Download Pintu App

Is the Halving Cycle No Longer Relevant? ETFs and Derivatives Now Drive Bitcoin’s Price

Jakarta, Pintu News – For more than a decade, crypto investors have believed that the price of Bitcoin (BTC) follows a four-year halving cycle. But now, that pattern seems to be breaking down. Despite record-high flows into spot ETFs and major corporations adding to their Bitcoin reserves, price movements no longer align with the old theory.

According to on-chain analyst James Check, Co-Founder of Checkonchain Analytics, the market is now driven by global liquidity, institutional investment flows, and derivatives growth, no longer by supply reduction from halving. “Bitcoin is now responding to the world, not the other way around,” he said, emphasizing that the traditional crypto cycle has now shifted to a new liquidity regime.

ETFs are the New Motor of the Market: Big Demand But Not Enough to Drive Prices

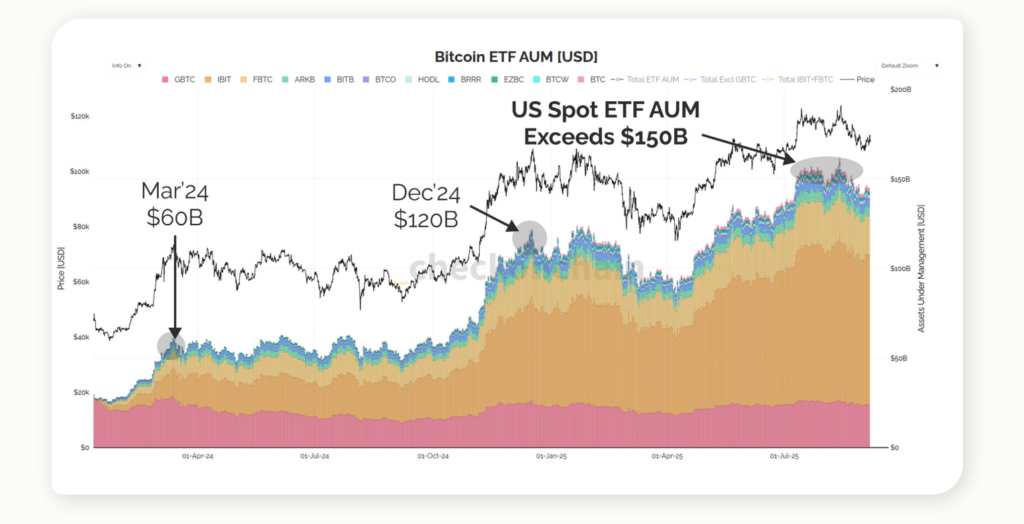

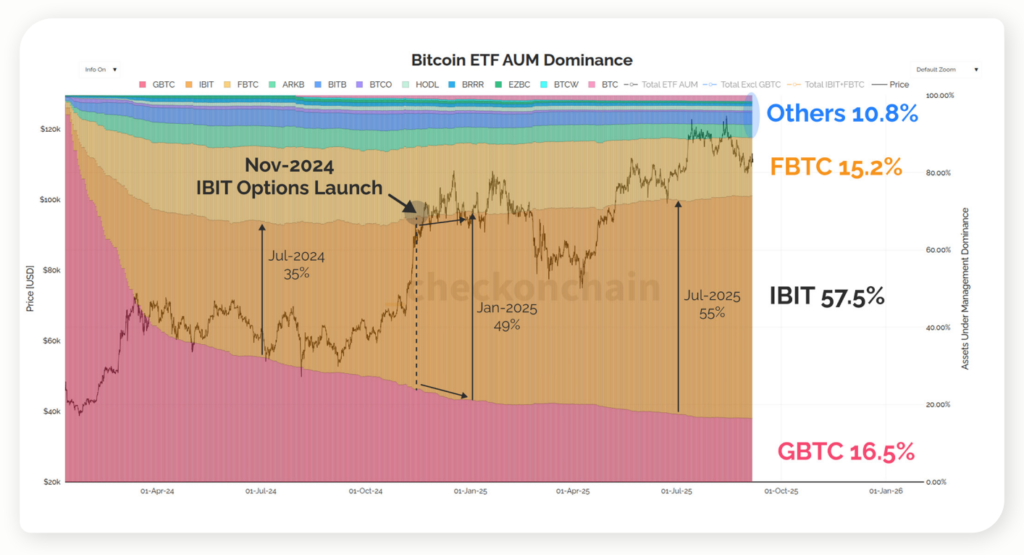

As of September 2025, CoinShares recorded $1.9 billion in crypto ETF inflows, with almost half of that coming from Bitcoin. While this figure shows tremendous interest, James thinks most of this fund flow is not new money, but rather a rotation from older products like GBTC (Grayscale Bitcoin Trust) to newer, more efficient ETFs.

The total value of incoming ETF funds has reached around $60 billion (IDR995 trillion), but the market remains consolidated as realized profit-taking from existing investors reaches $30-100 billion per month (IDR497-Rp1,657 trillion). This means that selling pressure from long-term holders is holding back the price increase. “The demand is huge, but the sell side is also incredibly strong,” James explained.

Exchange Data is No Longer Accurate: Long-term Supply More Relevant

Previously, crypto investors often used exchange inflow to read market signals – for example, declining Bitcoin flows to exchanges were assumed to be a sign of supply scarcity. But James believes this data is now less valid. “I rarely use exchange data because the coverage is incomplete,” he said, highlighting the difficulty of tracking wallet addresses that are widely spread across platforms.

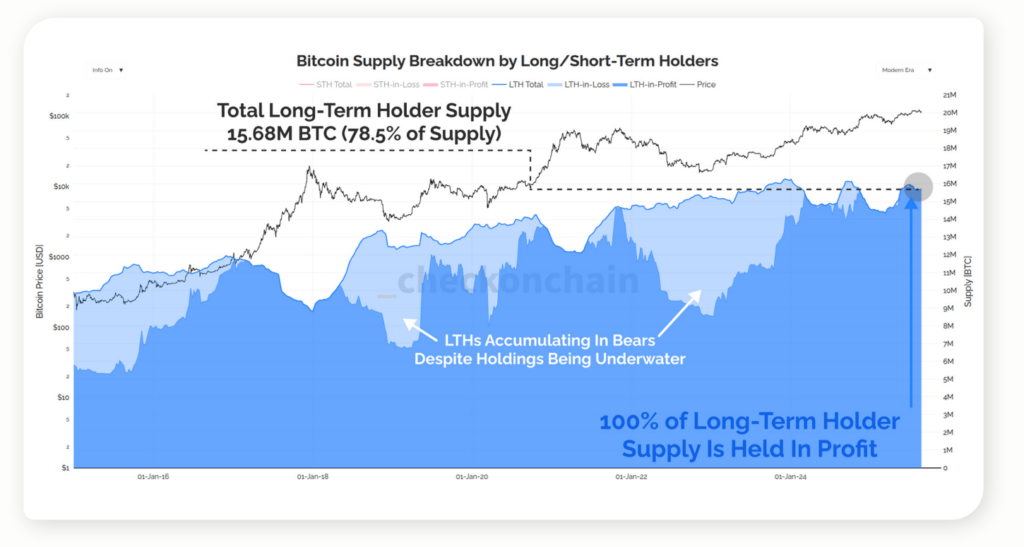

Instead, James suggests focusing on the supply of long-term holders (LTH), which now stands at 15.68 million BTC, or about 78.5% of the total circulating supply, and is entirely in profit. This data is more indicative of true scarcity than exchange balances, as it reflects investors’ long-term confidence in Bitcoin.

The influence of Bitcoin Miners is Now Almost Imperceptible

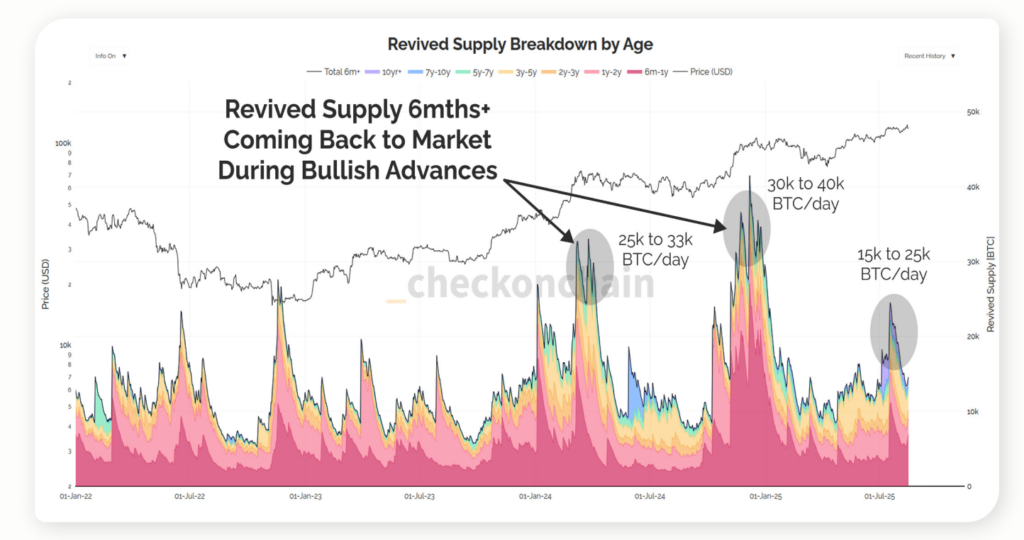

While mining activity used to be considered the main factor of selling pressure in the market, it is now playing a smaller role. With only 450 BTC issued per day, its influence lags far behind the 10,000-40,000 BTC (Rp166-Rp663 million) that old investors sold or moved during the bull market.

James asserts, “Halving has been unimportant, even irrelevant for the last few cycles.” The market is now more influenced by institutional flows, ETFs and corporate treasuries than the daily supply from miners. As such, the old narrative of halving as a trigger for big rallies seems to be obsolete in this post-ETF era.

From Cycles to Liquidity Regimes: The New Structure of the Bitcoin Market

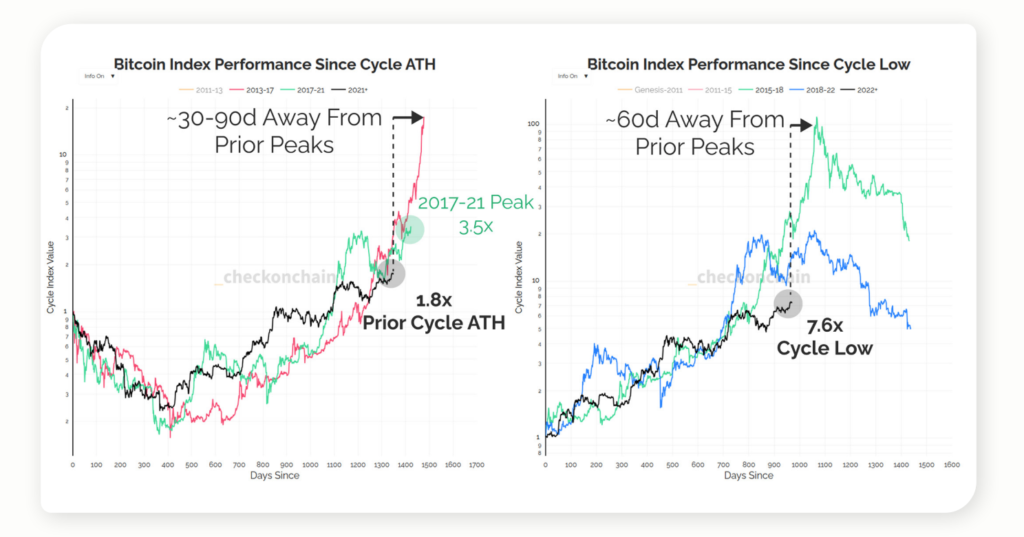

Checkonchain found two major turning points in Bitcoin’s history: the 2017 price peak and the 2022-2023 transition, when the asset became more “mature” and started to be treated like a global index. Today, its volatility is decreasing, and its correlation with macro assets like gold and stocks is increasing – showing that Bitcoin is already part of the global financial structure.

Instead of focusing on the halving cycle, James suggests monitoring the institutional cost basis and market liquidity. Checkonchain data shows that the Rp1.23-Rp1.32 billion ($75,000-$80,000) zone is now a strong area ofbear market floor formation. According to him, the old Realized Price calculated from all coins, including lost coins like Satoshi’s, is no longer relevant in this modern era.

Derivatives and ETFs become the main axis of the global crypto market

In addition to ETFs, the derivatives market is now a key driver of prices. Products such as options and futures contracts on top of spot ETFs are creating a new layer of liquidity. BlackRock’s IBIT is a successful example, accounting for nearly 90% of the crypto ETF market share in the US since launching an options product in late 2024.

The US is now the global center of dominance for crypto ETFs, absorbing almost all new fund flows in the institutional market. “The most important thing is not the ETF itself, but the ecosystem of options and derivatives on top of it,” James said. This phenomenon confirms that the crypto market is now driven by advanced financial instruments, not just retail adoption like in the past.

Conclusion

A new era of Bitcoin has begun – the halving cycle is no longer the primary roadmap. Global liquidity, ETF fund flows, and the growth of derivatives are now the new compass for crypto investors. With the Rp1.23-Rp1.32 billion area as the next potential bear market floor, investors are advised to set flexible strategies. As James said, “There is no perfect metric to predict the future – all you can control is your own decisions.”

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin ETF Cycle Liquidity 2026. Accessed on October 21, 2025

- Featured Image: Bitcoin News

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.