Download Pintu App

5 Reasons Why Crypto Markets Are Up Today

Jakarta, Pintu News – The cryptocurrency market showed a sudden surge in the last 24 hours, after last week’s sharp correction session. Global valuations rose by almost 5% to reach around US$3.58 trillion (± Rp59.8 quadrillion) with Bitcoin (BTC) breaking above US$107 000 (± Rp1.79 billion) and the majority of major altcoins scoring double-digit gains. But behind these numbers, there are five macro-economic and market catalysts driving this momentum!

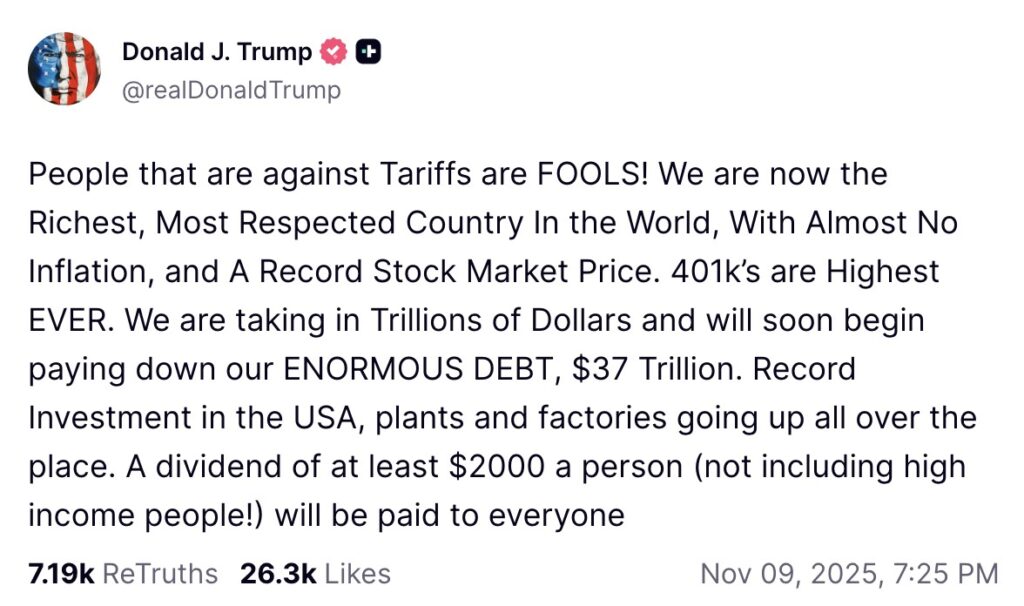

US Tariff Stimulus US$400 Billion

The announcement by Donald Trump of plans to pay a “tariff dividend” of US$2 000 per US citizen, funded from tariff revenues, has sparked expectations of a surge in liquidity. Market participants assume some of these stimulus funds could flow into riskier assets such as crypto – given previous experiences when relief checks drove the 2021 rally.

Assuming effective disbursement and distribution, this liquidity injection provided immediate support to the digital market. Uncertainty regarding the execution of the stimulus remains, but the expected impact was enough to trigger a market reaction.

The End of the US Government Shutdown

The long US government shutdown situation is showing signs of improvement, after a bipartisan agreement was reached to end the partial shutdown. This removes one of the main risks of risk-off market conditions and again allows the publication of important economic data such as inflation and employment.

With macro data flows recovering, investors again have a basis to assess the direction of interest rates and global risks – something that reinforces interest in crypto assets as part of “risk-on”.

SOFR temperature drops to lowest level in years

The US short-term interbank borrowing rate, the SOFR (Secured Overnight Financing Rate), recorded a significant drop to the lowest level in years, which usually encourages investors to take more risks.

Read also: 10 Layer-1 Crypto that Potentially Reach ATH in 2026

The low cost of short-term funding encourages allocation to more speculative assets, including crypto and tech stocks. Technically, these looser monetary conditions create a conducive environment for fund inflows into the crypto market that were previously held back by high leverage costs.

Massive Liquidation of Short Positions

With Bitcoin breaking the level of around US$106 000 (± Rp1.77 billion), leveraged short positions experienced massive liquidation, forcing the closure of bearish positions and providing “dopamine” to the market.

Within 24 hours, hundreds of thousands of traders were affected by liquidation with a total of billions of US dollars forced to close. This effect created strong technical momentum that spurred a quick rebound in major cryptos and altcoins.

Surge in Trading Volume & Derivatives Interest

The crypto market is now showing significant improvements in trading volume and open interest in futures contracts, signaling that market participants are back in with leveraged holdings and active participation.

Rising open interest maintains liquidity and allows for more expansive price movements. The re-engagement of investors suggests that the accumulation or correction phase could shift into a strengthening phase.

Conclusion

Today’s crypto market is running on optimism built from a combination of a large fiscal stimulus, improvements in the US macro-economy, loose monetary conditions, large technical liquidations and increased trading activity. Despite the many positive catalysts, market participants remain cautious of the risks ahead such as inflation, potential interest rate hikes and earthquakes in the derivatives market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinPedia. 5 Key Reasons Why the Crypto Market Is Up Today. Accessed on Nov 10, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.