Download Pintu App

Whale Crypto Buys 51 Million Aster Tokens, Will ASTER Price Soar?

Jakarta, Pintu News – Aster (ASTER) has been moving flat for almost a month, showing limited volatility as it struggles to break out of resistance areas.

The altcoin is still stuck below “The Void”, a resistance zone that has never been tested before and needs to be broken to support a significant recovery. However, accumulation by whales indicates growing optimism among institutional investors.

Aster Whales Potentially Trigger Recovery

Whales have shown increased activity in recent weeks, reflecting growing confidence in Aster’s long-term prospects.

Read also: Why These 3 Altcoins Are Grabbing Attention Right Now

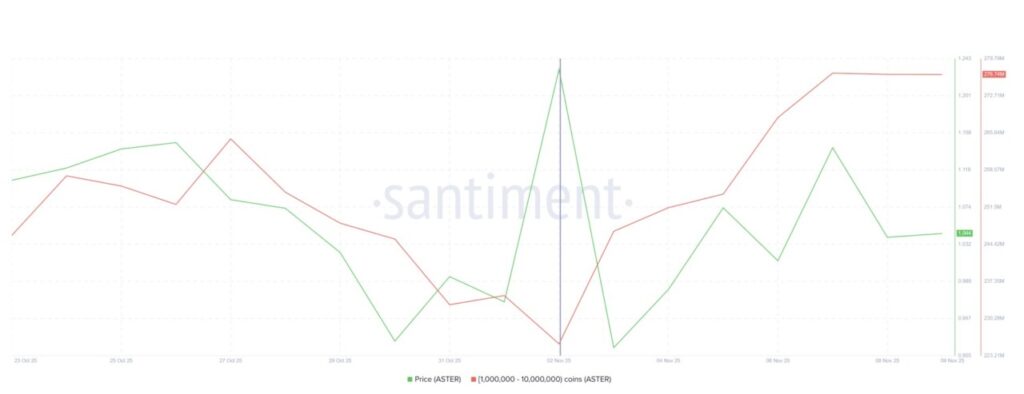

On-chain data shows that wallets holding between 1 million and 10 million ASTER have added more than 51 million tokens since early November, with a value of about $53 million.

This surge in accumulation by big wallets indicates that the whales are positioning themselves for a potential rally. Historically, such accumulation phases often precede sharp rallies, as large investors tend to buy when prices are perceived to be at market bottoms.

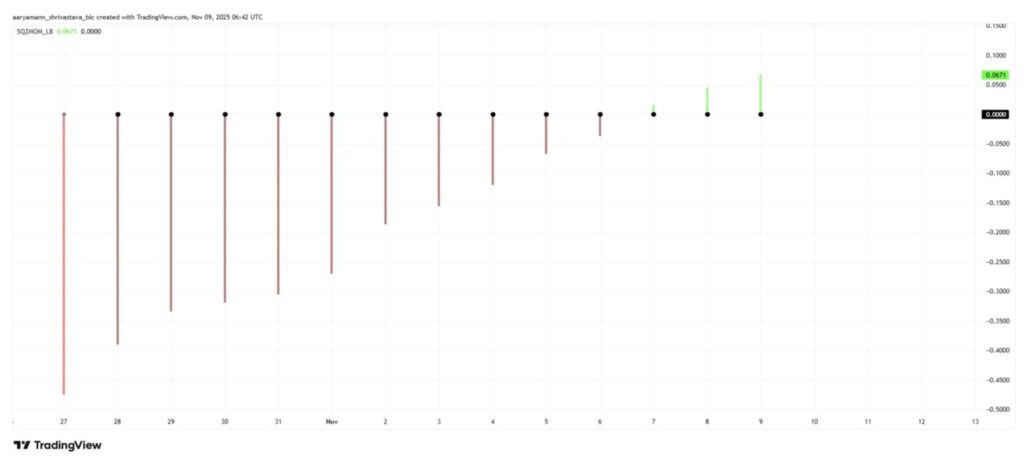

The Squeeze Momentum indicator is currently showing growing pressure, characterized by black dots that generally precede significant price movements. This formation is often the first sign of a spike in volatility, suggesting that Aster may experience stronger price movements in the near future.

Currently, the green bars on the indicator show that bullish momentum is building in this phase.

If this positive volatility continues to develop, ASTER could potentially break out of its narrow moving pattern, with buying pressure pushing prices higher. However, this pressure could also turn negative if market sentiment weakens or macro conditions deteriorate.

ASTER Price Faces Resistance

ASTER’s price is currently at $1.04, remaining stable above the $1.00 psychological threshold. While this support still holds, the more crucial lower boundary lies at $0.91, which has been the main support during the recent consolidation phase.

Read also: COTI Soars 55% in a Day: Testing Falling Channel Resistance, Is a 100% Breakout Imminent?

ASTER’s consolidation range is formed between $0.91 and $1.25. Above the $1.25 level is an area of resistance known as “The Void”, a zone that has never been tested before. A breakout of this zone is required to recover the 55% loss incurred in October. Based on these factors, ASTER has the potential to surpass $1.50 and move towards $1.63.

However, if the market sentiment deteriorates, ASTER could resume its horizontal movement pattern or even break below $0.91. Such a drop could push the price towards $0.80, which would invalidate the current bullish assumptions and delay the recovery prospects.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Aster Whales Accumulate, Price Outlook. Accessed on November 10, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.