Download Pintu App

Can Solana (SOL) Price Break $200 Again? Check out the Analysis!

Jakarta, Pintu News – The price of Solana (SOL) continues to face resistance around the $200 level, a point that has proven difficult to break. After several attempts to recover, the altcoin is still stuck just below that threshold.

Despite the optimism in the overall market, Solana’s inability to make the $200 level a support kept investors cautious and encouraged profit-taking to continue.

Solana’s Advantage Remains Unstable

Recent data shows that the amount of Solana supply that is in profit is highly volatile.

Read also: Arthur Hayes Triggers FOMO with Bold Prediction: ZEC Price Could Soar to $10,000

In just 48 hours, the percentage of SOL supply that recorded a profit jumped from 52% to 70% – an 18% increase – while the SOL price itself only rose by less than 5%. This discrepancy indicates that many SOL holders bought their tokens around the $200 level.

When the Solana price dropped, the gains quickly disappeared, which triggered selling pressure again. These sharp fluctuations confirm that the $200 level is still an important psychological and technical boundary.

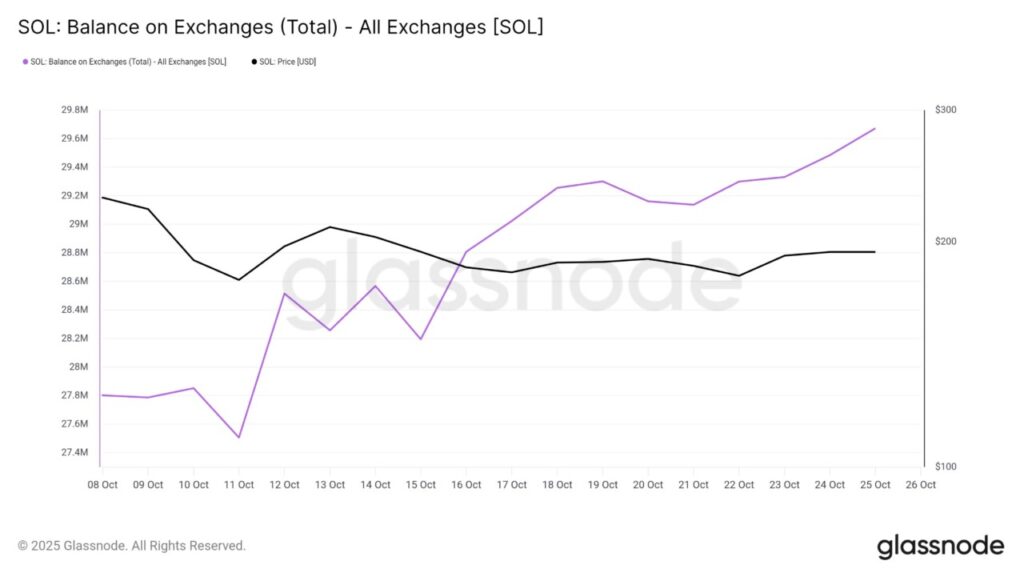

Data from crypto exchanges reinforces this cautious view. In the last 10 days, around 1.5 million SOLs – worth nearly $300 million – have been moved to exchanges. This trend suggests that many holders are choosing to sell rather than add to their holdings, reflecting a bearish market sentiment.

A rise in SOL balances on exchanges is often a harbinger of a short-term correction, as increased supply on trading platforms magnifies the risk of a sell-off. Unless inflows slow down or strong buying interest emerges, Solana will likely still face downward pressure.

SOL Prices Need to Find Strength to Strengthen

As of October 26, Solana was trading at $197, just below the $200 resistance level. This price level has repeatedly been the upper limit that has hindered a sustained recovery. To signal the strength of the uptrend, SOL should be able to break out and make $200 a solid support.

Read also: Nasdaq-Listed Bonk Holdings Buys $32 Million Worth of BONK Tokens!

If the selling pressure persists, Solana’s price is at risk of dropping below $192, with a potential further decline towards $183 or even $175. The increase in SOL balances on exchanges as well as volatile profit-taking activity reinforces this bearish scenario in the short term.

However, if Solana manages to break above $200 and continue its rise to $213, the bearish outlook could be invalidated. A clean breakout above $200 would most likely reignite investor interest, improve market sentiment, and reduce volatility in the short term.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Price Profit Fluctuates Sharply. Accessed on October 27, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.