Download Pintu App

Dogecoin Price Sees Minor Pullback – Is a Bearish Trend Emerging?

Jakarta, Pintu News – The Dogecoin (DOGE) price looks set to close October on a downward note, having slumped by 16% since the start of the month. As of October 29, the meme coin is trading at around $0.19 and is still struggling to regain momentum after experiencing a sharp sell-off in the middle of the month.

With momentum continuing to weaken, DOGE may find it difficult to reach its local highs again before the end of the month. A number of technical indicators and on-chain data suggest that buying pressure is starting to weaken.

Here are the key levels to look out for as well as possible price movement targets. Previously, we will discuss Dogecoin price movements as of today (Oct. 30).

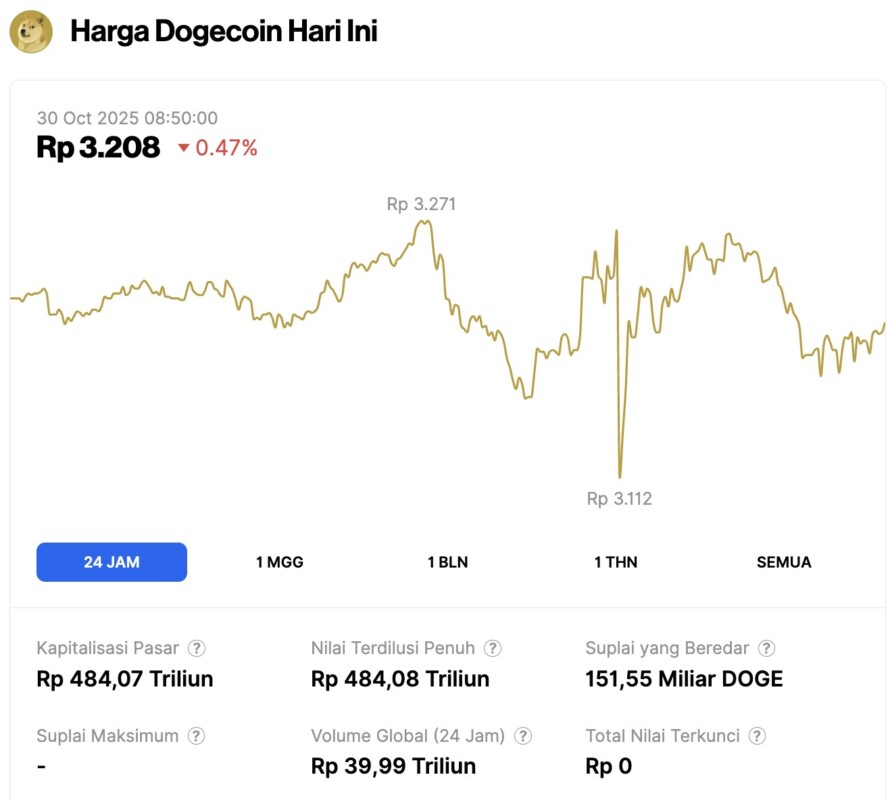

Dogecoin Price Drops 0.47% within 24 Hours

On October 30, 2025, Dogecoin saw a slight correction of 0.47% over a 24-hour period, with its price trading at $0.1932, or approximately IDR 3,208. During that time, DOGE fluctuated between IDR 3,271 and IDR 3,112.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 484.07 trillion, with a 24-hour trading volume of roughly IDR 39.99 trillion.

Read also: Ethereum Drops to $3,900 Today — Could ETH Climb to $5,000 After the FOMC Meeting?

Dogecoin Fails to Break Key Levels

Previously, the Dogecoin price was moving in an upward channel pattern on the 4-hour chart. However, this has now changed. From the latest chart, DOGE is seen to have broken below the lower trend line of the channel, which is around the $0.20 level. This drop suggests that the bulls are not strong enough to defend the support area.

This is also reflected in the Bull Bear Power (BBP) indicator, which is currently showing a negative value. This indicates that the sellers (bears) are dominating the market. In addition, CCN notes that the $0.20 level which was previously a support has now turned into a major resistance blocking the movement of DOGE.

If this trend continues, the Dogecoin price is likely to drop through the crucial zone at $0.19. If that level is breached, the next target will be around $0.17.

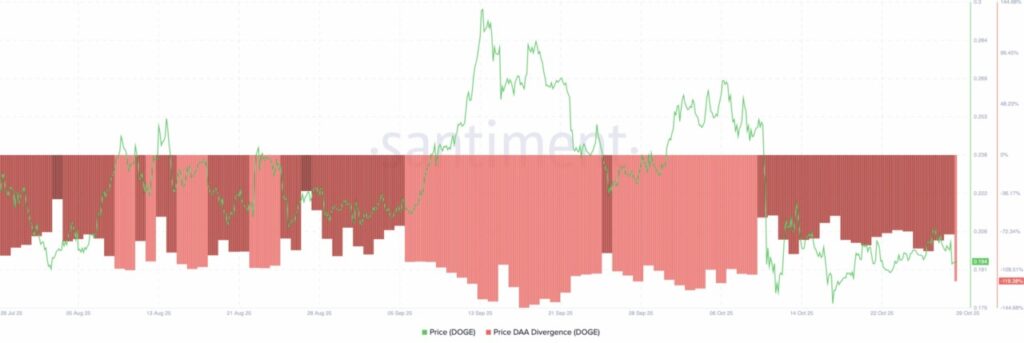

On-Chain Interest in Meme Coin Declines

Aside from the technical side, analysis from CCN also found that Dogecoin’s Daily Active Addresses (DAA) is still showing negative divergence. This data indicates that fewer unique users are interacting with the network, despite the DOGE price attempting to stabilize.

Negative divergence on the DAA signals weakening network participation, which could be an early signal of stagnation or price declines if engagement levels do not pick up again.

In other words, the on-chain data does not yet indicate a positive trend reversal, thus reinforcing the view that Dogecoin price may find it difficult to return to previous local highs.

Read also: Shiba Inu soars! Here are 5 reasons the Ethereum rally is the main driver of the SHIB price increase

DOGE Price Analysis: Bearish Pattern Begins to Form

From the daily chart (10/29), Dogecoin’s price appears to have formed a bearish pennant pattern, which usually signals a continuation of the previous downward trend.

This pattern forms when the price consolidates within a narrowing trendline after a decline, reflecting temporary uncertainty before a potential further decline. If this pattern is confirmed, the price of DOGE could face additional selling pressure, and risks falling further after breaking the lower boundary of the pennant at $0.18.

If that happens, the price of this memecoin could drop below $0.15. However, if the bulls manage to hold the support zone and thwart the pattern, there is a possibility of a short-term rebound, with a potential price target of $0.22.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin (DOGE) Under Pressure: 16% Fall and Support Break Raise Red Flags. Accessed on October 30, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.