Download Pintu App

Aave DAO Proposes $50 Million Annual Token Buyback from DeFi Revenue

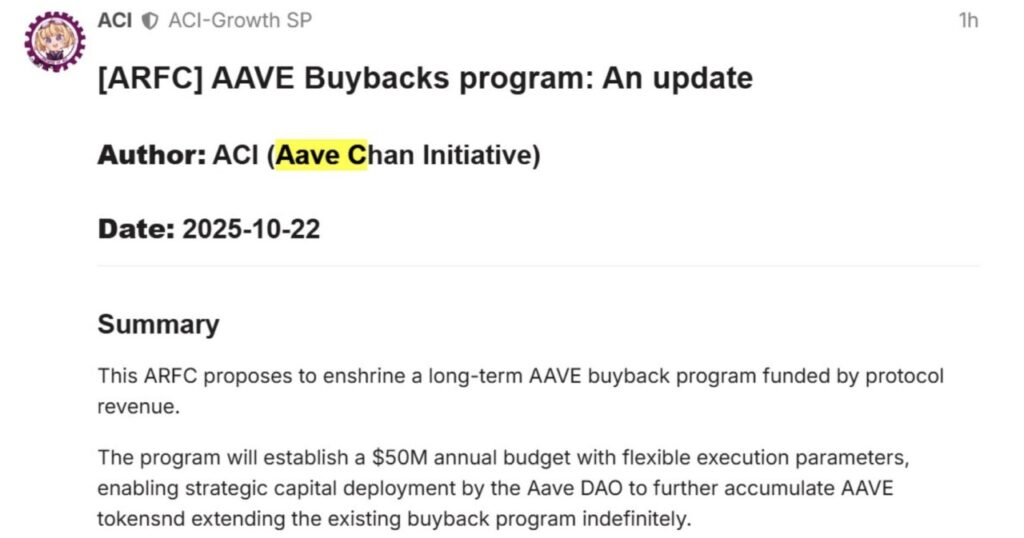

Jakarta, Pintu News – Decentralized Autonomous Organization (DAO) Aave (AAVE) has submitted a proposal to establish a long-term Aave token buyback program funded directly by the protocol.

The program will use up to $50 million of annual revenue to buy back Aave tokens.

ACI Submit AAVE Buyback Program Proposal

According to Cointelegraph, this proposal was submitted on Wednesday by the Aave Chan Initiative (ACI), with the aim of making the buyback program a permanent part of Aave’s tokenomic structure.

Read also: Crypto Whales Buy 30 Million XRP Tokens: Can XRP Reach $3?

Under the plan, the Aave Finance Committee (AFC) along with TokenLogic will be responsible for the execution of the program, which includes the buyback of AAVE tokens worth between $250,000 to $1.75 million weekly, depending on market conditions, liquidity, and volatility.

If approved, this proposal will go through an Aave Request for Comment (ARFC) stage to get community feedback, followed by a vote on Snapshot, and finally confirmation through on-chain governance.

In contrast to short-term market interventions, this initiative aims to institutionalize the buyback mechanism as a recurring strategy, making the DAO an active capital manager.

ACI explained that the program was inspired by the success of previous buyback initiatives. Back in April, Aave’s token price jumped 13% after the community approved a $4 million token buyback.

This Buyback Plan is a Development of the Previous Proposal

The $50 million buyback proposal is a continuation of the previous initiative submitted last Friday, which proposed an immediate $20 million buyback of Aave tokens, in order to capitalize on Aave’s price condition which is considered to be below its fair value.

The initial proposal assessed that Aave’s current token price is much lower compared to its fundamental value. It also stated that Aave’s treasury has sufficient funds to carry out the buyback without disrupting operational expenses or other reserve funds.

In contrast to the short-term nature of the $20 million proposal, the latest proposal aims to make buybacks a permanent policy integrated directly into the DAO’s governance system and financial management.

Read also: BSC Meme Season Ends, PumpFun Outperforms Four Memes with $8 Million Inflows

This approach will shift Aave’s strategy from reactive market action to a systematic rules-based capital allocation strategy, similar to the financial practices of large corporations.

Buyback Launched Ahead of Aave v4 Update

This proposed buyback framework is designed ahead of the launch of the Aave v4 update, which is scheduled for release in the fourth quarter of 2025.

This major upgrade will significantly change the technical and economic architecture of the Aave protocol, introducing a modular “hub and spoke” type design.

This structure allows for a flexibly customizable lending market, while still integrating liquidity through a central “hub”-aimed at improving efficiency and scalability.

In addition, this update will also bring dynamic risk configurations designed to minimize liquidation risk, especially in multi-asset portfolios.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Aave DAO proposes $50M annual token buyback using DeFi revenues. Accessed on October 23, 2025

- The Block. Aave DAO proposes $50 million annual token buyback program funded by protocol revenue. Accessed on October 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.