Download Pintu App

Antam Gold Price Chart Today October 29, 2025: Up Thinly to IDR 2.12 Million per Gram

Jakarta, Pintu News – The price of Antam gold on Wednesday, October 29, 2025, slightly strengthened again after weakening in the last few days. Based on data from HargaEmas.com at 13:50 WIB, the spot gold price is at IDR 2,118,230 per gram, up around IDR 8,761 compared to the previous trade.

This increase occurred in line with the strengthening of world gold prices which broke the level of US$3,964.50 per troy ounce, as well as the rupiah exchange rate which was in the range of IDR16,618.57 per US dollar. Based on this data, Antam’s gold price continues to be a concern for market participants amid global geopolitical sentiment and the Fed’s interest rate trend which is still uncertain.

World Spot Gold Prices Strengthen Amid Dollar Strengthening

According to data released by HargaEmas.com (2025), the world gold price rose by US$10.30 in today’s trading. The increase was driven by increased demand for hedge assets (safe haven) due to fears of a global economic slowdown and inflation that remains high in a number of developed countries.

Meanwhile, the strengthening of the US dollar index did not put too much pressure on gold prices as the market assessed that the Fed’s interest rate hike had reached its peak. This provides room for investors to re-enter precious metal assets. Gold prices in the global market are now moving in the range of IDR 2,098,000 to IDR 2,122,000 per gram in the Indonesian domestic market.

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

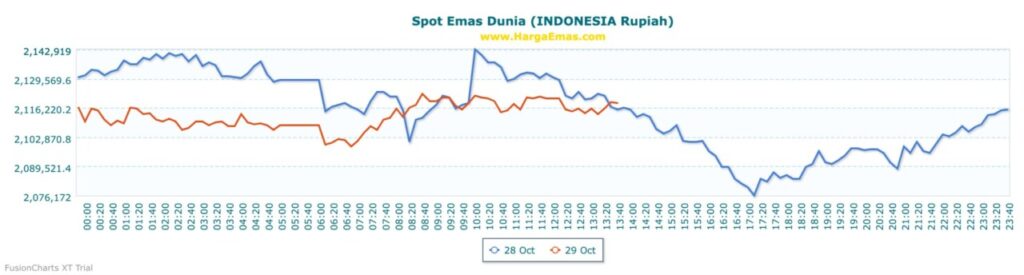

World Gold Price Chart (IDR) Shows Positive Trend

Based on the World Gold Spot chart in Rupiah from HargaEmas.com, the movement of gold prices on October 28 and 29, 2025 shows a fluctuating pattern. At the beginning of the day, the price had moved flat in the range of IDR 2,102,000 per gram, before finally rising to a daily peak above IDR 2,118,000 per gram towards noon.

The chart shows a price recovery after the significant drop that occurred at the end of the previous week. Technically, this pattern signals a potential short-term consolidation before possibly resuming the uptrend, especially if the US dollar weakens and demand for physical gold increases towards the end of the year.

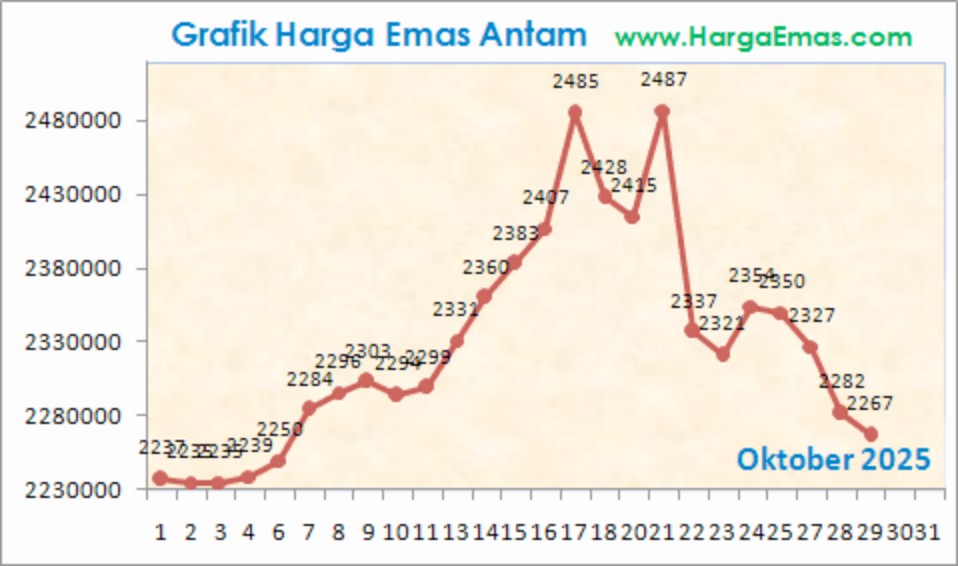

Antam Gold Price Movement Through October 2025

If you look at the historical data of Antam gold prices during October 2025, the price trend shows a fairly sharp up-and-down pattern. Based on the monthly chart from HargaEmas.com, the price peaked at IDR 2,487,000 per gram in the middle of the month, before dropping gradually to IDR 2,267,000 per gram towards the end of October.

The mid-month price hike was triggered by global stock market turmoil and increased demand for gold bullion in Asia. However, after selling pressure emerged due to the strengthening of the dollar, gold prices corrected. Now, with a mild strengthening trend towards the end of the month, analysts estimate that Antam gold prices could stabilize again above IDR 2.1 million per gram if external factors are favorable.

Gold Prices Still on a Positive Path

Overall, Antam’s gold price today shows a positive performance at the end of October 2025. Although volatility is still high, data from HargaEmas.com shows that gold remains a safe investment option amid global uncertainty.

Investors are advised to monitor the movement of the rupiah exchange rate against the US dollar as well as the direction of global central bank policies, as these two factors greatly affect the price of precious metals in the near future. If the upward trend in global prices continues, it is possible that Antam gold will again break the Rp2.2 million per gram level in the coming weeks.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. World Gold Spot and Antam Gold Price Today. Accessed on October 28, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.