Download Pintu App

Where Will Stellar (XLM) Go in November 2025?

Article Summary:

- The price of XLM is stagnant at around $0.30 after falling 17% in October.

- November’s historical performance is volatile, with upside potential but high risk of correction.

- Technical indicators show weak large investor support and limited momentum.

Stellar (XLM) is flat as early as November 2025 with a weak outlook due to lack of institutional support and fragile technical momentum.

Jakarta, Pintu News – Going into November 2025, the price of Stellar (XLM) seems to be moving flat around $0.30 after experiencing a tumultuous October. Although October witnessed a price drop of up to 17%, Stellar managed to hold its ground better compared to other cryptocurrencies with a weekly loss of only around 6%. However, with a mixed history in November, Stellar’s prospects seem less convincing this time around.

November’s Volatile History

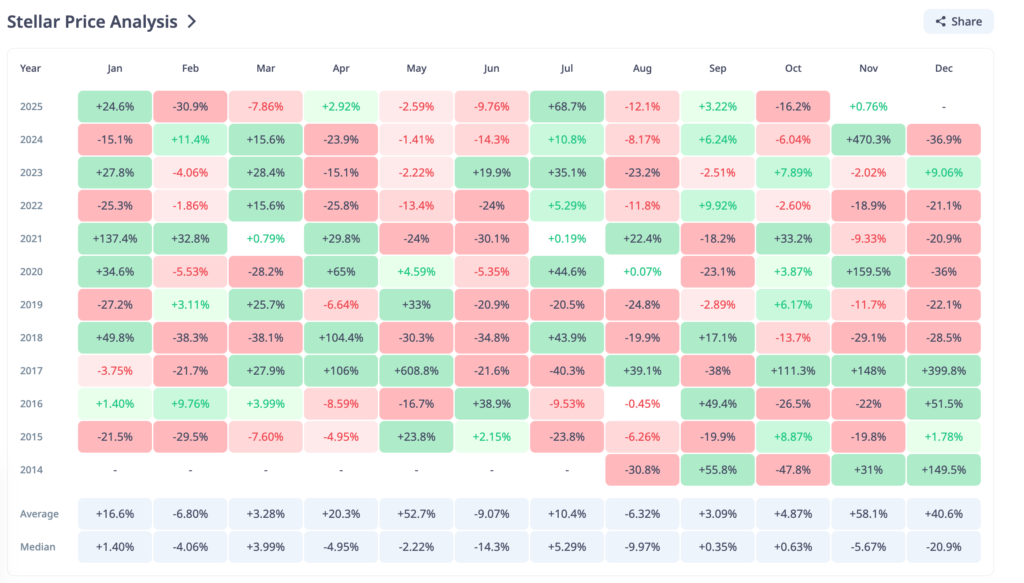

Historically, November is often a strong month for Stellar thanks to average gains reaching +58%, including dramatic spikes of +470% in 2024 and +159% in 2020.

However, the median return of (-5.67%) reveals that the majority of November ended in a decline. This suggests that while there is potential for significant upside, downside risks cannot be ignored.

Short-term Fund Flows Promising, but Big Investors Still Cautious?

One positive indicator came from money flow data. The Chaikin Money Flow (CMF), which measures whether funds are entering or leaving the market, showed a slight improvement on the shorter time frame with a value of around +0.04.

However, on the two-day chart, the CMF is still at around -0.10, signaling that large and possibly institutional holders have yet to actively re-engage. This suggests that despite hopes from small investors, support from large investors is still not solid.

Also read: Bitcoin (BTC) Fails to Respond to US-China Deal, What’s Next?

Stellar Price Chart Shows Narrow Range and Key Levels

On the two-day chart, Stellar is moving in a symmetrical triangle pattern, which forms when buyers and sellers move in balance but no one takes control. The price has been in the $0.27 to $0.35 range for a few days, indicating indecision.

If Stellar price manages to break and close above $0.35 and surpass $0.37, it could test the upper range and try to reach $0.47. However, the short-term RSI momentum still shows limited support for such a move.

Conclusion

The direction of the Stellar price in November 2025 will largely depend on which trend line is broken first. The weak momentum shown by the RSI indicates that the lower trend line is more at risk. Investors and market watchers should pay attention to these indicators to make informed investment decisions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Stellar (XLM) Price Outlook for November 2025. Accessed on November 4, 2025

- Featured Image: InvestorPlace

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.