Download Pintu App

Dogecoin Slumps Today, A Death Cross Emerges — What’s Ahead for DOGE?

Jakarta, Pintu News – The Dogecoin (DOGE) price has plummeted into local bear market territory after experiencing a more than 38% decline from its September high. This sharp decline is accompanied by the emergence of a risky technical pattern, which indicates the potential for further declines ahead.

Then, how is the current Dogecoin price movement?

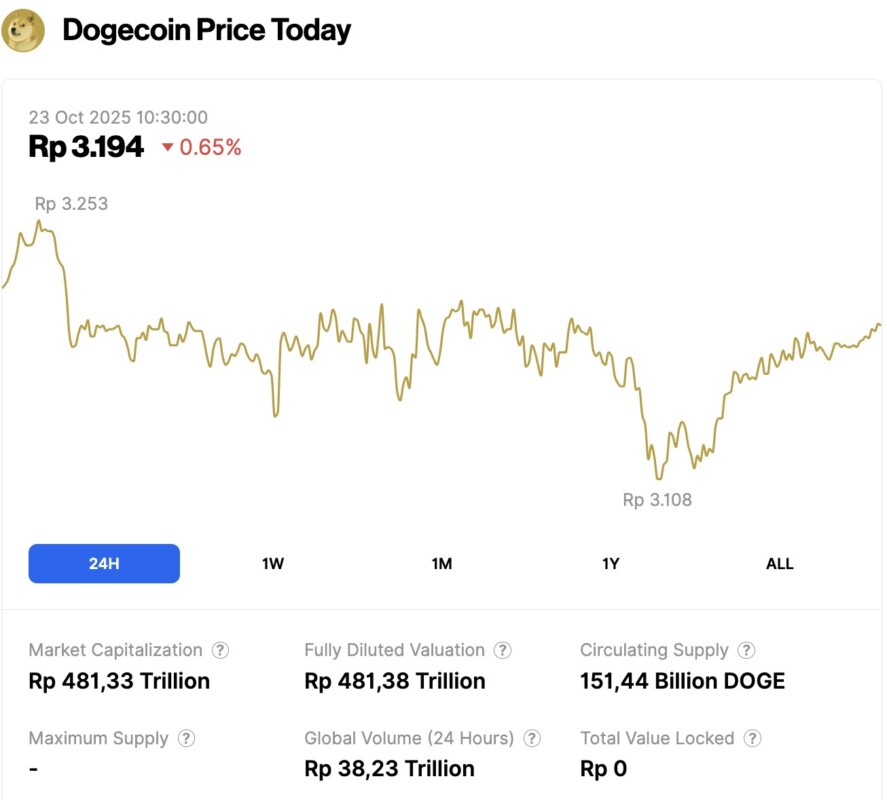

Dogecoin Price Drops 0.65% within 24 Hours

On October 23, 2025, Dogecoin saw a 0.65% drop over the past 24 hours, trading at $0.1915, or approximately IDR 3,194. During that time, DOGE fluctuated between IDR 3,253 and IDR 3,108.

At the time of writing, Dogecoin’s market capitalization is around IDR 481.33 trillion, with a 24-hour trading volume of roughly IDR 38.23 trillion.

Read also: Ethereum Holds Steady at $3,800 Today as Holders Begin to Sell — What Comes Next?

Dogecoin Forms Death Cross Pattern, Signaling Further Decline

According to Crypto News, the price of Dogecoin has plummeted from its September high of $0.3066 to the current $0.1900. This decline is due to the recent crypto market crash that triggered massive liquidation.

DOGE’s price drop was also triggered by the formation of a rising wedge pattern, which is a technical pattern characterized by two rising trend lines approaching each other. This pattern often results in bearish breakouts when the lines meet or almost intersect.

Currently, Dogecoin is preparing to form a death cross, which is when the 50-day exponential moving average (EMA) cuts below the 200-day EMA. If this happens, it will be the first death cross since last March – a technical signal often associated with a medium-term downward trend.

Furthermore, the DOGE price has broken below important support levels according to the Murrey Math Lines tool, as well as below the Supertrend indicator and the Ichimoku Cloud – all of which reinforce bearish signals.

Under these conditions, DOGE is likely to continue its decline, targeting this month’s low of $0.1515. If this scenario were to occur, the price would drop about 20% from current levels.

Read also: With Accumulation Rising, Is Dogecoin Poised for a Move to $0.50?

However, if DOGE is able to break above the strong pivot level at $0.2150, then this bearish view could be invalidated, opening up opportunities for price recovery.

DOGE ETF Inflows and Futures Open Interest Decline

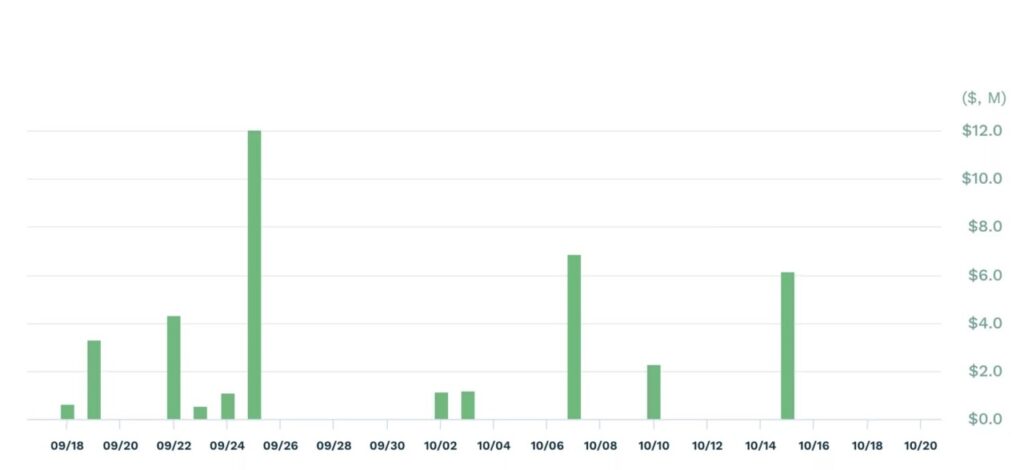

Third-party data shows that the growth of REX-Osprey’s newly launched Dogecoin ETF (DOGE) has started to stagnate.

Based on information from its official website, the new DOGE ETF has raised $32 million – significantly lower than REX-Osprey’s XRP ETF which has crossed the $100 million mark, despite both launching on the same day.

According to data from ETF.com, the DOGE ETF fund has received no inflows at all in the past two trading days. This is likely due to the wait-and-see attitude of investors, as the Crypto Fear and Greed Index is still in the red zone (fear sentiment).

On the other hand, interest in the Dogecoin derivatives market has also weakened. Recent data shows that open interest for DOGE futures contracts has fallen to $1.85 billion – the lowest level since June 25. This is well below the year-to-date peak of $6 billion, signaling that demand for Dogecoin is shrinking significantly.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Dogecoin price warning: death cross nears as DOGE ETF momentum fades. Accessed on October 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.