Download Pintu App

Is Hedera (HBAR) Ready to Surge? Bullish Signs Start to Emerge! (10/27/25)

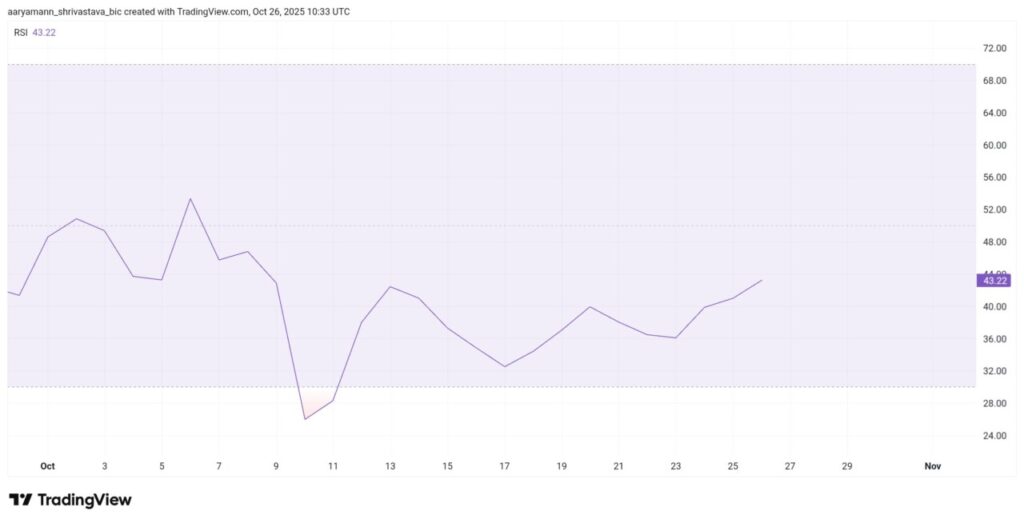

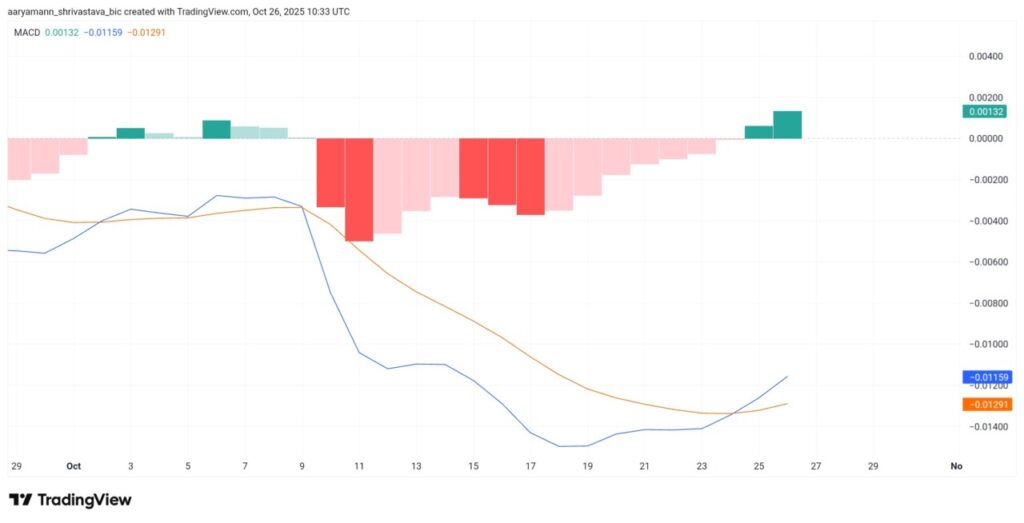

Jakarta, Pintu News – The cryptocurrency market is always full of unexpected dynamics. Recently, Hedera Hashgraph (HBAR) showed some signals that caught the attention of investors and market analysts. Key technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) started to show strong bullish signs.

Hedera Hashgraph Reinforcement Indication (HBAR)

The Hedera Hashgraph (HBAR) Relative Strength Index (RSI) is currently showing a rising trajectory, which indicates increased buying pressure. This rise is a positive signal after an almost three-week period of inactivity. Nonetheless, the RSI is still below the neutral mark of 50.0, which signals that the bullish momentum is not yet fully confirmed.

A move past the 50.0 threshold will mark the entry into positive territory and end the bearish phase that has lasted for the past 20 days. This change could attract new capital and trading interest, which would strengthen the positive sentiment in the market.

Also Read: 7 Altcoins that Cross-Chain with XRP Most Often

Potential Rupture of HBAR Price

Currently, the price of Hedera Hashgraph (HBAR) is still consolidating between $0.178 and $0.162. For this alternative currency to initiate a clear breakout, the price needs to close above the $0.178 resistance. If successful, this will pave the way towards the psychological limit of $0.200, which will confirm a potential uptrend. To reach $0.200, an increase of 13.6% from current levels is required.

The bullish crossover on MACD and the rising RSI suggest that this move is achievable, provided investor participation continues. However, if selling pressure returns, HBAR may retest support at $0.162, extending its consolidation phase.

Implications if Selling Pressure Increases

If selling pressure dominates again, Hedera Hashgraph (HBAR) may retest support at $0.162. If the price falls below this level, it will thwart the bullish thesis and push the price down to $0.154, signaling renewed weakness. This situation will require careful market monitoring and a quick response from traders.

On the contrary, if Hedera Hashgraph (HBAR) manages to maintain its momentum and break the $0.178 resistance, this would be a very positive signal. This would not only strengthen investor confidence but could also trigger a bigger buying wave from market participants.

Conclusion

Looking at the current technical indicators, Hedera Hashgraph (HBAR) shows potential that should not be ignored. Although there are still some hurdles to overcome, the positive signals from RSI and MACD give hope to investors who have been waiting for a significant price movement. Going forward, it is imperative that investors continue to monitor these indicators and adjust their strategies according to market dynamics.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Hedera Hashgraph (HBAR) Price Forms Bullish Crossover, Will It Break Out? Accessed on October 27, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.