Download Pintu App

Whales Are Betting Against Crypto — Is a Bear Market Just Around the Corner?

Jakarta, Pintu News – The crypto market is showing warning signals, with the total market capitalization dropping to $3.83 trillion, or 0.62% lower. Key indices from CoinMarketCap reflected the cautious attitude; the CMC 20 index was almost stagnant at $243.75, and the fear & greed index plummeted to a “fear” level of 37.

Is the Altcoin Season Losing Steam?

Quoting the Coinpedia report (15/10), the altcoin season also began to cool down, only reaching a score of 38 out of 100. The average crypto RSI also stands at 47.93, indicating weak market momentum.

Read also: Bitcoin Drops to $110,000 Today — Could It Fall to $50,000? Peter Brandt Thinks So

Some important economic data that can affect the market, such as the NY FED manufacturing index, the Philly FED manufacturing report, and the NAHB housing index, have all declined this week – opening up opportunities for increased volatility. Today’s market mood is tense, and for good reason: the US government just moved 667 BTC worth about $75 million to a new wallet.

In addition, there was action from “deep whales” who increased their short positions by more than $500 million, indicating expectations of a deeper price drop.

Whale Movement and Government Activity

When the whales made their move, the market responded immediately. According to a report from SwanDesk, the “deep whale” believed to be behind last week’s flash crash is now back in action, even doubling its short position to exceed $500 million. These whales are betting heavily against further market declines.

This level of confidence is rare unless there is something big going on behind the scenes. At the same time, the US government’s action of moving 667 BTC cannot be taken lightly either.

Historically, transfers like this have often signaled the beginning of a massive sell-off that could push prices deeper. Naturally, investors are now wary of a potential sudden dump that could accelerate the bearish trend.

Exchange Outflows and Liquidation Wave

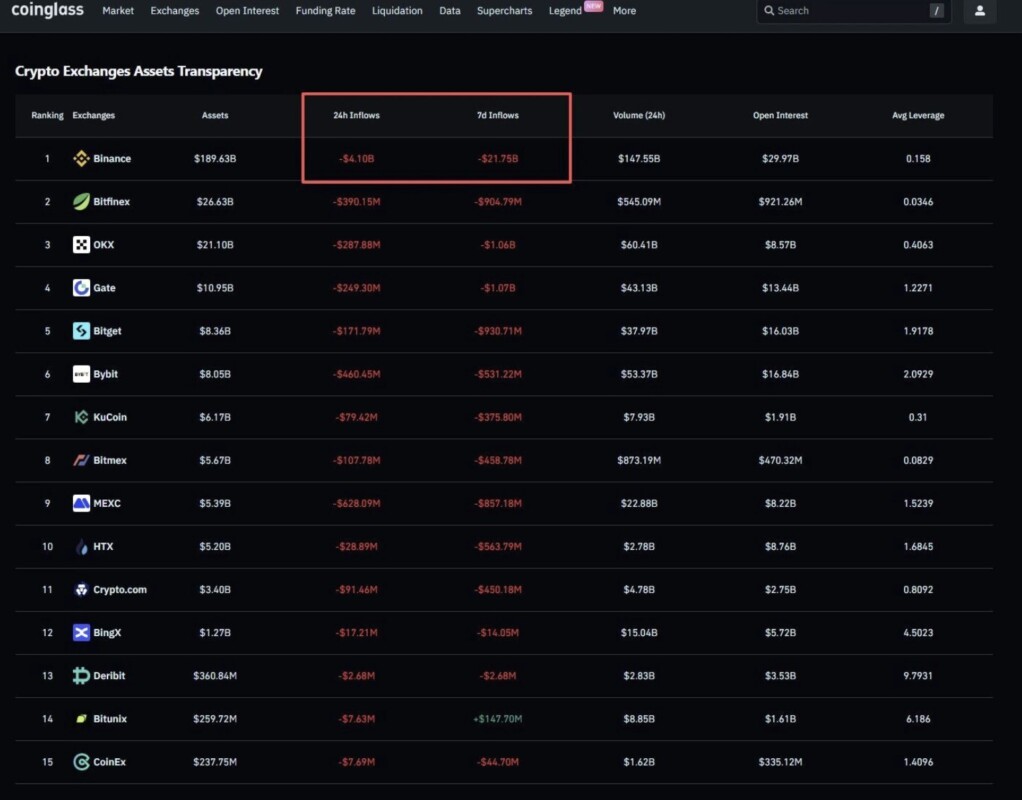

According to data from CoinGlass, centralized crypto exchanges recorded massive outflows – a classic indication of uncertainty and loss of market confidence.

Binance alone recorded an astonishing net outflow of $4.1 billion in the last 24 hours, and many other major platforms are showing similar trends. This data reinforces the narrative that big players are starting to exit the market to avoid further losses, or are preparing to sell assets elsewhere.

Read also: Solana Stages a Comeback as Technical Pattern Points to $550 Target

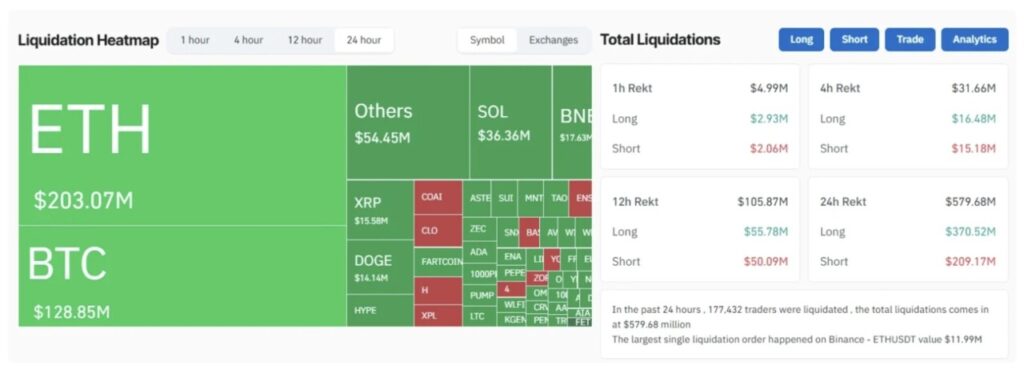

Additionally, the liquidation map shows that nearly $580 million worth of trading positions have been liquidated in the past 24 hours, with ETH and BTC being the most affected – at $203 million and $129 million respectively.

Most of the positions liquidated were long positions, indicating that many traders who took bullish positions were trapped, thus reinforcing the cautious sentiment in the market.

Bearish Indicators and Market Sentiment

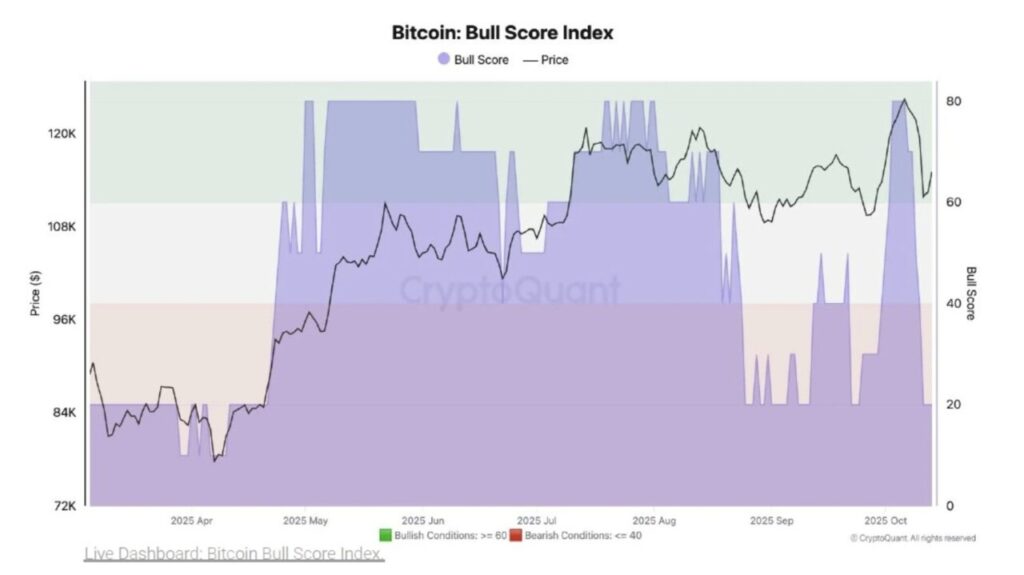

CryptoQuant’s Bull Score Index hasn’t just taken a dip, it’s actually plummeted. From a strong position of 80 last week, it has now plummeted to 20. Historically, scores below 40 often correlate with a bearish market phase.

Across sentiment indicators, fear dominates: the fear & greed index reads 37, and altcoin momentum has dropped sharply. The recent price movements are not just a momentary disturbance – there is a wave of risk aversion spreading across the crypto market.

Macro Events and Risks Ahead

It’s not just the internal factors of the crypto market that keep traders on their toes. With whales and governments showing bearish signals, and liquidation on the rise, a single hawkish surprise from external factors could be the trigger that drops the market into a deeper bearish phase.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Is the Crypto Bear Market Here? Whales Go Short, Fears Spike Big. Accessed on October 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.