Download Pintu App

10 Stocks that Keep Warren Buffett King!

Jakarta, Pintu News – Warren Buffett – nicknamed the “Oracle of Omaha” – has long been recognized as a legendary figure in the investment world. The success of his portfolios does not happen by chance: much of it comes from picking high-quality stocks with strong fundamentals and long-term potential. In this article, we’ll take a look at 10 stocks that were often part of Buffett’s portfolio and are still relevant today.

Through the tokenized stock service on Pintu xStocks you can own a portion of these global stocks – albeit from Indonesia.

1. Coca-Cola (KO)

One of Buffett’s most iconic investments. Coca-Cola offers stable cash flow and a consistent annual dividend-factors that Buffett values highly. The stock is often dubbed as “set it and forget it” due to its long-term profitability.

Also Read: $45 Million BNB Airdrop Ready to Rock the Meme Coin World in October 2025!

2. Chevron (CVX)

As a large energy company, Chevron is an attractive defensive instrument in a portfolio. Buffett sees it as a core business that can withstand market shocks and continue to pay attractive dividends despite volatile oil prices.

3. Apple (AAPL)

Buffett looks at Apple because of its strong consumer ecosystem and brand loyalty. Although outside the traditional “value stock” sector, Apple has shown reliable growth characteristics.

4. Bank of America (BAC)

The financial sector also received Buffett’s attention. He chose Bank of America because of its exposure to the US market and strong position in the national banking system. With large capital and liquidity, BAC is often considered the foundation of the financial sector.

5. American Express (AXP)

This credit card and financial services company offers competitive advantages in the areas of brand and customer loyalty. Buffett invested in AXP because of its stable margins and business that is resistant to economic fluctuations.

6. Moody’s (MCO)

Buffett puts his trust in Moody’s thanks to its dominant position in the credit rating industry. In a world where financial confidence is paramount, Moody’s continues to play a vital role in the global economic system.

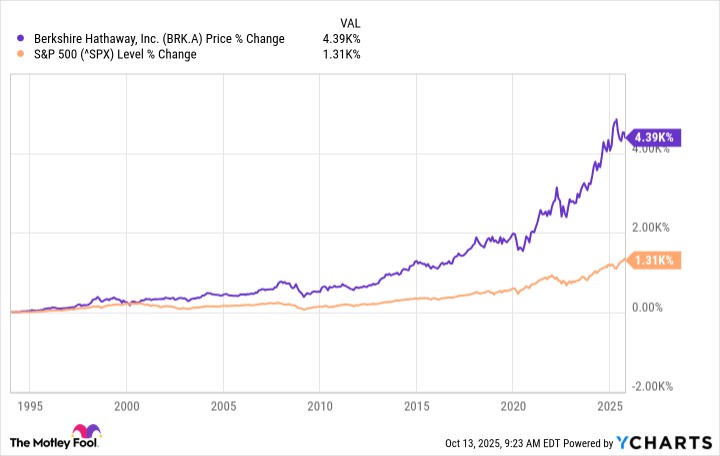

7. Berkshire Hathaway (BRK.B / BRK.A)

Shares belonging to Buffett’s own company. Through BRK, investors can own a portion of the Buffett generation’s diversified portfolio. It is not just a stock, but a representation of his personal philosophy and track record.

8. Kraft Heinz (KHC)

Despite the downturn, Buffett continues to hold this stock. Consumer staples such as food and beverages have relatively stable demand, making them a defensive investment that he often relies on.

9. Occidental Petroleum (OXY)

Buffett also entered the advanced energy sector with the acquisition of shares in this oil company. This decision shows that he is not afraid to take risks with deep fundamental logic.

10. US Bancorp (USB)

This regional bank is Buffett’s choice for small to medium-sized financial sector exposure. With prudent management and a strong fund base, USB is considered a “value” addition to a financial portfolio.

Buffett can now invest in stocks from Indonesia through the xStocks portal

You don’t need a US stock account to own Buffett’s stocks. Through the xStocks Door you can own fractions of these global stocks in digital form. The platform replicates the price movements of real stocks and allows Indonesian investors to share ownership with affordable capital.

Conclusion

Warren Buffett’s long-term success comes not only from being a smart stock picker, but also a stock candidate who holds the value of competitive advantage. With tokenized stocks on Pintu such as Apple (AAPLX), you can now follow Buffett’s lead from anywhere.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- The Motley Fool. The Best Warren Buffett Stocks to Buy With $1,000 Right Now. Accessed on October 16, 2025.

- Investopedia. Warren Buffett Reveals His Top Stock Bets for 2025. Accessed on October 16, 2025.

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.