Download Pintu App

Hyperliquid (HYPE) Under Threat! This New Pattern Could Trigger Bigger Losses? Here’s What Analysts Say!

Jakarta, Pintu News – The cryptocurrency market is always full of unpredictable dynamics, and Hyperliquid (HYPE) is currently in the spotlight with trading patterns that could trigger huge losses. With the recent rejection of the Exponential Moving Average (EMA), as well as the increasingly intense activity of the whales, there is a lot to keep an eye on to know the next direction of HYPE.

EMA Rejection and its Impact

The recent rejection of the EMA shows that bearish pressure is still very strong in the Hyperliquid (HYPE) market. This indicates that sellers are still dominating the market for now, which could mean that HYPE prices may continue to decline in the near future.

This rejection also indicates that the price recovery expected by some investors may be delayed. Technical analysis is important because it gives an idea of current market sentiment and future expectations.

Read More: Bitcoin (BTC) Price Prediction: Influenced by the Fed’s Interest Rate Decision on October 29, 2025

Whale Response to Volatility

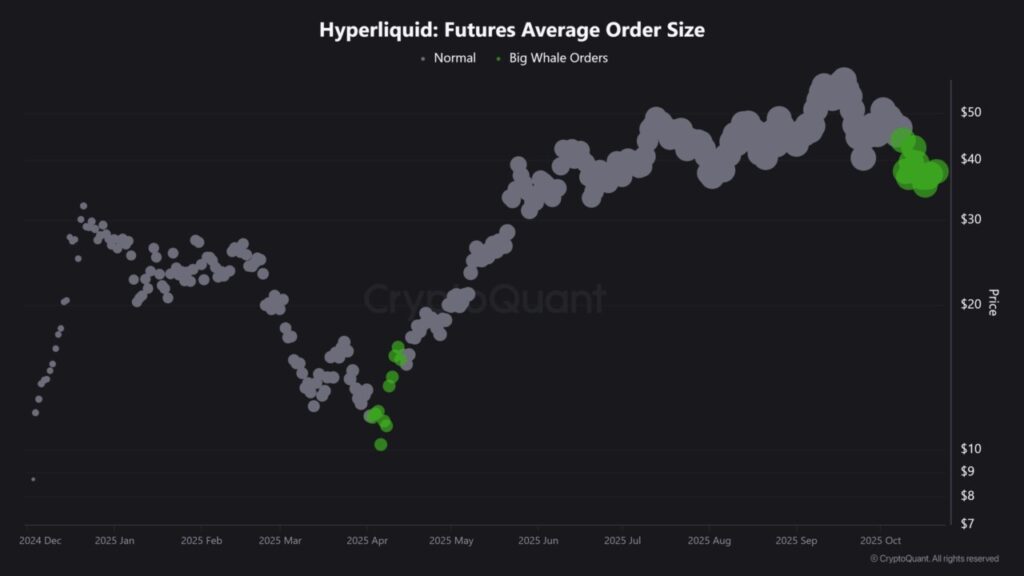

Despite increased volatility and liquidation, whales in the Hyperliquid (HYPE) market seem unfazed. They have instead continued to add to their positions, which could be in preparation for a price rebound in the short term. This accumulation activity suggests that there is confidence from the big players that the market may stabilize soon. However, it also adds complexity to market analysis as it could be an attempt to manipulate the market through massive buying.

Whale Strategy vs Market Momentum

The dynamic between accumulation by the whales and the increased level of liquidation will largely determine the next direction of HYPE. If the whales continue to add to their positions and manage to stabilize the market, we may see a price increase.

However, if the liquidation continues and pushes the price lower, this whale strategy may not be strong enough to change the market momentum. Market watchers should be very careful in analyzing these actions to understand their potential impact on HYPE prices.

Conclusion

With all these factors at play, investors and market watchers should remain vigilant on Hyperliquid (HYPE)’s price movements going forward. Understanding the dynamics between EMA rejection, whale activity, and the resulting liquidation will be crucial in making informed investment decisions. The cryptocurrency market is always full of surprises, and Hyperliquid is currently a good example of how various factors can have a major impact on price dynamics.

Read More: Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. HyperLiquid: Why this pattern could trigger more hype losses. Accessed on October 23, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.