Download Pintu App

Bitcoin (BTC) Bull Run Cycle Predicted to End in 10 Days? Analyst Explains

Jakarta, Pintu News – According to the latest analysis from a veteran trader known as CryptoBirb, the current Bitcoin (BTC) bull phase is expected to come to an end. Based on processed cycle data, CryptoBirb predicts that the next major peak in the Bitcoin (BTC) cycle will occur on October 24. The Fear and Greed Index has shown a sharp decline, which may signal preparations for a final rally before entering a bearish phase.

Cycle Analysis and Peak Prediction

CryptoBirb revealed that it has been 1,058 days since Bitcoin (BTC) hit its last major low, signaling that the current bullish phase is nearing the end of its cycle. The model used by CryptoBirb, known as the “Cycle Peak Countdown,” points to October 24 as the likely day when Bitcoin (BTC) will peak.

In previous cycles, Bitcoin (BTC) typically peaked between 518 to 580 days after the halving, and it is currently at day 543, which means it is right in the middle of that peak zone. CryptoBirb added, “Not only are we nearing the peak, but we’re already inside the time window where every previous major Bitcoin (BTC) peak occurred.”

Although Bitcoin (BTC) price recently dropped from its ATH (all-time high) of $126,300 to $102,560, this drop is considered a healthy correction that often occurs to eliminate weak holders before a big rally.

Read also: 5x Bitcoin and Ethereum ETF Coming Soon? Volatility Shares Ready to Break the Crypto Market

Technical Indicators and Institutional Behavior

Technical indicators support this view, with the Fear and Greed Index dropping from 71 to 38, and the RSI (Relative Strength Index) declining to 45. These indicators suggest that market emotions are being reset, which could create the basis for a possible final rally.

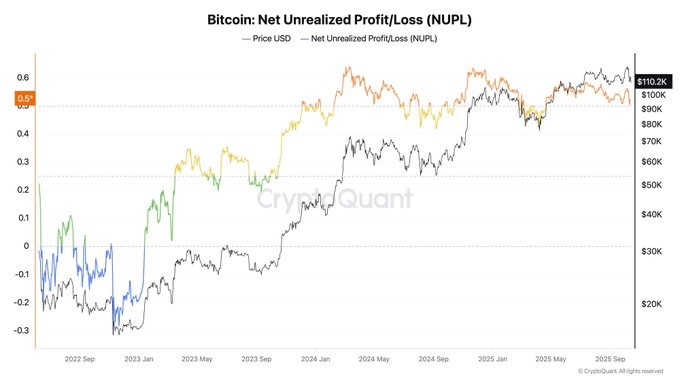

On-chain metrics also showed some decline, with NUPL dropping to 0.522 and MVRV dropping to 2.15, reflecting the profit-taking that took place recently.

Meanwhile, institutional behavior is also worth noting. Bitcoin (BTC) ETF inflows went from +$627 million to -$326.4 million, and Ethereum (ETH) ETF saw outflows of $428.5 million. Experts interpret this as a sign that smart money is taking profits before retail FOMO pushes the last leg of the rally.

Also read: Will ETFs Take Ripple (XRP) to New Heights?

October 24th: The Decisive Moment

Historically, the October 20 to November 5 time window marks the peak zone for the Bitcoin (BTC) cycle. With key dates like October 24 approaching, traders should anticipate heightened volatility and possible explosive moves. Currently, Bitcoin (BTC) is trading around $112,281, reflecting the 3% decline seen in the last 24 hours.

Conclusion

With various indicators and analysis from experts, the upcoming period could be very critical for Bitcoin (BTC) investors and traders. Monitoring technical indicators and market behavior will be crucial in navigating the potential peaks and dips that may follow.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinpedia. Bitcoin Bull Run Ends in 10 Days, Veteran Trader Warns of Cycle Peak. Accessed on October 16, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.