Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (10/31/25)

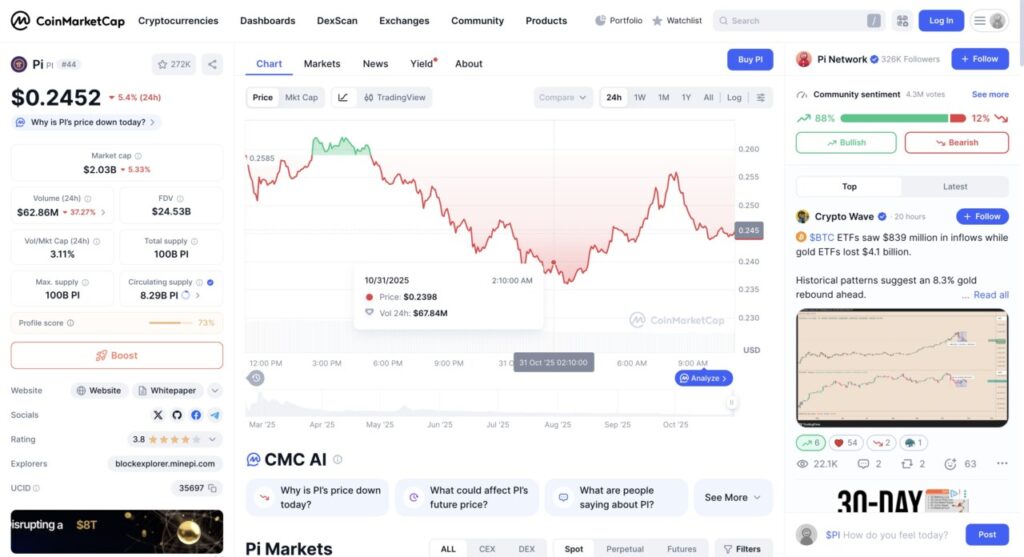

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia today, October 31, 2025, is recorded at around IDR 4,073 or around $0.2452, down more than 5% in the last 24 hours. This decline reflects the weakening market sentiment towards the crypto asset after daily trading volume fell sharply.

In the context of technical analysis of Pi Network prices, chart movements show a short-term correction pattern which indicates that selling pressure is still dominant, although there is limited rebound potential if prices are able to stay above their psychological support level.

How much is 1 PI in Indonesia today?

Based on the Pi Network (PI) price chart from CoinMarketCap on October 31, 2025, it can be seen that the PI price experienced a daily decline of 5.4%, down to the level of US$0.2452 or around IDR4,073 (assuming an exchange rate of IDR16,608 per US dollar). In the last 24 hours, the PI price touched a low of US$0.2398 (IDR3,983) at 02.10 WIB, before rebounding slightly to around US$0.245 at the end of the trading session.

Pi Network’s market capitalization also fell by 5.33% to US$2.03 billion (approximately IDR33.7 trillion), signaling weakening short-term investor confidence. Meanwhile, daily trading volume fell sharply by 37.27%, reaching only US$62.86 million (approximately IDR1.04 trillion), indicating decreased market activity and more dominant selling pressure.

The chart shows a volatile price pattern with a sharp correction phase since the beginning of trading, although there was a brief rise to the level of around US$0.258 before going back down. Technically, this pattern illustrates a short-term bearish sentiment, where investors are likely to engage in profit-taking after the previous small rally.

Also read: Solana (SOL) Price Prediction in November 2025!

Technical Analysis of Pi Network Price

Pi Network (PI) price seems to be in the initial phase of a short-term uptrend. The price has formed a higher low at $0.19 and a higher high near $0.29. The price recovery above EMA 9 and EMA 21, as well as the bullish crossover between the two moving averages, provided the first meaningful bullish signal since the May rally.

Nonetheless, strong rejection around $0.28 and $0.29, which is visible from the long upper wick on the latest peak, suggests that sellers are still active at those levels. With both the RSI and Stochastic RSI oscillators in overbought territory, the probability of a short-term price pullback or consolidation seems high. However, as long as Pi Network’s price can hold above the current uptrend line, the short-term bias remains bullish.

Read also: Charles Hoskinson Reveals Big Vision for Cardano’s Future Until 2030

Factors Supporting the Pi Network Price Increase

In addition to its bullish technical analysis, Pi Network recently announced its first investment in OpenMind, a company developing decentralized operating systems for robots and AI systems. Prior to the investment, both teams had conducted proof-of-concept experiments using over 350,000 Pi Network nodes, which successfully demonstrated that the network could process real AI workloads.

In addition, Pi Network has also joined or aligned with the ISO 20022 messaging standard, a global banking/financial messaging standard also followed by networks such as Ripple (XRP) and Stellar (XLM). This move is expected to improve Pi Network’s interoperability with traditional banking and payment systems, opening up more integration and adoption opportunities in the global financial ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Pi Network Price Rejects Sharply at $0.29, Can the Uptrend Hold?. Accessed on October 31, 2025

- Featured image: Brave New Coin

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.