Download Pintu App

Ethereum Falls 3% on October 28 — Is a Rally to $4,500 Still Possible by Year-End?

Jakarta, Pintu News – Earlier this week (10/27/25), Ethereum (ETH) broke through the $4,200 level, reigniting optimism among investors. However, analysts are still divided on whether this surge signals a sustainable uptrend or a misleading bull trap.

Monday’s rise in ETH price past the psychologically important threshold sparked speculation that Ethereum may be entering a medium-term bullish phase. Even so, caution is advised as the market signals are not yet entirely clear.

Then, how is Ethereum’s current price movement?

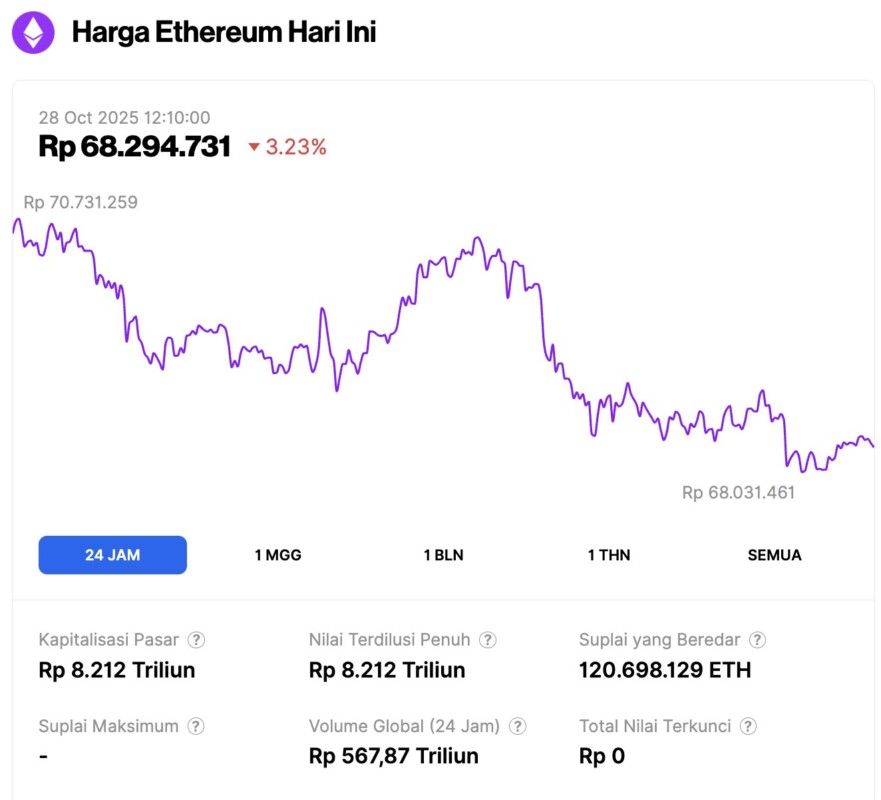

Ethereum Price Drops 3.23% in 24 Hours

As of October 28, 2025, Ethereum was trading at approximately $4,091, or about IDR 68,294,731 — marking a 3.23% decline over the past 24 hours. During this period, ETH dipped to a low of IDR 68,031,461 and peaked at IDR 70,731,259.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,212 trillion, while its 24-hour trading volume has climbed 10% to reach IDR 567.87 trillion.

Read also: Bitcoin Price Drops to $113,000 Today: BTC’s Whale Movement Declines

Structural Factors Behind ETH Price Rise

Market watchers are now looking at a number of key indicators such as actual spot buying, large order inflows, and the balance between buying and selling pressure. Analysis from a number of crypto experts on the X platform (formerly Twitter), such as @swarmister and @acethebullly, highlight the current market structure and possible breakout scenarios that are forming.

Based on research from several analytics firms, ETH’s intermediate price target is expected to be in the range of $4,500 to $4,650, driven by strong fundamentals. The Ethereum ecosystem continues to evolve-from the DeFi (decentralized finance) sector, the increasing demand for staking, to the accelerated development of Layer 2 solutions that strengthen network scalability.

From a technical perspective, ETH’s price surge from the $3,900 level suggests a broader consolidation pattern. The 200-day moving average currently hovering around $3,568 remains a strong long-term support zone. Now, traders are focused on monitoring whether the price is able to hold above the 50- and 100-day exponential moving averages (EMAs), which determine the direction of the short-term trend.

Global macroeconomic conditions are also likely to support bullish sentiment. Expectations of a possible US interest rate cut and falling real yields could trigger a return of risk-on sentiment, potentially pouring liquidity into digital assets like Ethereum.

Crypto analyst @swarmister notes that Ethereum is currently forming a “symmetrical triangle” pattern, which usually appears as a consolidation phase after an impulsive move.

“If the price holds above $4,000 with increasing volume and positive delta, this could confirm a bullish scenario,” he said. He also added that a strong breakout could push ETH to the $4,800 to $5,600 range.

These technical signals suggest that Ethereum’s recent price movements may not be just short-term fluctuations, but part of a structural shift in overall crypto market sentiment.

Market Resistance and Downside Risk

While Ethereum’s price trend looks promising, some analysts warn that this optimism may be premature. On-chain data shows that spot fund flows are still limited, while leveraged positions are increasing-signaling a potential vulnerability to a sell-off due to mass liquidation.

Technical analyst @acethebullly describes the current market conditions as “stuck in a narrow range”, with ETH prices consolidating between $4,050 to $4,100.

“The concentration of liquidity near $4,100 acts as strong resistance,” he said. He added that despite significant buying pressure around $4,050, large sell orders above $4,100 continue to limit the upside. “Buyers are guarding this level, but the thick sell wall makes upward movement difficult.”

This liquidity balance suggests that Ethereum is currently at a crucial point. Without a convincing breakout above $4,150 on solid volume, the continuation of the bullish trend is likely to remain on hold.

Read also: Crypto Whales Take Big Positions – Bullish Sign or Cautionary Signal?

On the other hand, Bitcoin’s (BTC) dominance over the overall market direction is also a limiting factor, making it difficult for ETH to rise independently.

If Ethereum fails to maintain support at $4,000, analysts expect a potential correction to the $3,900 area or even lower. Macro risks such as tightening global liquidity, new regulatory pressures, or a shift in investor sentiment towards the negative could also be factors that pressure the price further.

Can ETH Reach $4,500 by the End of 2025?

Ethereum’s price increase towards the $4,500-$4,550 range is still very possible, provided ETH is able to break through the strong resistance level at $4,150-$4,220. If this breakout occurs with the support of improved market volume and liquidity, as well as relatively stable macroeconomic conditions, then a bullish scenario as projected by a number of analysts could be realized.

However, on the contrary, ETH’s failure to break the resistance could extend the consolidation phase, delaying the potential for further rallies. If the selling pressure (sell wall) remains strong and spot buying interest weakens, it is not impossible that Ethereum will continue to move sideways until the end of the year.

All in all, Ethereum’s chances of reaching $4,500 before the close of 2025 will largely depend on price action in the near term-especially whether the current accumulation phase can result in a valid technical breakout.

Some important metrics to monitor include:

- Spot buying activity: Shows how much real demand there is for ETH on exchanges, reflecting healthy market participation.

- Leverage ratio: Describes the proportion of borrowed funds in the derivatives market. A high ratio means the risk of liquidation is also increased.

- Liquidity heatmaps: Visualize the concentration of buy and sell orders in the order book-often important support or resistance areas.

- ETH to BTC performance (ETH/BTC): Indicates the relative strength of Ethereum compared to Bitcoin. If ETH rallies on its own, it’s a sign of independent dominance; otherwise, ETH is still “following” BTC’s movements.

All of these indicators are lifted from the technical observations of market analysts. For example, @swarmister highlights the formation of a symmetrical triangle pattern, which indicates a potential trend continuation if accompanied by increased volume.

Meanwhile, @acethebullly emphasized that the liquidity concentrated around $4,100 is a major barrier, although there are quite strong buy defenses in the $4,050 area.

By keeping a close eye on these metrics, investors can better understand whether the breakout is truly driven by strong demand, or if it is susceptible to a short-term correction.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. ETH Breaks Above $4,200 – Can It Reach $4,500 by Year-End? Accessed on October 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.