Download Pintu App

DOGE’s Drop Deepens — Have the Bears Taken Control of the Market?

Jakarta, Pintu News – Dogecoin (DOGE) continues to decline and is increasingly entering a bearish zone, with the price of this memecoin continuing to be beaten down. Once a major symbol of meme culture in the crypto world, Dogecoin’s price continues to weaken as caution among market participants increases.

As of October 21, Dogecoin was down 3.72%. Its trading volume has also fallen by 20.8%, signaling declining market interest in the asset. Various market indicators suggest that this downward trend may not be over yet, as bearish pressure continues to build across multiple timeframes.

So, how is the Dogecoin price moving today?

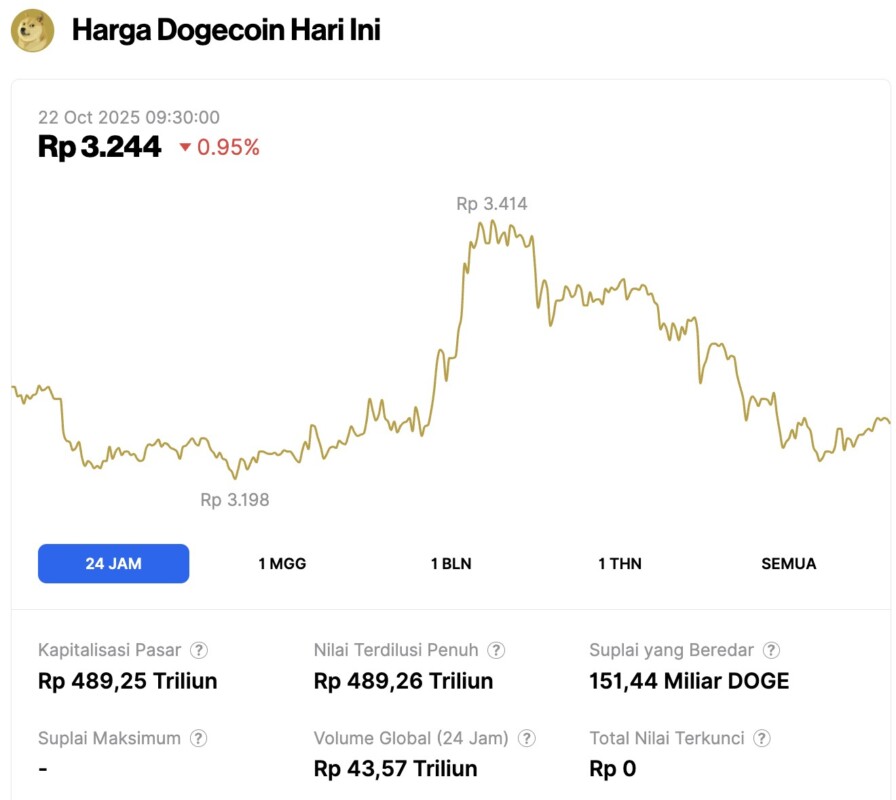

Dogecoin Price Drops 0.95% within 24 Hours

As of October 22, 2025, Dogecoin saw a 0.95% decline over the past 24 hours, trading at $0.1949, or approximately IDR 3,244. Throughout the day, DOGE fluctuated within a range of IDR 3,198 to IDR 3,414.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 493.46 trillion, with a 24-hour trading volume of approximately IDR 32.55 trillion.

Read also: Ethereum Price Slips to $3,800 – Here’s Why ETH Is Struggling to Break Above $4,000

Bearish Dogecoin Reigns in the Market

Technically, the structure of Dogecoin (DOGE) still appears fragile. The 4-hour chart shows a consistent bearish pattern, with lower lows and lower highs forming – a sign that seller pressure still dominates.

The 20-day Exponential Moving Average (EMA) indicator reinforces this view, where DOGE is currently trading below that EMA line as well as below the previous support line.

Momentum indicators also support this negative sentiment. For example, the Moving Average Convergence Divergence (MACD) shows fading green histogram bars as well as a bearish crossover, where the 26 EMA (orange line) crosses the 12 EMA (blue line) from bottom to top.

This confirms the weakening buying power and signals that sellers are increasingly controlling Dogecoin’s price movements.

DOGE price signals downward momentum

The overall technical picture for Dogecoin (DOGE) also shows signals that point to caution.

On the daily chart (10/21), DOGE’s momentum remains in a bearish trend, with theecoin failing to hold a key support level. This indicates weakening impetus from the buyers’ side, and signals that the asset could potentially enter oversold territory in the near future.

As buying pressure eases, sellers seem to be taking control of market sentiment in the short term.

The Money Flow Index (MFI) indicator, which measures capital inflows and outflows based on price and volume, currently stands at 29.58. This figure is an additional bearish signal indicating increasing selling pressure in the market.

Read also: Dogecoin Could Jump 25% Following Elon Musk’s Tweet — A Closer Look at the Data

If the MFI falls below 20, the DOGE price could be entering oversold conditions – conditions that usually precede a potential further decline before a possible rebound.

Fibonacci retracement analysis also reinforces this bearish view. When measured from the most recent swing high to the most recent low, the price of DOGE is currently trading below the 0.236 Fibonacci level, with the price movement getting closer to the next important support level at $0.18.

Things to Watch Out for

If DOGE’s price decline continues and breaks the current support level consistently, there is potential for the price to drop deeper towards $0.15. A further drop could even test the next Fibonacci level around $0.13.

However, the potential for reversal still remains. If the Dogecoin price manages to break back through the 0.236 Fibonacci level at $0.21, bullish traders may try to regain control of the market and push the price recovery towards $0.27.

If the positive momentum continues to strengthen, the price of these memecoins could potentially rise further to the 0.5 Fibonacci level around $0.31.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Warning Lights Are on as Price Risks Drop Below $0.15. Accessed on October 22, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.