Download Pintu App

Ethereum Price Plummets to IDR 55.7 Million as Liquidations Reach $1.1 Billion!

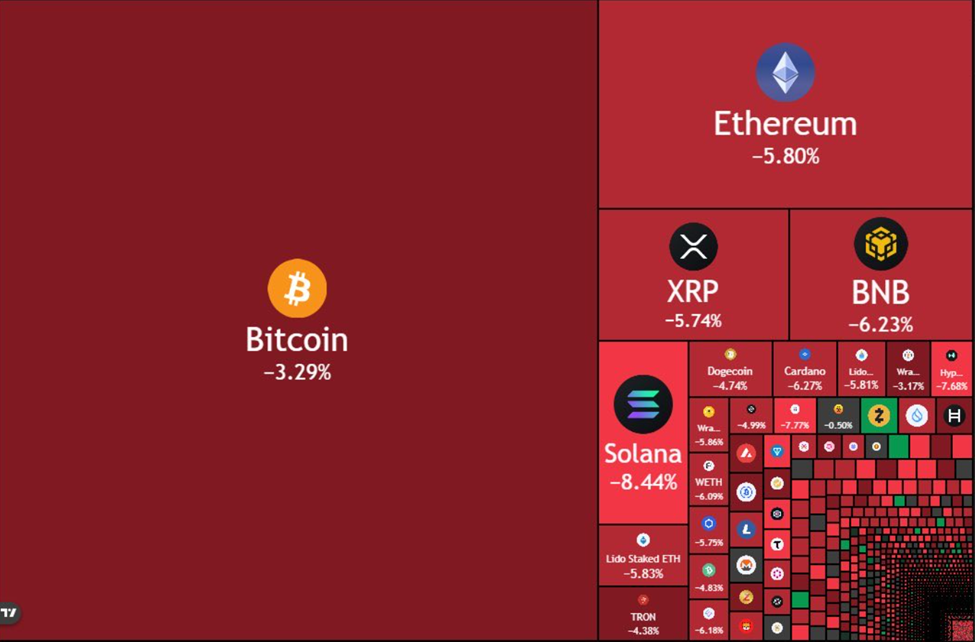

Jakarta, Pintu News – The crypto market experienced a major shakeup in 2025, with Ethereum (ETH) dropping below the critical $3,400 mark, marking the biggest drop in recent months.

This event indicates a significant change in sentiment after a relatively long period of stability in the altcoin market. Meanwhile, Bitcoin (BTC) also experienced a decline, approaching the $100,000 psychological support zone, which has not been touched since late June.

Ethereum Profit Removal

Ethereum (ETH) started 2025 at around $3,353, but has now lost all of this year’s gains after a 7% freefall in a single day. This drop not only erases the gains made earlier but also marks a major shift in investor perception of the asset.

Ethereum’s (ETH) Relative Strength Index (RSI) shows that the asset is almost into the oversold zone, indicating very strong selling pressure. Meanwhile, Bitcoin (BTC) has not escaped the pressure either, with the price dropping to a daily low of $100,721. If Bitcoin (BTC) continues to decline and breaks below $100,000, it could trigger further selling and exacerbate the already negative sentiment in the digital asset market.

Read also: Bitcoin (BTC) Starting to Lose Power? Analysts say Rp2 billion target will not be reached this year

Mass Liquidation in Crypto Market

Data from Coinglass shows that over 303,000 traders were liquidated in the last 24 hours, with the total liquidation reaching $1.10 billion across multiple exchanges. In one hour alone, over $300 million worth of positions were removed, with $287 million of that being long positions. This suggests that many traders who were overly optimistic with their bullish positions have suffered huge losses as the market broke through key support levels.

Ethereum (ETH) and Bitcoin (BTC) were the two assets most affected by the liquidation, but high-beta assets such as Solana (SOL), Binance Coin (BNB), and Ripple (XRP) also saw sharp declines. Traders were forced to reduce their exposure amid widespread market panic.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (5/11/25)

Different Behavior Between ‘Whale’ and ‘Shrimp’

According to a report from Santiment, there is a stark difference in behavior between large and small Bitcoin (BTC) holders. Wallets holding between 10 and 10,000 BTC, often referred to as whales and sharks, have sold over 38,366 BTC since October 12.

This represents a decrease of 0.28% of their total holdings, which has a huge impact on the market as they control 68.5% of the total Bitcoin (BTC) supply.

On the other hand, retail traders who own less than 0.01 BTC, often referred to as shrimp, increased their holdings by 415 BTC, an increase of 0.85%. This accumulation pattern is often seen during market downturns, however, a sustained recovery will only begin when the whales start accumulating again rather than distributing.

Conclusion

With Ethereum (ETH) and Bitcoin (BTC) now at critical psychological and technical thresholds, the market is watching closely to see if there will be further stabilization or decline. If Bitcoin (BTC) manages to break below $100,000, it could accelerate outflows and deepen the already negative sentiment in the digital asset space.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Turns Negative for 2025 as Crypto Liquidations Exceed $1.1 Billion. Accessed on November 5, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.