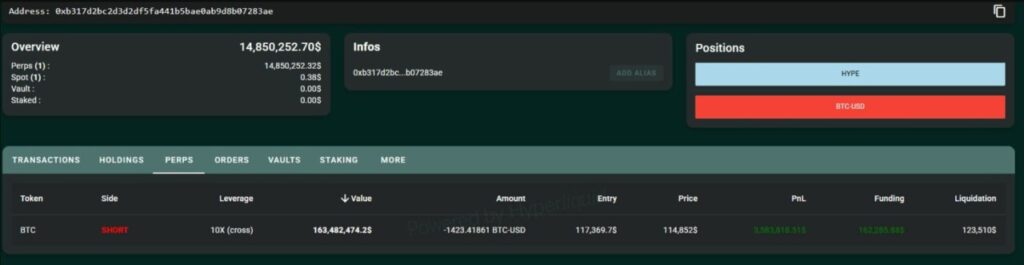

The short position is currently worth approximately $163.5 million with 10x cross leverage on the Hyperliquid platform. To date, the trader has secured over $683,000 in unrealized gains. This wallet address 0xb317d2bc has proven to have an exceptional ability to predict and capitalize on market fluctuations.

Also Read: How to Buy NVIDIA Shares in Indonesia (2025) – Complete Step-by-Step!

Previous Success and Timeliness

The crypto whale first opened a short position when Bitcoin (BTC) was trading near $125,000 and successfully closed the position when the price fell below $110,000. This action resulted in a profit of $192 million. Currently, with Bitcoin (BTC) hovering around $115,100, the whale seems confident of further declines.

Analysis from CoinCentral revealed that the initial short positions on Bitcoin (BTC) and Ethereum (ETH) were opened minutes before the announcement of the tariffs by Trump, which raises questions about possible prior knowledge. The uncertainty generated by the impact of Trump’s tariffs has created significant volatility in the markets, providing an opportunity for these traders to again capitalize on market conditions.

Impact across Platforms

The losses experienced by many traders on the Hyperliquid platform show just how much of an impact this latest market turmoil has had. Statistics show that the number of wallets containing more than a million dollars has decreased significantly since Friday’s drop. Compared to the losses experienced by hundreds of other platform members, this crypto whale is taking a more aggressive approach.

While it is still unknown whether this latest short position will result in a profit, this trader’s successful trading history and the large size of the position caught the attention of other market participants.

Conclusion

With a proven history, this crypto whale continues to demonstrate his skill in capitalizing on volatile market conditions. This persistence and well-timed strategy has not only resulted in huge profits, but also set a new standard in crypto trading. The market will continue to watch this trader’s next move with great anticipation.

Also Read: 3 Reasons Bitcoin’s Rise to $125,000 Could Be Delayed – Watch Out For These Signals!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. Whale Who Made $192M on Crypto Crash Opens New Bitcoin Short. Accessed on October 15, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.