Download Pintu App

3 Interesting Altcoins to Watch Ahead of the FOMC Meeting at the End of October 2025!

Jakarta, Pintu News – The crypto market is buzzing ahead of the Federal Open Market Committee (FOMC) meeting on October 28-29, as traders brace for possible interest rate cut signals following the lower-than-expected US Consumer Price Index (CPI) report. Currently, the market has gained almost 4%, with Bitcoin (BTC) and Ethereum (ETH) showing solid performance.

With inflation easing and liquidity expectations rising, the focus is now on three altcoins worth watching ahead of the FOMC meeting, citing the BeInCrypto page. If the Fed takes a dovish stance, these three tokens could potentially move quickly.

Chainlink (LINK)

The first altcoin to watch ahead of the FOMC meeting is Chainlink (LINK), whose chart reflects both caution and potential. LINK is currently in a falling wedge pattern, which usually indicates abullish reversal, but there was also a hidden bearish divergence between October 13 and 27.

Read also: XRP Price Prediction for November 2025 According to ChatGPT

The price forms a lower high, but the Relative Strength Index (RSI), which measures buying and selling pressure, records a higher high. This is often a sign that a larger downtrend may be continuing. Over the past month, LINK’s price fell 10.2%, although it rose 6.8% in the past week.

The $17.08 level remains a strong support area; a daily close below this level could trigger a 9% drop towards $15.

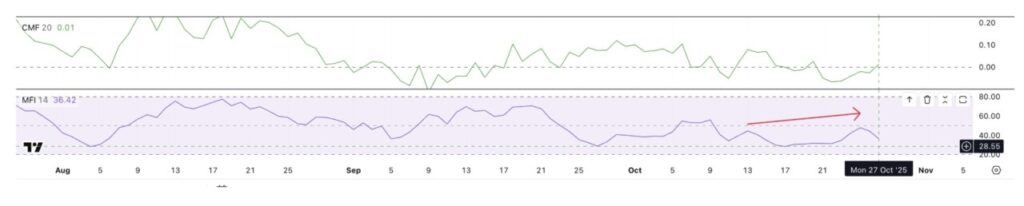

However, not all signals are bearish. The Money Flow Index (MFI), which measures the inflow and outflow of funds from assets, showed higher peaks since mid-October – a sign that buying on the way down is still continuing.

Meanwhile, Chaikin Money Flow (CMF), an indicator of accumulation by large investors(whales), has just moved above zero, signaling that large holders are starting to buy LINK again.

The combination of these signals suggests that Chainlink is in a “floating” situation – bearish pressure is easing, buying interest from retail investors is increasing, and fund flows from large investors are improving.

The policy tone from the FOMC could be a bellwether, making LINK one of the key crypto assets to watch this week, especially if the Fed actually cuts rates as expected.

Dogecoin (DOGE)

The second altcoin worth watching ahead of the FOMC meeting is Dogecoin (DOGE), which is currently on the verge of a potential breakout. Dogecoin’s price has been moving sideways since October 11, fluctuating between $0.17 and $0.20, while traders wait for the next trigger for movement.

The key level to watch is $0.21. If DOGE manages to break this level decisively, a potential 6% rise towards $0.27 could be in the cards – especially if the market’s risk appetite increases due to a possible rate cut by the Fed.

The Wyckoff volume profile, which measures the balance between buying and selling pressure, shows a shift in market forces. Between October 23 and 25, the chart changed from yellow (seller control) to blue (buyer control), indicating that the bulls briefly took over the momentum.

However, the buying power weakened again, reflecting the indecisive state of the market – a common occurrence in sideways price movement patterns like the one Dogecoin is currently experiencing.

Adding to the appeal, Dogecoin whales appear to have started accumulating quietly. In the last 48 hours, holders with balances between 100 million and 1 billion DOGE increased their holdings from 28.87 billion to 29.04 billion DOGE.

Read also: Dogecoin Price Plunges 4% Today: Support Level $0.18 is the Key to DOGE Movement

The value was around $34 million, which suggests that large investors started positioning themselves early ahead of the FOMC decision.

The combination of accumulation by whales, neutral behavior from retail investors, and narrow price movements makes Dogecoin one of the key crypto assets worth monitoring as markets await the Fed’s next move.

Zcash (ZEC)

The last altcoin worth keeping an eye on ahead of the FOMC meeting is Zcash (ZEC), a privacy coin that has been on an incredible surge. In the past month, the price of ZEC has risen more than 540%, breaking out of a bullish flag and pole pattern and moving steadily towards its next target of $441 – in line with previous projections.

The bull run has successfully crossed strong resistance levels at $314 and $344, signaling solid momentum despite some technical warning signals.

Between October 11 to 27, the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicators on the daily chart showed bearish divergence.

Although the price printed higher highs, the RSI and CMF formed lower highs. This indicates that the buying power is starting to weaken even though the price continues to rise.

This opens up the opportunity for a mild correction of around 10%-12%. In other words, ZEC prices may retest the $314 level or even $284 before resuming its uptrend.

The zone around $247 becomes a deeper support area, while a drop below $187 could invalidate the bullish structure currently formed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins to Watch: FOMC, LINK, DOGE, ZEC. Accessed on October 28, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.