Download Pintu App

How Did the Fed Meeting Turn Out?

Jakarta, Pintu News – At its latest meeting, the US Federal Reserve (Fed) announced a 25 basis point cut in interest rates, to 3.75-4.00%. This is the second such cut this year, signaling a policy that is expected to stimulate further economic growth.

The Fed’s Recent Monetary Policy

The Federal Reserve has decided to lower its benchmark interest rate by 25 basis points. This decision was made after a two-day Federal Open Market Committee (FOMC) meeting. This follows a similar policy in September, which also lowered interest rates by 25 basis points.

This policy was taken amid inflationary pressures that are still above the Fed’s long-term target of 2%. The latest data showed that annual inflation in the United States in September amounted to 3%, slightly below the previous prediction of 3.1%. This suggests that although inflationary pressures are easing, there is still a need to maintain a balance between economic growth and price stability.

Read also: Ethereum (ETH) Surpasses Bitcoin (BTC) in Institutional Investment Trends, Toward $4,500?

Market Dynamics and Future Projections

With this latest policy, financial markets showed a moderate reaction. Bitcoin (BTC) and the stock market showed modest gains, awaiting further remarks from Jerome Powell, the Fed Chair. The statement is expected to provide clues on whether the monetary easing cycle will continue into December.

In addition, there is speculation in the market that Jerome Powell may not continue his tenure as Fed Chair. President Donald Trump has confirmed that there are five candidates under consideration to replace Powell. This decision, expected in December, will greatly influence the direction of Fed policy in 2026.

Also read: Telegram and TON Usher in a New Era of Decentralized AI, What’s the Project?

Implications for the Crypto Market

The Fed’s interest rate cut and cessation of balance sheet reduction will probably increase risk appetite in the market in the short term. Bitcoin (BTC) and other major cryptocurrencies often benefit when liquidity increases and bond yields decrease.

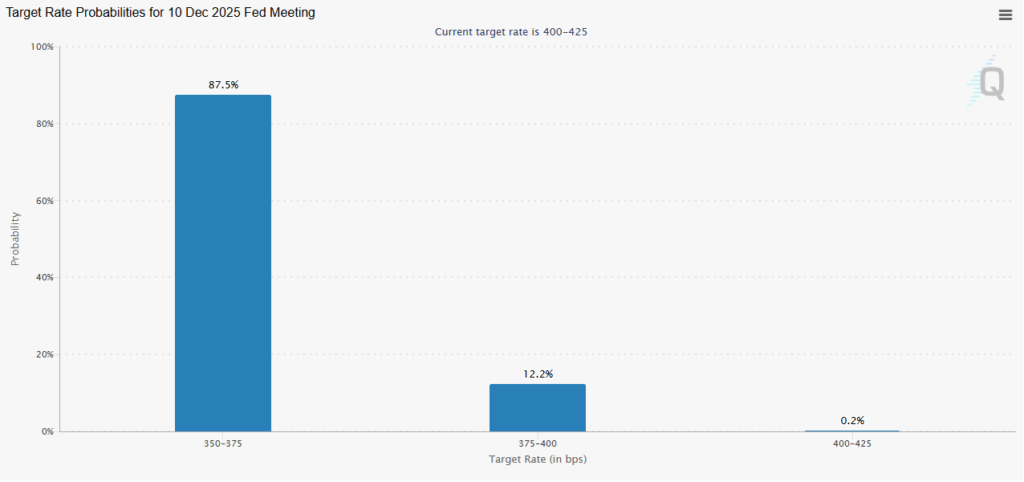

This could be good news for investors in the crypto market. Additionally, data from Polymarket shows that nearly 89% of traders expect one additional cut before the end of the year. This suggests that the market is still anticipating the possibility of more easing policies that could support crypto asset prices.

Conclusion

The Fed’s rate cuts and more accommodative monetary policies are expected to support economic recovery, despite the uncertainty caused by the US government shutdown. These policies are also expected to provide a boost to the crypto market, which often reacts positively to increased liquidity.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Fed Interest Rate Cut: FOMC & Crypto Market Outlook. Accessed on October 30, 2025

- Coingape. FOMC Meeting: Federal Reserve Lowers Interest Rates by 25 bps in Second Cut of the Year. Accessed on October 30, 2025

- Featured Image: Fortune

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.