Download Pintu App

Is the Big Crypto Wave Coming? Expert Predictions About the Fed’s Liquidity Policy

Jakarta, Pintu News – The crypto market may be in for a big change with indications that the Federal Reserve (Fed) will change its liquidity policy. After 18 months of tightening, there is a possibility that the Fed will stop its quantitative easing (QT) policy and switch to quantitative easing (QE) quietly.

Fed Policy Changes and Their Impact on the Crypto Market

Market expert, VirtualBacon, emphasized that the Fed’s policy change towards liquidity will be the most significant event for the crypto industry this year, even more important than the Bitcoin (BTC) cut or exchange-traded fund (ETF) approval.

In 2019, when the Fed stopped QT, there was a price surge in altcoins. Conversely, in 2022, when the Fed started QT, altcoin prices peaked. Now, with the expected end of QT in 2025, VirtualBacon predicts a similar spike for altcoins. The correlation between the Fed’s increase in liquidity and the rise in altcoin prices is clear. The main question is when exactly QT will end.

Also Read: Top 3 Crypto’s that are Trending and Stealing Investors’ Attention by the End of 2025!

Indications from CME FedWatch Tool and Major Financial Institutions’ Predictions

The CME FedWatch tool shows a high probability of a rate cut. Major financial institutions such as Goldman Sachs, Bank of America, and Evercore have made predictions that the Fed may end QT soon. Goldman Sachs stated that the October meeting is the base case for the end of QT, while Bank of America expects QT to end by the end of this month.

While the Fed may not explicitly call the shift QE, the crucial moment will come when they remove the language regarding “balance sheet size reduction”. This is similar to the repo crisis of 2019, when banks faced instant cash shortages, prompting the Fed to inject $75 billion into the financial system.

M2 Money Supply and Bitcoin’s Projected Surge

Despite the current market uncertainty, VirtualBacon asserts that Bitcoin (BTC) has not yet reached its peak. Of the 30 historical indicators that usually signal the peak of a bull market, none are active yet, with data showing there is still room for growth.

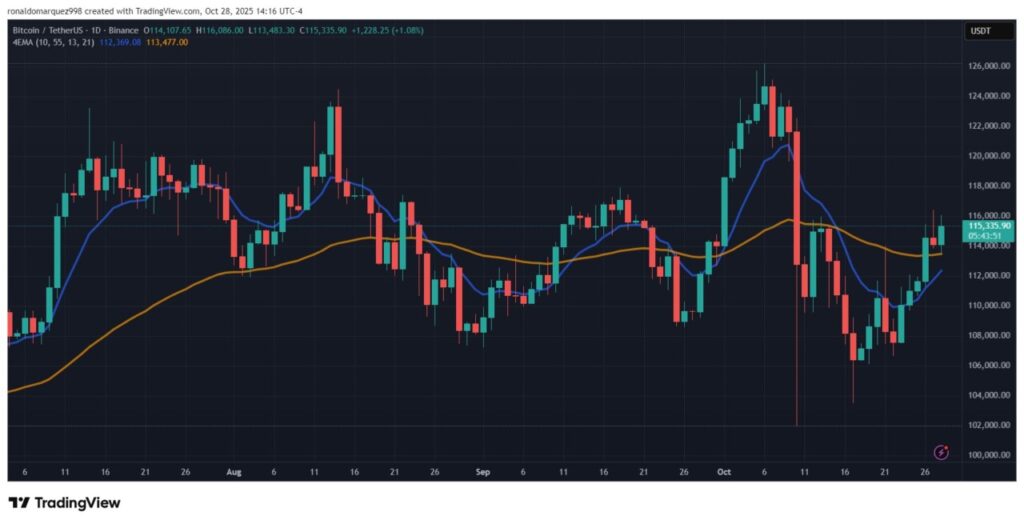

M2’s global money supply continues to increase, which historically precedes Bitcoin’s (BTC) price by about 10 to 12 weeks. Since the beginning of the month, this money supply has increased, signaling that the next upside move for Bitcoin (BTC) is already on its way, albeit lagging behind the liquidity curve. In addition, VirtualBacon predicts that once the Fed moves on, a new season of altcoins will probably begin.

Conclusion

By various indications from expert tools and analysis, the crypto market seems to be on the verge of a major change triggered by Fed policy. Investors and market watchers should pay attention to these signs to capitalize on the potential price spikes that may occur along with increased liquidity.

Also Read: Bitcoin (BTC) Breaks $115,000, Fear & Greed Index is Neutral!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Is a Crypto Melt-Up Coming? Top Expert Forecasts Liquidity Surge with Fed’s QT Shift. Accessed on October 30, 2025

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.