Download Pintu App

Market Recovery, These 5 Altcoins Rise Up to 40% Today

Article Summary:

- Five crypto assets scored huge gains of 23-49% in the last 24 hours.

- The majority of charts show sharp spikes followed by consolidation, signaling strong accumulation.

- Market sentiment looks positive with prices staying above initial levels.

Jakarta, Pintu News – The crypto market is starting to show signs of recovery after a period of intense selling pressure. In the midst of this rebound, five altcoins have recorded impressive price spikes, even touching a 40% increase in the last 24 hours. This sharp strengthening reflects the return of strong buying interest and increased investor confidence in the short-term prospects of the digital asset market.

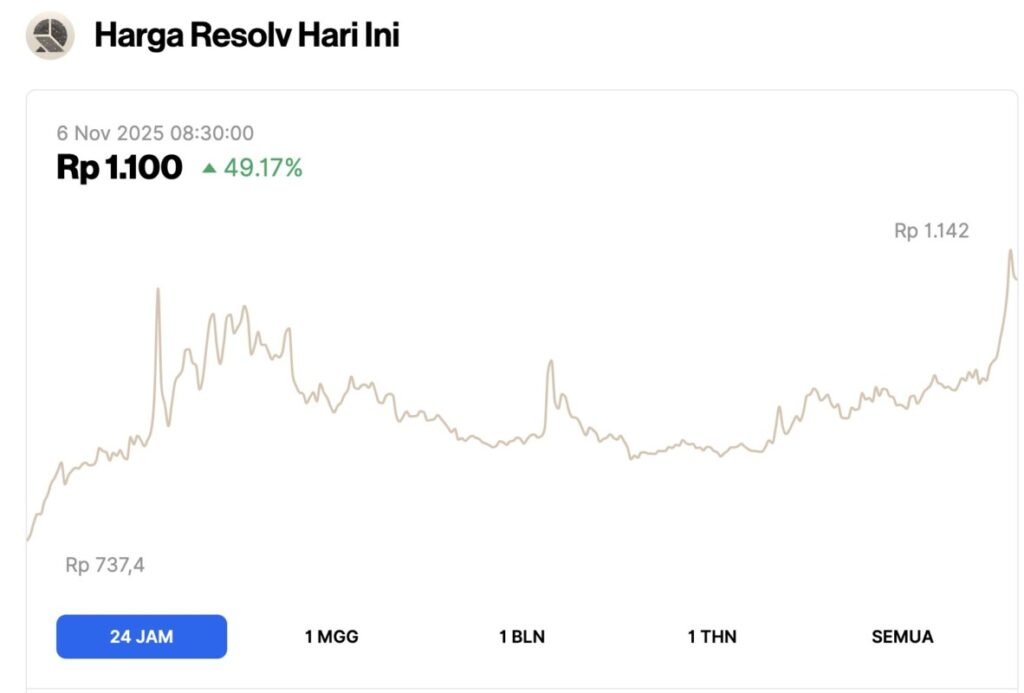

RESOLV Price Rises Up to 49.12% in 24 Hours

The price chart of Resolv (RESOLV) shows a significant increase in the last 24 hours, with the price moving from a low of around Rp737.4 to Rp1,100 at 08:30. The biggest spike occurred in the early phase of trading when the price briefly broke Rp1,142 before consolidating again.

The up-and-down movement that followed illustrated high volatility, but the overall trend remained upward. The 49.17% increase shows a strong increase in buying interest from the market.

After reaching the intraday peak, the chart saw a period of relative stability with mild fluctuations, before bullish momentum returned towards the end of the session. The price push back up towards IDR1,142 suggests continued accumulation from market participants.

Despite some minor corrections, the chart structure still maintains a gradual upward pattern. Overall, Resolv’s performance in the last 24 hours illustrates the positive sentiment that pushed the price to its daily high.

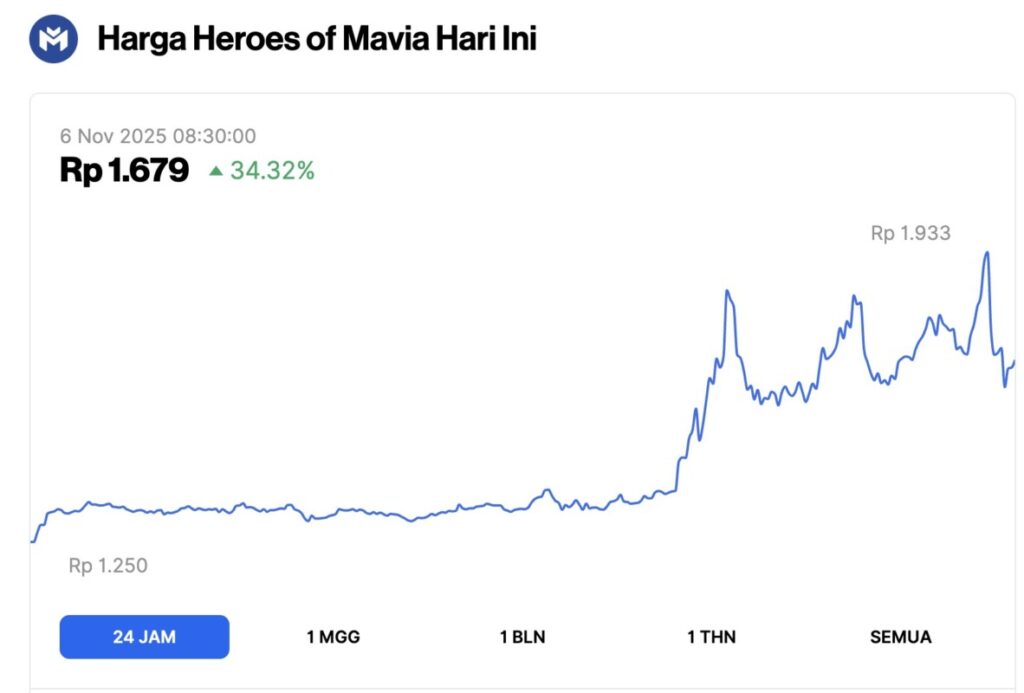

MAVIA Price Skyrocketed 34.32% in 24 Hours

The price chart of Heroes of Mavia (MAVIA) shows a significant gain in the last 24 hours, with an increase of 34.32% to the level of Rp1,679 at 08:30. The price movement started in the area around Rp1,250 and was flat for a while before bullish momentum gradually emerged.

A strong surge occurred in the mid-session phase, when the price accelerated to a peak of IDR1,933. This increase reflected increased demand and buying activity from market participants.

After reaching the intraday peak, the chart showed more volatile fluctuations with a series of small increases and corrections that kept the overall uptrend in check. Despite a brief dip after the high, the price is still moving at a higher range compared to the beginning of the session.

This movement structure indicates that market interest in Heroes of Mavia remains strong. Overall, the price performance in the last 24 hours illustrates an increase in positive sentiment and solid accumulation from investors.

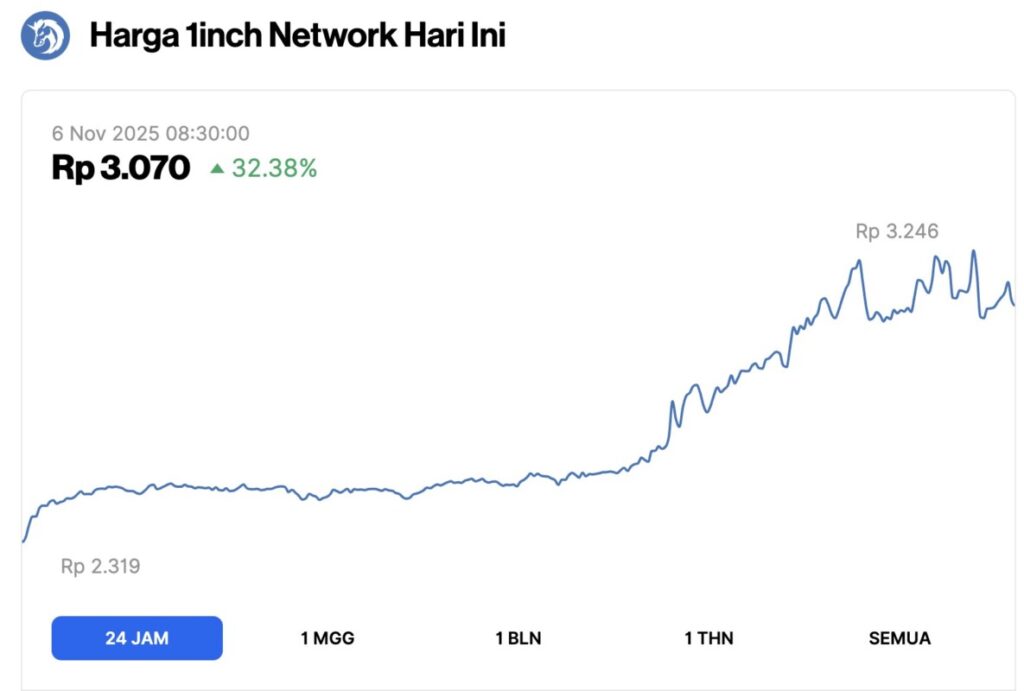

1INCH Price Soars 32.28% in 24 Hours

The price chart of 1inch Network (1INCH) shows strong gains in the last 24 hours, with a 32.38% surge to reach IDR3,070 at 08:30. The movement started at levels around IDR2,319 and tended to stabilize at the beginning of the session before bullish momentum began to gradually build.

A consistent uptrend was seen with a series of small gains that continued to push the price to higher levels. This rise signifies increased market interest and solid accumulation from crypto players.

Read also: Bitcoin Whale Bounces Back, The Smarter Web Company Investing as the Price Falls?

A more significant surge occurred in the second half of the period, when the price moved quickly towards an intraday high of IDR3,246. Despite fluctuations after reaching that peak, the chart shows that the price remained in a higher range, reflecting strong market support.

The mild consolidation pattern after the sharp rise indicates that the bullish momentum is still maintained. Overall, the 1inch performance in the past 24 hours illustrates the optimistic conditions that pushed the price well above its initial level.

SHRAP Price Surges 27.69% in 24 Hours

The price chart of Shrapnel (SHRAP) in the last 24 hours shows a significant surge of 27.69%, bringing the price to IDR37.08 at 08:30. The price movement started from around IDR29.04 and moved relatively stable before entering a phase of high volatility.

Two extreme spikes are evident, with the highest peak reaching IDR42.93. This pattern indicates either large-scale buying activity or a market response to a specific catalyst, which drives the price up in a short period of time.

After reaching its peak, the price moved down but remained in a higher range than the initial position. The consolidation occurring at intermediate levels signals stabilization after the buying pressure subsides. Overall, the chart dynamics show that Shrapnel is under strong bullish momentum, although intraday volatility remains high.

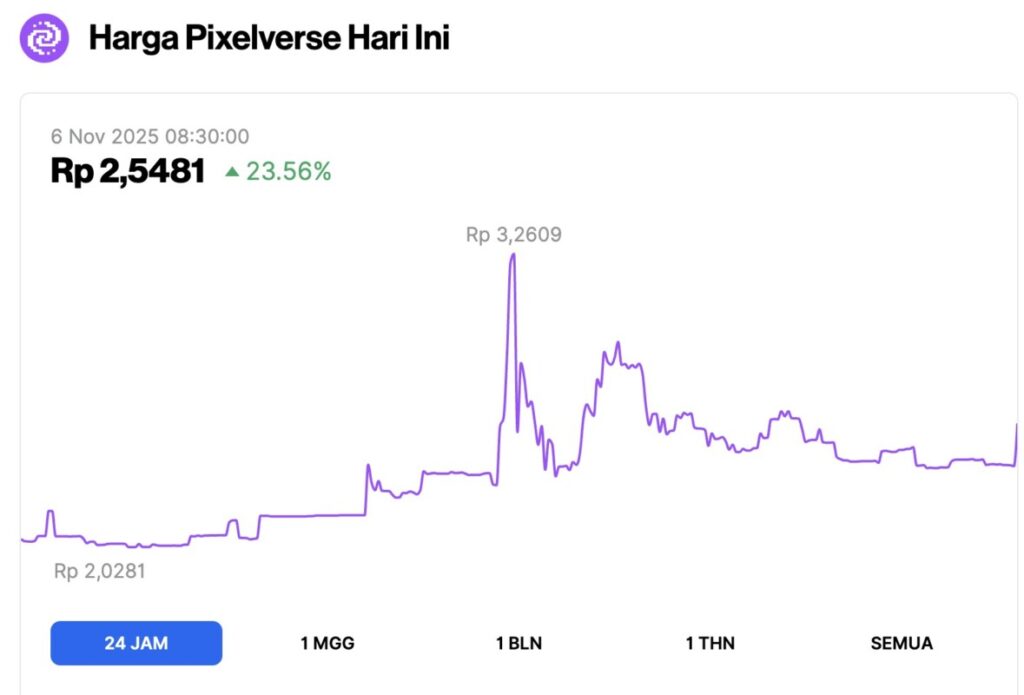

PIXFI Price Rises 23.56% in 24 Hours

The Pixelverse price chart in the last 24 hours shows a strong increase of 23.56%, bringing the price to IDR2,5481 at 08:30. The price movement started at around IDR2.0281 and stabilized before entering a phase of high volatility.

The sharp spike was evident when the price touched its peak at IDR3.2609, indicating either a large influx of liquidity or a market response to a sudden positive sentiment.

Also read: Will Ripple (XRP) ETF be the savior of the ailing crypto market?

After touching the high, the price corrected but still moved in a higher range than the initial position. The consolidation pattern formed suggests that the market is starting to balance buying aggressiveness with profit-taking. Overall, the Pixelverse’s intraday trend confirms that bullish momentum is still maintained, although volatility remains the dominant factor in its price movements.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Market Door

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.