Download Pintu App

Gold plummets, is it time for Bitcoin (BTC) to triumph?

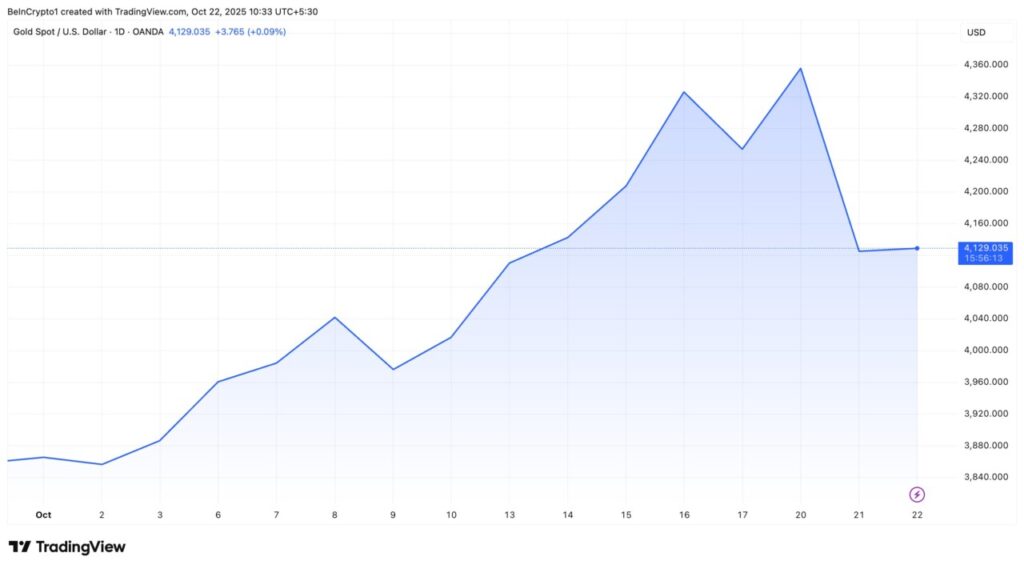

Jakarta, Pintu News – On October 21, gold experienced its biggest daily price drop in more than 12 years, an event that took investors and market analysts by surprise. After reaching record peaks, gold is now facing a significant correction. Meanwhile, Bitcoin (BTC) is showing increased momentum, fueling speculation about a potential power shift in the global investment market.

Is Gold’s Peak Rise Over?

Previously, gold was known as an asset that continued to show positive trends, even when crypto markets experienced high volatility due to President Trump’s announcement of tariffs. However, the recent drastic decline raises serious questions about the continuation of gold’s rally. Investors who previously took refuge behind the safety of gold may now start considering other investment alternatives.

Although gold has long been considered a safe haven asset, this sharp decline may signal a change in market sentiment. Market analysts are beginning to question whether this is the start of a sustained decline or just a temporary correction. This will certainly affect market participants’ long-term investment strategies.

Read More: Bitcoin (BTC) Price Prediction: Influenced by the Fed’s Interest Rate Decision on October 29, 2025

Implications of Gold’s Decline on Bitcoin (BTC)

While gold has been on the decline, Bitcoin (BTC) has shown an increase of 0.51% in the last 24 hours. This has caught the attention of investors who are looking for investment alternatives that may be more profitable. Data from BeInCrypto Markets shows that there is an increased interest in Bitcoin (BTC) amid the uncertainty of the gold market.

This increase is also supported by predictions from Binance founder CZ, who has previously stated that Bitcoin (BTC) will eventually surpass gold. While it’s still too early to declare that Bitcoin (BTC) will completely replace gold, current market conditions seem to favor this crypto asset. If this momentum continues, we could be witnessing the beginning of a structural shift in the investment world.

Bitcoin’s (BTC) Long-term Prospects Compared to Gold

The debate about Bitcoin (BTC) being ‘digital gold’ is nothing new. However, recent events provide more evidence of Bitcoin’s (BTC) potential as a long-term investment asset. With a growing infrastructure and increasing adoption, Bitcoin (BTC) offers advantages that gold lacks, such as ease of transfer and immunity to government intervention.

In addition, a younger generation of investors seems to prefer Bitcoin (BTC) over gold. This indicates a shift in preference that could have a major impact on future market dynamics. If this trend continues, Bitcoin (BTC) may not just be an alternative, but the first choice for many investors.

Conclusion

The significant decline in gold prices and the momentum held by Bitcoin (BTC) indicate a potential shift in global investment preferences. Although the future cannot be predicted with certainty, current trends suggest that Bitcoin (BTC) may be on its way to becoming the new safe haven asset, replacing gold’s position in investors’ portfolios.

Read More: Ethereum Price Prediction: Here’s the Long-Term & Short-Term Bullish Potential

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Gold and Bitcoin Rotation Predicted for 2025. Accessed on October 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.