Download Pintu App

Top 3 Crypto Projects Recommended by Liquid Capital Founder

Jakarta, Pintu News – Jack Yi, founder of Liquid Capital, recently shared his views on the core areas that investors should pay attention to from a long-term cyclical perspective.

In a post, Yi emphasized the importance of focusing investments on public chains, exchanges, and stablecoins, which he referred to as assets that can “transcend cycles.” This approach suggests a strategy that focuses on sustainability and long-term growth in the digital asset ecosystem.

Public Chain: Ethereum (ETH)

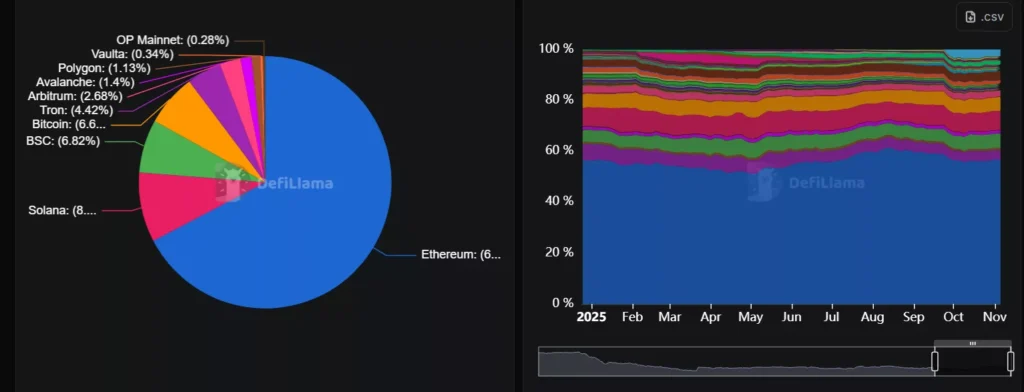

According to Jack Yi, Ethereum (ETH) is one of the public blockchains that deserves more attention. Data from DeFi Llama shows that Ethereum still leads as the public chain with the largest total value locked in DeFi, reaching $75.21 billion, or more than 67.32% of the total value locked on-chain.

With 1,660 protocols operating within its ecosystem, Ethereum (ETH) continues to dominate the market compared to Solana (SOL), Binance Smart Chain (BSC), and Bitcoin (BTC).

Ethereum (ETH) is not only the leader in terms of locked value, but also the underlying infrastructure that supports a wide range of applications and smart contracts. This makes Ethereum (ETH) a strong investment choice for those looking for an asset with stable and sustainable growth potential.

Also read: Market Recovery, These 5 Altcoins Gained Up to 40% Today

Exchange: BNB and Aster

In the exchange category, Yi highlighted BNB and Aster as two promising platforms. BNB, which is the native token of Binance, is known for its stable revenue and strong ecological foundation. Meanwhile, Aster is considered the “second growth curve” for Binance, according to Yi. Although Aster still ranks sixth in terms of total value locked in BSC with $531.4 million, the platform has shown significant growth.

Aster, with support from YZi Labs Chairman Changpeng Zhao, has seen a surge in projects and the launch of its native token, ASTER, as well as Aster Chain. This shows Aster’s great potential as an exchange that can grow rapidly and play an important role in the Binance ecosystem.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (6/11/25)

Stablecoins: A Bridge between Traditional and Decentralized Finance

Stablecoins, according to Yi, are important assets that ensure transactional stability and serve as a bridge between traditional and decentralized finance. With the ability to maintain a stable value, stablecoins like Tether (USDT) and USD Coin (USDC) allow users to avoid the volatility that often occurs in the crypto market.

The role of stablecoins in facilitating secure and stable transactions not only increases user trust but also expands the adoption of decentralized finance. This makes stablecoins a critical component in building and sustaining an inclusive and efficient financial ecosystem.

Conclusion

With a focus on Ethereum (ETH), BNB, and Aster, as well as the importance of stablecoins, Liquid Capital’s Jack Yi provides valuable insights into assets that have the potential to survive and thrive beyond various market cycles. Investments that focus on basic infrastructure, liquidity, and transactional stability may be a wise strategy for those seeking long-term growth in the digital asset ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Liquid Capital Founder Reveals Top Projects to Watch. Accessed on November 6, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.