Download Pintu App

4 US Economic Agenda Items That Could Determine Bitcoin’s Move to $110,000

Jakarta, Pintu News – With increasing optimism towards a deal to end the long-running US government shutdown, Bitcoin (BTC) price has shown strength by surpassing the $105,000 threshold. However, whether this rise will continue or see another decline depends largely on the US economic news that will emerge this week.

Federal Reserve Official Speeches

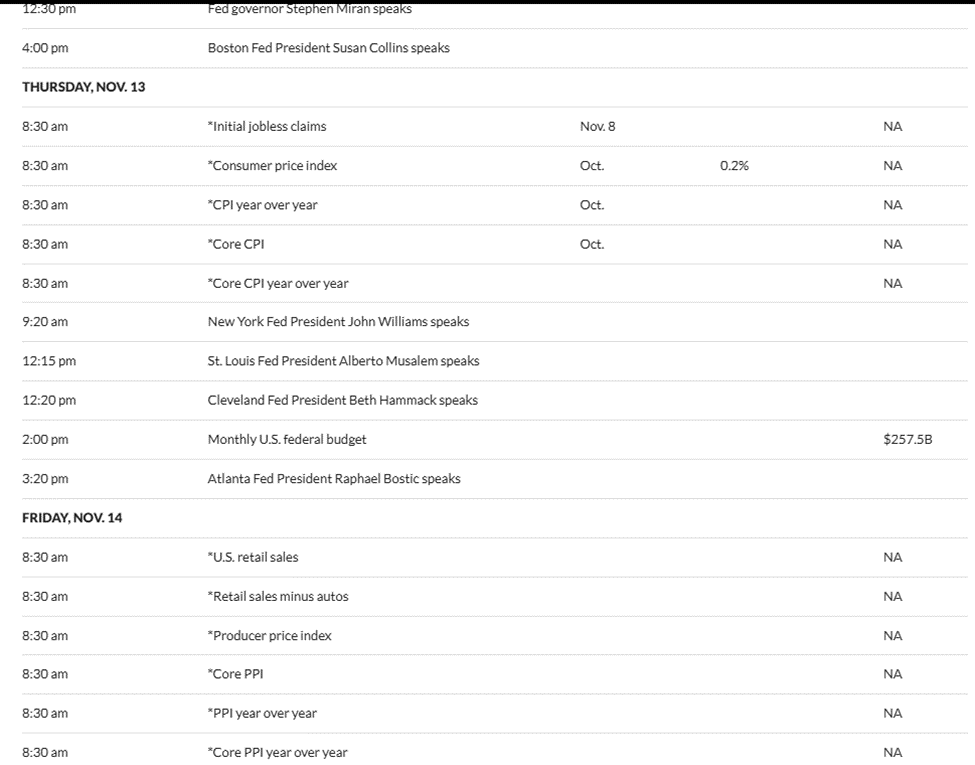

This week, a number of Federal Reserve (Fed) officials are scheduled to speak. Fed Governor Michael Barr will speak on Tuesday, followed by New York Fed President John Williams, Philadelphia Fed President Anna Paulson, Fed Governor Chris Waller, Atlanta Fed President Raphael Bostic, Fed Governor Stephen Miran, and Boston Fed President Susan Collins who will speak on Wednesday.

Comments from these officials are very important as they can provide clues about upcoming monetary policy. Investors and analysts will scrutinize every word spoken to pick up signals about the direction of interest rates and other economic policies that could affect markets, including cryptocurrency markets like Bitcoin (BTC).

Initial Jobless Claims

The Initial Jobless Claims report, which measures the number of US citizens who applied for unemployment insurance last week, is also of key interest. This report is an indicator of the health of the US labor market and can influence Fed policy decisions as well as market sentiment.

If the number of claims increases, this could be an indication that the economy is slowing, which might prompt the Fed to consider further easing of monetary policy. Conversely, a decline in claims could indicate a strengthening labor market, which might support the argument for policy tightening.

Read also: What Altcoins Are Crypto Whales Eyeing Amid Market Recovery?

CPI (Consumer Price Index) data

CPI or Consumer Price Index data for October is expected to be released this week, on Thursday. This figure will show how much the prices of goods and services increased during October. However, this schedule still depends on the end of the US government shutdown.

In comparison, the previous September CPI was recorded below expectations, with annual inflation rising around 3% year-over-year. Crypto analyst Killa mentioned, “We have four days to the CPI release. The narrative leading up to this data release will determine the next direction of the market-whether it reaches a local peak or a new bottom.”

As long as the inflation rate remains above the 2% target set by the Fed, monetary policy will remain tight and delay any potential interest rate cuts. This could have a slightly negative impact on Bitcoin (BTC), as crypto assets generally rally when market liquidity increases.

If the CPI figure rises from 3.0% in September, it suggests inflation is still high and could force the Fed to hold or even raise interest rates again, so interest in risky assets could decline. Conversely, if the CPI falls below 3.0%, it indicates inflationary pressures are easing (disinflation) and could raise hopes for a rate cut-a situation that is usually favorable for Bitcoin.

PPI (Producer Price Index) data

In addition to CPI, PPI or Producer Price Index data will also be released after the US government resumes full operations. PPI measures price increases at the producer level before goods reach consumers, and is an early indicator of inflationary pressures in the supply chain.

Market analyst Mark Cullen stated, “This week the market is focused on two things: inflation and politics. Investors are preparing for two big data sets-CPI on Thursday and PPI and retail sales on Friday. This data will provide a complete picture of the strength of inflation and consumer spending power, and will determine the direction of risk asset markets for the rest of the year.”

With this situation, the US government shutdown drama is still an important factor that could affect the direction of Bitcoin price movement this week.

Conclusion

With a series of speeches from Fed officials and important economic reports to be released, financial markets, including cryptocurrency markets, may experience high volatility. Investors and market participants should pay close attention to make the right investment decisions amidst the fast-changing dynamics.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Economic Events and Bitcoin’s $110,000. Accessed on November 15, 2025

- Featured image: Generated by Ai

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.