Download Pintu App

Dogecoin Could Jump 25% Following Elon Musk’s Tweet — A Closer Look at the Data

Jakarta, Pintu News – As reported by Cointelegraph (20/10), Dogecoin (DOGE) briefly jumped 2.5% to $0.20 after market attention was drawn to Elon Musk’s latest post on the X platform, which featured the coin’s meme mascot Shiba Inu. The price of DOGE immediately rose 29% in response.

These gains extend DOGE’s sharp recovery trend from its recent low of $0.13 – its lowest point since April – registering a 55% recovery in just two weeks.

Musk’s previous tweets are known to have triggered DOGE’s spectacular rally in 2021, which saw its price jump from a few cents to almost $0.73.

Now, with market sentiment improving and a number of technical indicators showing bullish signals, this top meme coin looks set to continue its recovery in the second half of October.

DOGE A&E Indicator Hints at Potential 25% Increase

Dogecoin is currently forming an Adam and Eve double-bottom pattern, which is a bullish reversal formation characterized by a sharp “V”-shaped drop (Adam), followed by a steeper recovery (Eve). This pattern indicates that the selling pressure is starting to subside and buyers are starting to take control of the market.

Read also: House of Doge Officially Acquires Italian Football Club, US Triestina Calcio 1918!

The neckline of this pattern is at around $0.216. If the price of DOGE manages to break this level convincingly, then there is potential for an upside move towards $0.260 – about 25% higher than the current price.

The target is in line with the measured move projection of the pattern, and coincides with an important technical confluence zone. Moreover, this level also corresponds to the 0.382 Fibonacci retracement on the weekly chart of DOGE.

The chances of this recovery are getting stronger as DOGE is also bouncing off the support zone formed from theascending trendline and 0.236 Fibonacci line. This reinforces the view that buyers are defending the lower levels while eyeing $0.26 as a short-term upside target.

Short Squeeze Could Push DOGE to $0.26 Target

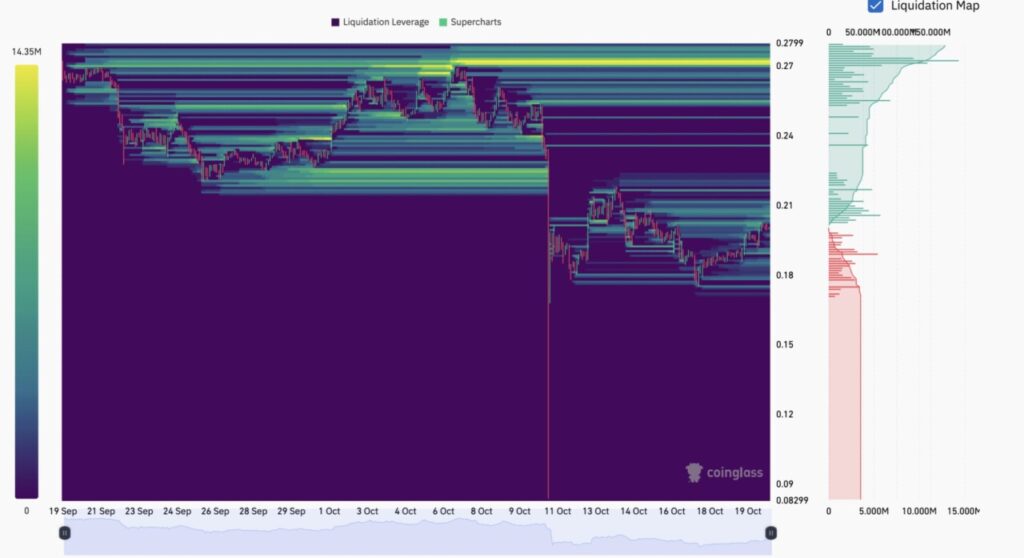

Data from the futures market shows a greater concentration of short liquidations in the $0.215 to $0.27 price range, while long liquidation levels are relatively flat below $0.18.

This imbalance indicates that the downside risk is lower, as there are few leveraged long positions that could trigger major selling pressure. Conversely, on the upside there is a solid wall of liquidity from short positions that could potentially be squeezed.

Read also: Dogecoin Drops 3% Today, but MVRV Z-Score Signals Room for Growth

Therefore, if the price of DOGE manages to break the neckline at $0.216, it could trigger a wave of liquidation of short positions – where bearish traders are forced to buy back DOGE to cover their positions – ultimately accelerating the price movement towards $0.26.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Dogecoin price set for 25% jump after Elon Musk’s new cryptic DOGE post. Accessed on October 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.