Download Pintu App

Litecoin Shines Again: Is $105 the Next Target in November 2025?

Jakarta, Pintu News – Litecoin (LTC) looks set to surge after a significant increase in ETF fund flows and retail activity.

Why is Litecoin back in the spotlight?

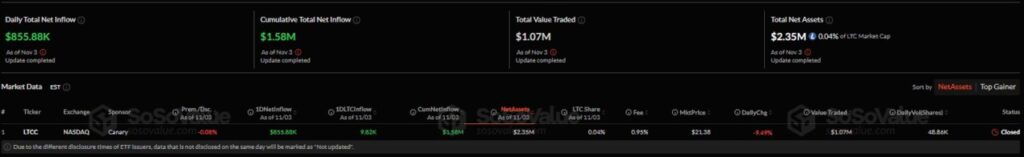

Recently, Litecoin (LTC) caught the attention of institutional and retail investors after an increase in ETF inflows of $855,000 was recorded on November 3rd. This is one of the highest daily totals in recent weeks. This increase signals that there is renewed market confidence in Litecoin (LTC).

In addition, broader trading activity around Litecoin (LTC) has performed better than Zcash (ZEC), an altcoin that has recently experienced significant price momentum. With demand increasing from multiple fronts, investors are starting to wonder if Litecoin’s (LTC) latest surge is just the start of something bigger.

Also Read: Will Bitcoin (BTC) Experience a Sharp Drop Before Surging Again? Here’s the Analysis!

Institutional Fund Flows Strengthen Litecoin’s Position

ETF activity remains a reliable indicator to gauge institutional conviction. The latest surge in inflows suggests that professional investors are beginning to shift their capital to Litecoin (LTC) amid broader market fatigue. Moreover, a cumulative trade value of $1.07 million and a consistent premium close to net asset value (NAV) confirms steady interest.

This increase shows not only confidence, but also the potential of Litecoin (LTC) as an attractive investment asset in the eyes of institutional investors. This creates a solid foundation for Litecoin (LTC) to continue growing in the market.

Retail Demand Joins

Outside of ETFs, Litecoin (LTC) has also seen a significant surge in retail participation. Active addresses and spot market volumes have continued to increase in recent sessions, while Open Interest in the Futures market has also continued to rise.

Data shows that Litecoin (LTC) outperforms most of its peers in daily transactions and active wallet activity. When institutions and retail traders alike show high interest, momentum tends to persist. This suggests that there is a synergy between institutional confidence and retail participation that could drive Litecoin (LTC) prices higher.

What’s Next for Litecoin Price Action?

Currently, Litecoin (LTC) price is in a tight consolidation zone between $85 and $100, with selling pressure starting to show signs of exhaustion. The stochastic RSI is bouncing off from almost oversold levels, indicating that the bearish momentum is starting to weaken.

However, the next move largely depends on ETF inflows and trader confidence. If inflows continue to increase and retail activity remains strong, LTC could test resistance near $105 in the short term. However, traders should remain vigilant. A sudden drop in trading volume or sharp profit-taking could depress the price, extending the consolidation before a decisive breakthrough.

Conclusion

With increased ETF inflows and retail participation, Litecoin (LTC) is showing potential that is not just temporary. Investors and traders are advised to monitor these market indicators closely to make informed investment decisions in the future.

Also Read: Dash price soars, hitting $100 after almost 4 years!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Litecoin: $855k ETF inflow sparks new life, next target is $105 if. Accessed on November 6, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.