Download Pintu App

Bitcoin (BTC) Held Above $114K: What’s the Secret Behind Its Stability? (28/10/25)

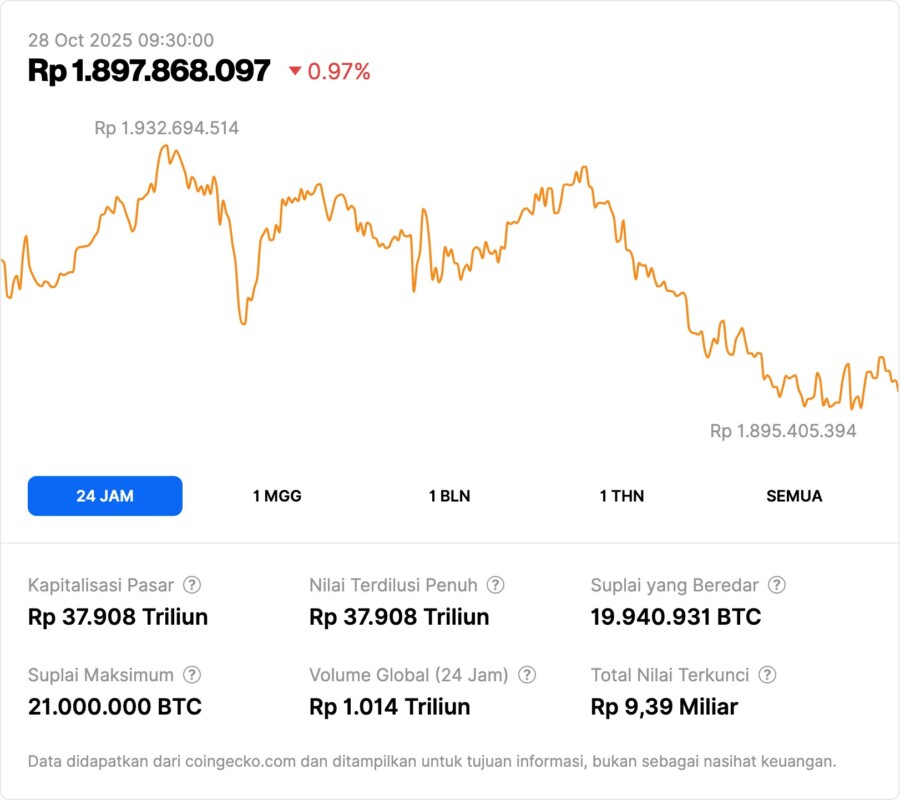

Jakarta, Pintu News – The Bitcoin (BTC) market is showing a steady recovery above $114,000, driven by absorption by large holders and a rebalancing of short positions. This article will delve deeper into the dynamics affecting Bitcoin (BTC)’s current price movement, as well as its impact on the crypto market as a whole.

Bitcoin (BTC) Recovery: Not Just an Ordinary Surge

The latest data from Glassnode shows that approximately 62,000 BTC has moved from wallets that have been dormant over the long term, marking the first illiquid supply drop in this cycle. This suggests that some long-held coins are now returning to more liquid hands. Nonetheless, the whales have continued to absorb this flow without any meaningful sales since October 15.

This indicates a phase of redistribution where smaller holders tend to reduce risk, while large holders continue to accumulate. In the derivatives market, leverage remained balanced with around $4.1 billion in open interest split almost evenly between long and short positions.

Data from Coinglass recorded approximately $413 million in liquidations over the past 24 hours, with $337 million of that being shorts. This is an indication that the market is experiencing a purge of overextended bets, but not enough to change the overall position or trigger panic buying.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

Other Market Movements: Ethereum (ETH) and Gold

While Bitcoin (BTC) showed a steady recovery, Ethereum (ETH) recorded a rise to $4,186, up about 6% in 24 hours. This rise occurred as traders turned to higher-beta assets after the stabilization of Bitcoin (BTC). However, on-chain and derivatives data suggests that this move was driven more by momentum than strong new inflows.

On the other hand, gold is also gaining attention with predictions from JPMorgan expecting gold prices to reach $5,055 per ounce by the end of 2026 and $6,000 by 2028. This prediction is based on interest rate cuts by the Fed, fears of stagflation, and increased demand from central banks and investors diversifying away from the dollar.

Recent Developments in the Crypto Market

Beyond the price movements of Bitcoin (BTC) and Ethereum (ETH), the crypto market is witnessing some significant developments. The New York Stock Exchange (NYSE) has floated spot crypto ETFs for Solana (SOL), Hedera (HBAR), and Litecoin (LTC) this week. This signifies the increasing adoption and recognition of cryptocurrencies in the financial mainstream.

In addition, OwlTing continues to innovate its stablecoin infrastructure, demonstrating the continuous growth and evolution in the crypto ecosystem. These initiatives not only increase liquidity but also open up new opportunities for investors and users around the world.

Bitcoin (BTC) Stability in Wait for the Next Catalyst

For now, Bitcoin (BTC) is likely to fluctuate between $113K and $116K until the next catalyst appears. With the expectation of a dovish policy from the Fed already widely anticipated, the market may be waiting for the next influence that will determine the next direction. The current dynamics show that the market is not only driven by speculation but also by a mature absorption strategy by large holders.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Asia Morning Briefing: Bitcoin Holds Above $114K as Whales Absorb Supply and Shorts Rebalance. Accessed on October 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.