Download Pintu App

Dogecoin (DOGE) Surges, Breaks $0.21 Resistance: Here’s the Outlook for November (10/28/25)

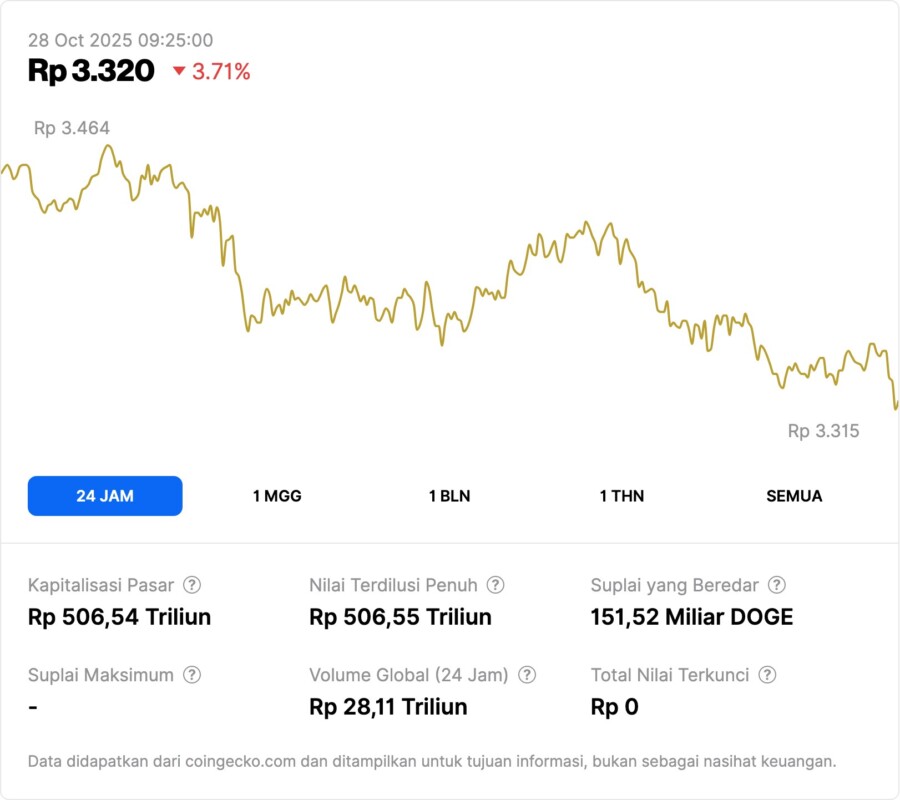

Jakarta, Pintu News – Dogecoin (DOGE) has recently registered a significant rise, breaking through the resistance barrier that has held for several months and turning it into a support zone. With trading volumes increasing by almost 10% above the weekly average, this signals an early accumulation phase within the prevailing breakout structure.

Background of Dogecoin Gain

Dogecoin (DOGE) saw an increase of 1.4% to $0.21 in Tuesday’s trading session, marking a significant move past the $0.2026 resistance threshold since late August. This performance showed higher relative strength compared to the overall crypto market, outperforming the CD5 index by more than 2%.

Trading volumes increased by 9.82% above the seven-day average, indicating continued institutional participation in the meme asset segment. According to market analysts, this surge is indicative of the early momentum of the cycle forming after almost two months of consolidation in the $0.19-$0.20 corridor.

Rishi Patel, a quantitative strategist at Bluepool Digital, stated that Dogecoin’s (DOGE) resilience while Bitcoin (BTC) and Ethereum (ETH) are consolidating suggests that rotational flows are returning to higher-risk assets.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

Price Action Summary

Dogecoin (DOGE) increased steadily from $0.1950 to $0.2072 over a 24-hour window, creating a series of higher peaks and valleys along an intraday range of $0.0159. The crucial peak occurred at 22:00 UTC, when volume surged to 834.5 million tokens-about 180% above the daily average-and the price managed to break the key resistance level of $0.2026.

This momentum continued into early trading on Wednesday, with Dogecoin (DOGE) briefly touching $0.2087 before experiencing mild profit-taking. The price drop remained steady above the $0.2070 support, confirming that the previous resistance has turned into a short-term demand zone.

Technical Analysis

From a technical perspective, Dogecoin (DOGE) is still looking positive. The coin maintained its uptrend line from the $0.1949 base, with a successful retest of the $0.2060-$0.2070 zone confirming continued buyer control.

The RSI indicator hovers near 58 on the 4-hour chart-consistent with the early stages of an uptrend-while the MACD remains positive but shows narrowing, reflecting a short-term consolidation after the breakout spike.

Volume analysis shows a healthy distribution pattern, indicating re-accumulation rather than exhaustion. The price structure remains in line with a bullish continuation phase, although momentum confirmation requires a sustained close above $0.2085.

Important Information for Traders

CoinDesk, as an award-winning media outlet, provides coverage of the crypto industry by following a strict set of editorial policy standards. CoinDesk is part of Bullish (NYSE:BLSH), a global digital asset platform focused on institutions that provide market infrastructure and information services. Bullish owns and invests in digital asset businesses as well as digital assets themselves, and CoinDesk employees, including journalists, may receive equity-based compensation from Bullish.

Conclusion

The Dogecoin (DOGE) bull run marks an important phase in the dynamics of the crypto market, especially in the meme asset segment. With strong support from trading volumes and technical indicators, Dogecoin (DOGE) will probably continue to attract interest from both institutional and retail investors. Going forward, monitoring for new support and resistance levels will be crucial to predicting the next direction of price movement.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Dogecoin Breaks Multi-Month Range as $0.21 Resistance Flips to Support. Accessed on October 28, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.